Broadcom bids $105b for Qualcomm, open to going hostile

Chip maker Broadcom Ltd made an unsolicited $105 billion bid for Qualcomm Inc on Monday, setting the stage for a takeover battle that could reshape the industry at the heart of mobile phone hardware.

Qualcomm said it would review the proposal but the San Diego-based company is inclined to reject the bid as too low and fraught with risk that regulators may reject it or take too long to approve it, people familiar with the matter told Reuters.

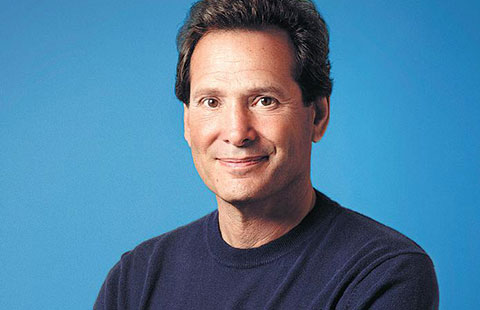

Broadcom Chief Executive Hock Tan, who turned a small, chipmaker into a $100 billion company based in Singapore and the United States, told Reuters he would not rule out a proxy fight to convince shareholders to replace the board and accept the offer.

"We are well advised and know what our options are, and we have not eliminated any of those options," said Tan, who has pulled off a string of deals over the past decade. "We have a very strong desire to work with Qualcomm to reach a mutually beneficial deal."

A combined Broadcom-Qualcomm would become the dominant supplier of chips used in the 1.5 billion or so smart phones expected to be sold around the world this year. It would raise the stakes for Intel Corp, which has been diversifying from its stronghold in computers into smart phone technology by supplying modem chips to Apple Inc.

Qualcomm shareholders, who have watched their investment sour over the past year in the face of a patent dispute with Apple, would get $60 in cash and $10 per share in Broadcom stock in a deal, according to Broadcom's proposal. Including debt, the transaction is worth $130 billion.

"Now it's a game of high-stakes poker for both sides," said GBH Insight analyst Daniel Ives, who believes bullish investors were hoping for $75 to $80 per share. The offer represents a premium of 27.6 percent to Qualcomm's closing price of $54.84 on Thursday.

Shares of Qualcomm, whose chips allow phones to connect to wireless data networks, traded above $70 as recently as December 2016 and topped $80 in 2014. They rose 1.1 percent to $62.52,suggesting skepticism a deal would happen.

Broadcom shares rose 1.4 percent to $277.52 after touching a record of $281.80.

Regulatory scrutiny

Any deal struck between the two companies would face intense regulatory scrutiny.

Qualcomm sells modem chips that allow phones to send data as well as communications chips for automobiles that handle "infotainment" systems and wireless electric vehicle charging.

Qualcomm provides chips to carrier networks to deliver broadband and mobile data and is also in the process of closing a $38 billion bid for automotive chipmaker NXP Semiconductors NV that it made last year.

Broadcom, Qualcomm and NXP together would have control over modems, Wi-Fi, GPS and near-field communications chips, a strong position that could concern customers such as Apple and Samsung Electronics Co Ltd because of the bargaining power such a combined company could have to raise prices. However, a combined company would also likely have a lower cost base and the flexibility to cut prices.

Herbert Hovenkamp, who teaches antitrust at the University of Pennsylvania Law School, said that US regulators would try to ensure the deal would not lead to higher chip prices.

"Based on what I've seen, it seems unlikely to me that there's a basis for a challenge (to stop the deal)," he said.

Tan added that if Broadcom acquires Qualcomm which in turn has acquired NXP, the combined company's net debt could be in the range of $90 billion.

Broadcom said BofA Merrill Lynch, Citi, Deutsche Bank, JPMorgan and Morgan Stanley have advised that they are confident that they will be able to arrange the necessary financing for the proposed transaction.

Broadcom also could spin out Qualcomm's licensing arm, QTL, to get regulatory approval and funding for the deal, raising as much at $25 billion from a sale, Nomura Instinet analyst RomitShah suggested.

Broadcom had $5.25 billion in cash and cash equivalent as of July 30. Qualcomm had $35.03 billion in cash as of Sept 24.

Broadcom also got a commitment letter for $5 billion in financing from private equity Silver Lake Partners, an existing Broadcom investor.

Vulnerable Qualcomm

Qualcomm stock has fallen this year because of a patent fight with Apple, which could quit using Qualcomm chips in its phones, and concerns that it may have to raise its bid for a NXP.

If Broadcom decides to make a hostile bid, Qualcomm's governance rules would allow the rival to submit its own slate for the entire 10-member board by a Dec 7 nomination deadline.

Two Qualcomm directors, Anthony Vinciquerra and MarkMcLaughlin, have been aligned with activist hedge fund JanaPartners LLC, which pushed for a shakeup of the company two years ago. Jeffrey Henderson, another Qualcomm board director, was added last year as a compromise candidate.

Apple, as a key customer, could play a key role. Analysts say that if Broadcom can salvage the Apple relationship, it would sharply increase potential returns from the takeover.

Tan also has a history of cutting costs at acquired companies, and Charter Equity analyst Ed Snyder predicted Tan would cut away waste at Qualcomm.

Broadcom plans to move its headquarters solely to the United States, which would allow it to avoid review by the Committee on Foreign Investment in the United States, which reviews foreign ownership of US assets.

Agencies