Opinion

Stock index queers future

By YI XIANRONG (China Daily)

Updated: 2010-05-15 11:43

|

Large Medium Small |

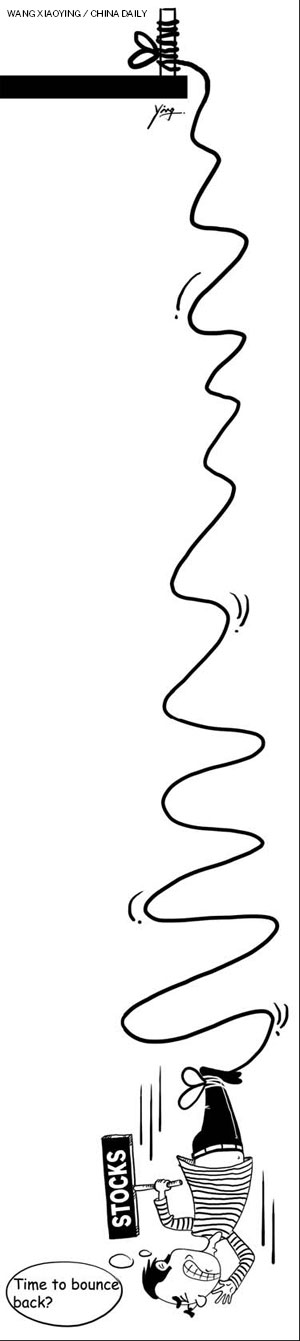

New financial derivative, weak policies and laxsupervision have caused share prices to plunge

The stock market has tumbled again, with the benchmark Shanghai Composite Index dropping 15 percent, from 3,166 on April 15 to 2,696 at May 14's closing session. Such a drastic drop in such a short period has not been seen since stock prices plummeted in the months following the global financial crisis in late 2007. Many domestic security analysts have attributed the drop to the gloomy economic prospect at home and abroad - which is the result of the stern policies and measures taken by the State Council and local governments to curb the sizzling real estate market, and the sovereign debt crisis in Greece and other European countries and the turbulence in Wall Street.

Despite their impact on the domestic stock market, these problems are by no means the dominant factor that have caused China's A-share prices to drop the most among the world's major stock markets. For a fledging market that still does not have a high degree of transparency, any negative news from the outside world is likely to create an impact on China's A-share market but unlikely to be the key factor determining its tendency.

Despite their impact on the domestic stock market, these problems are by no means the dominant factor that have caused China's A-share prices to drop the most among the world's major stock markets. For a fledging market that still does not have a high degree of transparency, any negative news from the outside world is likely to create an impact on China's A-share market but unlikely to be the key factor determining its tendency.

The roller-coaster ride China's stock market went through from 2007 to 2009 - though it performed relatively well compared with many other markets - was driven mainly by domestic factors. The 15 percent drop in domestic A-share prices is much higher than that of the global stock market, and proves that the global economic environment has failed to exert as much influence on the Chinese stock market as some domestic experts and analysts tend to believe.

The regulatory measures taken by the State Council, China's Cabinet, to cool down the real estate sector may have influenced the stock market's performance during the past few weeks. But the fact that the unprecedented boom in the real estate market since late last year has failed to cause a similar boom in the stock market shows the lack of connection between the two.

By the end of 2008, the value of listed real estate companies' shares was only 419.6 billion yuan ($61.46 billion), or 3.46 percent, of the combined 12.13 trillion-yuan-worth of shares on the Shanghai and Shenzhen stock exchanges. The proportion is still below 5 percent. So small is the percentage that new macroeconomic regulations targeted at the real estate sector is unlikely to have a great impact on the stock market. The corollary: The drastic decline in stock prices does not have much relevance to the country's macroeconomic environment.

The national economy is back on track - moving toward rapid growth since the beginning of the year. The first quarter GDP was as high as 11.9 percent year-on-year. Many listed companies have performed twice or thrice as better than the previous year. Hence, as the barometer of the national economy, the stock market should have risen, especially because of the at-least-10-percent economic growth expectation for 2010.

Why then did the stock market tumble?

The Stock Index Futures, introduced by the authorities in mid-April, has played a role in bringing down share prices this time. In the absence of a set of strict and effective supervisory mechanisms, the creation of any financial derivative in China's fledging stock market will encourage more speculation.

Since China still does not have a set of complete and well-planned financial institutions and financial innovative instruments carry risks, in all likelihood some market manipulators will use the Stock Index Futures for profiteering.

Such a financial policy will no doubt cause some fundamental changes in the previous investment notions among investors and will influence their investment decisions and activities because the policy has added uncertainties to people's expectations from the market.

In such a situation, some investors are likely to exit the market and adopt a wait-and-watch approach. In fact, after the Stock Index Futures was introduced, a lot of individual investors chose to leave the stock market, a development that to some extent contributed to the latest decline in shares.

It is not a coincidence that the share prices started falling immediately after the Stock Index Futures was introduced. The authorities should not confuse superficial phenomena from the real ones for the decline in stock prices. A thorough probe should be launched into the causes that led to the fall in share prices and to find ways to make new institutional arrangements that would ensure a healthy and stable development for the stock market.

The author is a researcher with the Institute of Finance and Banking under the Chinese Academy of Social Sciences.