|

BIZCHINA> Top Biz News

|

|

Related

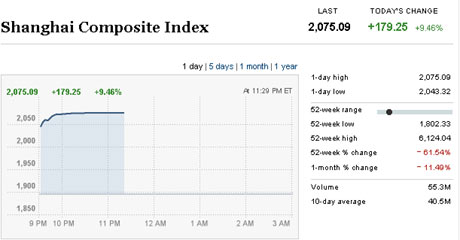

Stocks spurt at government rescue

By Dong Zhixin (chinadaily.com.cn)

Updated: 2008-09-19 11:49

Chinese stocks snapped up three straight days of losses with a sharp rise on Friday after the government stepped in to revive the market, cutting trading tax and promising share buybacks. The benchmark Shanghai Composite Index jumped 9.07 percent at the opening bell, recovering the steep losses in the previous three sessions due to the shockwaves of the US financial woes. The rally came after the Ministry of Finance announced overnight that the stamp tax on stock purchases will be scrapped from Friday. Investors interpreted the move as a signal that the government will not let the market fall further. The State-owned investment agency Central Huijin provided another boost. As the majority shareholder of three major banks, the Industrial and Commercial Bank of China, Bank of China and China Construction Bank, Huijin said it would buy shares of the three lenders in the secondary market. The aim is to "guarantee the government's controlling stake" and "boost their stock prices", it said in a statement. At the news, all but one financial shares jumped 10 percent, the maximum allowed by the exchanges. The Industrial and Commercial Bank of China jumped 9.88 percent. Banking shares alone account for more than 25 percent of the Shanghai Composite Index. Therefore, their performances can partly determine whether the rebound is short-lived or sustained. On top of the Huijin pledge, the State-owned Assets Supervision and Administration Commission voiced their support for the major State-owned firms to buy back their shares. Shrugging off the on-going scandals involving dairy producers, Beijing Sanyuan Food Co. surged by its daily limit, as none of its products were found to contain melamine, a chemical that have led to the death of four babies across the country. The long-awaited official rescue came after the Shanghai index lost 70 percent in less than one year, with valuations nearing record low levels. Experts have called on the government to intervene to put a floor on investor confidence. At the start of the week, the central bank cut lending rates and reduce the amount of cash small banks must set aside as reserves in a sharp reversal in the country's monetary policy. The tight monetary policy put in place at the end of last year to fend off inflation was partly blamed for the stock woes. However, the energizing impact of looser credit was overwhelmed by fears over the spillover effect from US financial turmoil, in which Lehman Brothers filed for bankruptcy protection and Merril Lynch sold itself to Bank of America. Across the globe on Wall Street, the Dow Jones Industrial Average leapt 410 points on Thursday to 11,019, powered by reports of a US government and Congress plan to soak up bad debts from troubled banks. (For more biz stories, please visit Industries)

|

主站蜘蛛池模板: 亚洲精品成人久久av| 狠狠色狠狠色综合日日不卡| 亚洲国产第一站精品蜜芽| 国产亚洲亚洲国产一二区| 精品综合久久久久久97| 国产乱人伦真实精品视频| 自拍偷自拍亚洲精品熟妇人| 亚洲综合久久国产一区二区| 人妻少妇精品视频专区| 欧美日韩精品一区二区视频| 最新国产精品好看的精品| 国内精品一区二区在线观看| 国产精品国产自线拍免费软件| 亚洲h在线播放在线观看h| 国产精自产拍久久久久久蜜| 亚洲欧洲一区二区天堂久久| 一区二区三区鲁丝不卡| 男女真人国产牲交a做片野外| 欧美成人精品手机在线| 亚洲AV无码无在线观看红杏| 男女18禁啪啪无遮挡激烈网站| 亚洲啪啪精品一区二区的| 亚洲男女内射在线播放| av无码精品一区二区乱子| 猛男被狂c躁到高潮失禁男男小说| 久久久国产精华液| 麻豆tv入口在线看| 国产99视频精品免费视频36| 亚洲天堂久久一区av| 自偷自拍三级全三级视频| 精品少妇人妻av免费久久久| 国产精品一二三区蜜臀av| 在线看片免费人成视频久网| 免费A级毛片樱桃视频| 丰满的女邻居2| 亚洲精品日本一区二区| 国产无遮挡18禁无码网站免费 | 荡乳尤物h| 欧美丰满熟妇xxxx性ppx人交| 亚洲综合色88综合天堂| av无码免费无禁网站|