|

BIZCHINA> Top Biz News

|

|

Cut in holdings of US debt may help diversify China's reserves

By Si Tingting (China Daily)

Updated: 2009-08-19 07:22

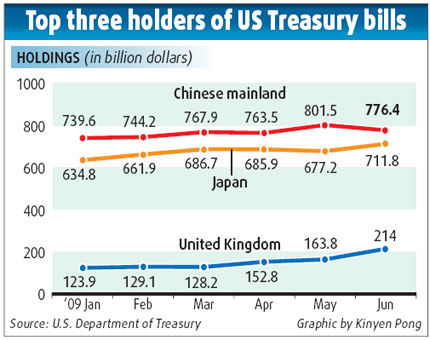

China drastically cut its holdings of US Treasury debt in June, but its purchase of more long-term securities indicates no significant change in its interest in US government bonds. The country's holding of US Treasury securities fell to $776.4 billion in June, from a record high of $801.5 billion in May. Despite the biggest monthly drop since 2000, China still retained its position as the top holder of US treasuries, according to US Treasury data released on Monday. While slashing its holdings of short-term bills by 25 percent, to $158.7 billion, China rotated into longer-dated maturities by $27 billion, a 4.5 percent increase.

"The fact that China has now returned and bought long-term notes is an encouraging sign," Patrick Bennett, Asia Foreign Exchange Rates Strategist with Societe Generale in Hong Kong, told China Daily. "It shows that China, as an investor, sees value in the issues and this speaks to the credibility of US policies." Bennett dismissed the idea that China's reduction in the holding of US treasuries represents "a big move". "The change is a slight surprise, but we need to see the next couple of months' data before determining the trend of purchases," he said.

"The recent pattern suggests China hastened its effort to diversify its international reserves," Crescenzi said. China's foreign exchange reserves totaled $2.13 trillion at the end of June. Yin Zhongli, a senior researcher with the financial research institution of the Chinese Academy of Social Sciences, believes that the share of US dollar-dominated assets in China's foreign exchange reserves is too large. "So, we have to diversify our portfolio for risk aversion," Yin said, adding that the country might buy more assets denominated in other foreign currencies, such as the euro, the Japanese yen and the Australian dollar. "But investment in US treasuries is still relatively safe compared with other options, because the recovery of the US economy is, by and large, stronger than other major economies, such as the European Union," he said. (For more biz stories, please visit Industries)

|

|||||

主站蜘蛛池模板: 欧美一区二区三区成人久久片| 国产精品国产三级国av| 最近中文字幕mv免费视频| 精品久久高清| 国产一二三五区不在卡| 东方四虎在线观看av| 日本高清不卡一区二区三| 精品一区二区三区在线成人| 国产精品激情av在线播放| 亚洲午夜亚洲精品国产成人| 久久久无码精品亚洲日韩蜜臀浪潮| 五月天久久综合国产一区二区| 久久高潮少妇视频免费| 亚洲自偷自拍另类小说| 豆国产96在线 | 亚洲| 亚洲一本二区偷拍精品| 天堂无码人妻精品一区二区三区| 国产精品午夜福利合集| 亚洲AV日韩AV一区二区三曲| 九九热免费在线观看视频| 无卡国产精品| 亚洲综合一区二区三区视频| 国产一区二区亚洲一区二区三区| 国产乱色熟女一二三四区| 69精品丰满人妻无码视频a片| 亚洲高清偷拍一区二区三区| 亚洲成av人片色午夜乱码| 国产精品v欧美精品∨日韩| 麻豆蜜桃伦理一区二区三区| 人妻少妇精品系列一区二区| 色就色偷拍综合一二三区| 毛片av在线尤物一区二区| 国产视频一区二区在线看| 久久免费网站91色网站| 最近高清日本免费| 国产又爽又黄又爽又刺激| 亚洲无码久久久久| 办公室强奷漂亮少妇视频| 91亚洲精品一区二区三区| 在线精品亚洲区一区二区| 长腿校花无力呻吟娇喘的视频|