Recent statistics on China's economy provide signs that the nation is turning the corner on some of the sharp downturns witnessed during the first quarter of 2014.

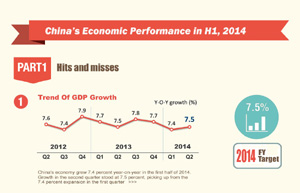

Second-quarter economic data released on July 16 confirmed that economic growth of 7.5 percent is still reasonable to expect in line with government projections. Just as important, the numbers suggest that China's economy is finally showing some long-awaited signs of rebalancing: Consumption accounted for 54 percent of growth in the second quarter, and the service sector also made gains.

The data, however, have spurred a divergence in opinion. Some argue that they mainly show that the government's rebalancing policy has started taking effect and consumption has finally picked up and will become the dominant force behind Chinese economic growth going forward.

Others remain skeptical, saying the data mainly show more weakness in manufacturing and exports than in the services sector. According to some, the economic growth engines are sputtering, and the difference is that the manufacturing and export sectors are losing speed at a much faster pace than consumption.

Of course, it is difficult to draw any definitive conclusions from one quarter of data. Nevertheless, the two forces indeed have to take place at the same time before Chinese economic rebalancing materializes. Between the two, one is more palatable to the government than the other.

Over the past couple of years, China's government and critics reached the same conclusion: China's economic growth model in the past three decades relied heavily on exports, cheap labor, and government stimulus, and investment in infrastructure no longer works. Diminishing investment returns, staggering overcapacity and mounting public and private debt all point in the same direction. An alternative model is badly needed to propel Chinese economic growth in the coming decades.

The answer, according to the experience of almost all developed economies, is household consumption and related growth in the services industry.

With increasing household income, China has already started feeling a shift in lifestyles. People spend more money not only on staples such as food and clothing but also on more experience-related consumption such as health and personal care and entertainment.

While some say that no matter how much money you earn, you can only eat three meals a day and sleep in one bed, people's demand for a fuller life experience has few limits other than time and money, and can grow faster as people become richer. The tourism industry, for example, experienced much faster growth than the overall economy in the past few years, indicating that such consumption has become increasingly appealing to consumers and valuable to businesses. Financial services have also enjoyed tremendous growth and success over the past few years. With increasing wealth being created, households have displayed a stronger need for better preserving and growing their wealth, and at the same time managing risks.

However, another aspect of this rebalancing process - the overall slowdown in economic growth - has proven much harder to deal with. On the one hand, Party leaders and government officials have reaffirmed their previous commitment not to engineer another big stimulus package to return growth to "the good old days" of 8 percent and higher. On the other, there have been reports that central and local governments are rolling out "mini stimulus" packages that are targeted at boosting growth by focusing on certain geographical areas and business sectors.

Apparently, it is not easy to settle for slower economic progress, especially after such miraculously fast-paced growth in recent decades in China. However, it should be understood that Chinese economic growth was always going to have to slow down - in part precisely because it was "too fast".

Investment-intensive growth can deliver a short-term boost, but it lacks the sustainability that consumption and the services industry, and perhaps only these two, can provide. This switch in economic growth models also is perfectly in sync with Party leaders' determination to let market forces play a greater role in Chinese economic growth.

The author is a faculty fellow at the International Center for Finance, Yale University; and deputy dean of the Shanghai Advanced Institute of Finance, Shanghai Jiao Tong University. The views do not necessarily reflect those of China Daily.

|

|

|

| Infographic: China's economic performance in H1, 2014 | China's economy to grow 7.5% in 2014: IMF |