China's green bond market goes to internationalization: expert

LONDON - China's green bonds market has taken important steps towards its internationalization, an expert in this new financial sector has said.

Important issuances

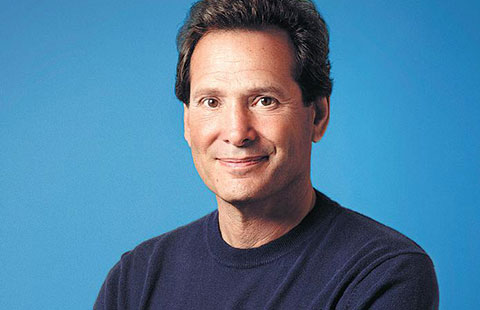

Sean Kidney, chief executive officer (CEO) of the international non-profit Climate Bonds Initiative, told Xinhua on Friday that issuances by three of the largest Chinese banks of green bonds were one of these important steps.

"The three large Chinese banks -- Bank of China (BOC), Industrial and Commercial Bank of China (ICBC) and China Development Bank (CDB) -- all have issued climate bonds, certified green bonds and it is a sign of the internationalization of China's bond market," Kidney told Xinhua.

Climate Bonds Initiative is an investment industry advocate group with headquarters in London, which is involved in developing the new multi-billion-dollar market for green bonds.

BOC issued a green bond from its Paris branch on Thursday on Euronext Exchange in three parts and in three currencies, one billion Chinese yuan, 700 million euros, and $500 million.

Kidney said the green bond market was growing and that China was its most significant player.

"There has been very strong demand from offshore investors for quality green bonds, and the demands for this Bank of China green bonds from international investors reflects that there is an appetite there for certified, quality green issuance out of China," said Kidney.

"The three currencies that this bond has gone to market is evidence of the diversification of China's green bond market in that issuers can come to market with a variety of currencies and are quite easily able to put those bonds away and meet investor demand," the CEO said.

China's green drive

Kidney said the BOC issuance followed two other significant issuances in the past four weeks from CDB and ICBC.

At the end of October, ICBC issued its first green bond on the newly-established Luxembourg Green Exchange amounting to $2.15 billion in three tranches, two in dollar and one in euro, with three and five-year tenors.

"We see that with China's continued drive on both environmental matters and climate-related matters with greater issuance this year and China among the top issuing nations is likely to continue," said Kidney.

CDB issued a $500 million green bond on Nov 10.

Funds raised from the CDB bond issuance will primarily be spent on three water protection and treatment projects in Central China's Hubei province.

The central government has been pushing for the development of green finance in order to seek sustainable growth and honor its commitments on addressing climate change.

Kidney said: "China is likely to stay at the head of the league table for global bond issuance and green bond issuance will accelerate in 2018."

"The signs are there with these three large Chinese banks making their initial forays into the green bond market this year for next year to be quite large in terms of China's issuance."

China accounted for nearly 40 percent of new green bonds last year, followed by the United States, France and Germany, said Moody's Investor Services, the bond credit rating agency.

Climate Bonds Initiative said the market was worth $82 billion last year, a figure was surpassed already this year with an expectation of it reaching $120 billion by the year's end.