InfoGraphic

Gold prices set to soar as demand outpaces supplies

By Hou Qingyang (China Daily)

Updated: 2010-03-30 09:35

|

Large Medium Small |

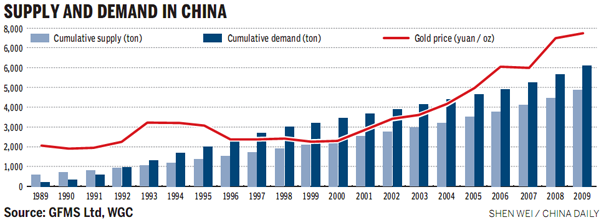

BEIJING -- Gold consumption in China is likely to double over the next decade, boosting prices as burgeoning demand will outpace the growth in supplies, said a report released on Monday by the World Gold Council (WGC).

|

|

Aram Shishmanian, CEO of World Gold Council, expects demand to stay bullish over the next ?ve years. |

With gross domestic product set to grow at above 9 percent this year, China, the world's second largest gold consumer after India, has the potential to double its gold consumption from the 2009 level of 500 tons a year, the report said.

The only way for the Western countries to resolve the economic crisis is to slowly repay their debts and print more money, which devaluates the currency and results in inflation, said Shishmanian.

Conventionally, gold is priced against the dollar and performs inversely against the greenback. "The dollar is now being challenged as the world currency and the US economy will struggle for a number of years before recovering. In such a scenario gold prices would continue to remain robust," said Shishmanian

"If gold demand continues to increase, domestic supplies would be unable to keep pace. Whatever the outcome, China's outlook will have implications for the global gold market," said Eily Ong, investment research manager at WGC.

During the past five years, demand for gold increased at an average annual rate of 13 percent in China. The bulk of this demand has been satiated through domestic supplies.

During the last decade, Chinese gold miners have boosted output by 84 percent, but the nation's known reserves account for just 4 percent of the total global gold reserves.

The WGC report estimates that China could exhaust its known gold mining reserves in six years. That trend could change only if China attracts more capital for new ore exploration, said the report.

Sustaining the supplies is another major challenge for the nation. "The known global gold reserves are declining in the past 10 years," said Shishmamian.

In the long term, demand is set to accelerate, as investors and jewelry buyers accumulate the yellow metal in spite of higher prices. Further momentum may well come from central bank purchases, said the report.

If China bought a significant portion of gold in the open market, it would increase prices. But there have been many instances of such market purchases and sales. China has in the past boosted its reserves through off-market purchases.

| ||||

Yi Gang, vice-governor of PBOC and chief of SAFE, said at the National People's Congress earlier this month that gold is unlikely to be a major investment avenue for the nation's $2.4 trillion foreign exchange reserves.

China, the world's sixth largest official holder of gold, currently holds 1,000 tons of the yellow metal, approximately 2 percent of its total foreign exchange reserves.

Gold has gained in each of the past nine years. It hit a record $1,226.56 an ounce on Dec 3, as low US interest rates helped push the Dollar Index 4.2 percent lower during 2009.