Economy

Income tax rate under review

By Wang Xing (China Daily)

Updated: 2011-04-21 09:14

|

Large Medium Small |

Proposal will let wage earners keep larger slice

BEIJING - Taxpayers may be able to keep more of their income under a proposal submitted by the State Council to the nation's top legislature.

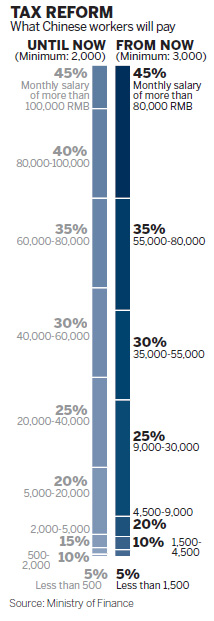

The Chinese Cabinet's proposal aims to raise the personal income tax threshold from 2,000 yuan ($306) to 3,000 yuan in a bid to boost domestic demand and reduce the burden on wage earners.

The draft amendment, presented to the Standing Committee of the National People's Congress, also proposed a reduction in the number of income tax brackets from nine to seven.

Xie Xuren, minister of finance, told the top legislators on Wednesday that if the plan is approved it will reduce the government's tax revenue by 109 billion yuan this year.

Lawmakers will review the draft amendment to the Individual Income Tax Law from Wednesday to Tuesday, the third revision since the law was introduced in 1980.

The move is part of the government's recent efforts to tackle income disparities and respond to public concern over surging living costs.

"The amendment is designed to reduce the tax burden for most salary earners while moderately increasing the taxation rate for those on a high income," Xie said.

He said only about 12 percent of low income earners will have to pay tax if the threshold is lifted, down from the current 28 percent.

The government said earlier that the draft amendment to the tax law will be open for public solicitation on April 25. A second review will start as early as June and the new tax rate, once agreed, is likely to be introduced in the second half of this year, it said.

|

||||

Jia Kang, head of the Research Institute for Fiscal Science affiliated to the Ministry of Finance, told China Daily in an interview that the tax law amendment is the government's response to increasing public concern over inflation.

"Inflation has increased difficulties for many, especially those in the low-income group," he said, noting that the current revision is expected to encourage consumer spending.

China introduced its individual income tax law in 1980 and raised the threshold to 1,600 yuan a month from 800 yuan in 2006 and then increased it to 2,000 yuan in 2008.

But the threshold increase lagged behind rising consumer prices. According to the National Bureau of Statistics, food prices surged 7.2 percent last year. Prices for new apartments also surged about 14 percent during the same period.

In March, the consumer price index hit a 32-month high of 5.4 percent. Analysts estimate that the figure is expected to continue to increase in the next few months.

Wang Xiaolu, deputy director of the China Reform Foundation's national economic research institute, said the tax revision is a good start in curbing the growing income gap.

But he also said that the best way to increase national income would be a comprehensive reform of the fiscal, taxation and administrative systems.

Wang conducted a controversial study last year showing that, if hidden income was taken into consideration, the income gap is far wider than earlier estimated.

Zhao Yinan contributed to this story.

| 分享按鈕 |