|

BIZCHINA> 30 Years of Reforms

|

|

Related

Country grapples with runaway property prices

By Hu Yuanyuan (China Daily)

Updated: 2008-08-19 11:36

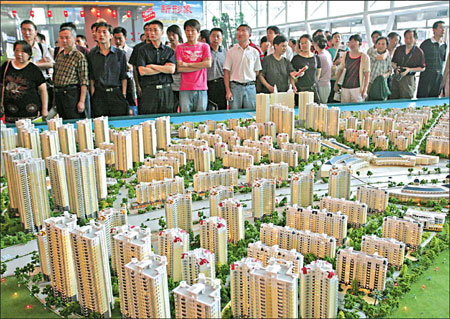

For most Chinese, owning a house is as much a necessity as it is a dream. And, for the Chinese government, making more houses available for the common people is one of its policy priorities.

The residential housing market now accounts for more than 70 percent of all property development in China. But only 10 years ago, the vast majority of people lived in housing provided by their work units, often in cramped conditions. The housing reform program introduced in the late 1990s has encouraged greater participation by the private sector, resulting in a huge increase in supply. Many homebuyers are taking advantage of the widening availability of bank financing to acquire their first homes.

As a result, per capita living space in urban areas has risen from 16 sq m per person nationwide in 1995 to 28 sq m per person in 2007, with hundreds of millions becoming homeowners, according to the National Bureau of Statistics. Homebuyers' soaring demand has been fueling a real estate boom in China for years, but has also sent property prices skyrocketing. To tackle speculation and cool down the sizzling property market, the government has ushered in a number of measures since 2005, including the introduction of new taxes on sales and capital gains and higher interest for mortgage lending on second homes. Meanwhile, the government has become increasingly concerned by the volume of funds seeking real estate investments in China, particularly the "hot money" entering the market looking for short-term gains. To deal with this, the government has, over the last several years, introduced a series of new regulations aimed at foreign investors in real estate. Foremost among these is perhaps Circular 171 that requires overseas investors in completed buildings to establish an onshore wholly foreign-owned enterprise or a joint venture before investing. This makes life difficult for foreign investors, but the potential returns from real estate investment in China are still exciting enough to keep investors streaming in. The economic fundamentals are still strong and there are opportunities across a range of sectors and in a range of geographical locations. (For more biz stories, please visit Industries)

|

主站蜘蛛池模板: 日本久久久久亚洲中字幕| 国产成A人片在线观看视频下载| 色综合天天综合| 人妻熟妇乱又伦精品无码专区| 免费无码午夜福利片| 中文字幕无码av不卡一区| а√天堂中文在线资源bt在线| 亚洲一区二区av高清| 国产a网站| 视频一区视频二区视频三| 精品亚洲欧美无人区乱码| 欧美19综合中文字幕| 午夜三级成人在线观看| 日韩欧美亚洲一区二区综合| 亚洲综合伊人五月天中文| 国产亚洲精品成人无码精品网站| 国产系列丝袜熟女精品视频| 欧美成本人视频免费播放| 96精品国产高清在线看入口| 日韩精品一区二区三区久| 91人妻熟妇在线视频| 婷婷丁香五月亚洲中文字幕| 在线中文字幕第一页| 亚洲国产初高中生女av| 在线观看成人年视频免费| 亚洲欧美日产综合一区二区三区| 日韩一区二区三区av在线| 亚洲一区二区约美女探花| 青青草视频华人绿色在线| 无码人妻丰满熟妇啪啪网不卡 | 成人特黄特色毛片免费看| 国产又黄又硬又粗| 羞羞影院午夜男女爽爽影视| 中国CHINA体内裑精亚洲日本| 人妻系列中文字幕精品| 国产精品无码素人福利不卡| 国产萌白酱喷水视频在线观看| 亚洲AV小说在线观看| 亚洲精品熟女一区二区| 国内精品久久久久久影院中文字幕| 精品国产免费一区二区三区香蕉 |