|

BIZCHINA> Top Biz News

|

|

Related

China Life plunges after Q1 profit declines

(China Daily)

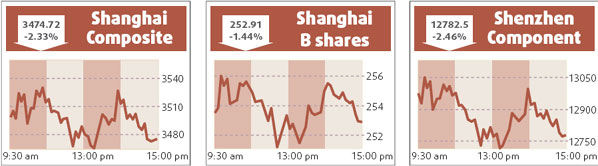

Updated: 2008-04-29 09:44   China Life Insurance Co, the nation's largest insurer, fell in Shanghai trading after the company reported a drop in first-quarter profit as a declining domestic stock market hurt investment returns. The Beijing-based insurer lost 4.12 percent to 32.8 yuan ($4.68) on the Shanghai market yesterday. Its Hong Kong-traded shares slid 1.63 percent to HK$33.25 ($4.27). China Life's net investment income declined 10 percent to 15.1 billion yuan in the first quarter as the nation's benchmark stock index lost 29 percent, making its market the world's seventh worst performer. The firm's 39.5 percent first-quarter premium growth also left it lagging a 52 percent average for the country's life insurance industry. "We've sold China Life shares as we lower our China exposure and face redemptions in the market downturn," said Gabriel Gondard, deputy chief investment officer at Fortune SGAM Fund Management Co. "What's key for investors is China's stock market performance, given its link to insurers' investment returns." Fortune SGAM sold 8 million China Life shares by the end of December. China Life's first-quarter net income fell 61 percent to 3.47 billion yuan, or 0.12 yuan a share, from 8.89 billion yuan, or 0.31 yuan a share, the firm said in a statement late Sunday.

The company had 23 percent of its 2007 portfolio invested in equities, compared with 24.7 percent for smaller rival Ping An Insurance (Group) Co. Shenzhen-based Ping An, China's second biggest insurance firm, is scheduled to announce first-quarter earnings on Wednesday. "Equities are actually not a large part of Chinese insurers' portfolios, but they ended up taking a disproportionate role in companies' reported earnings because the market was so heated last year, according to Howard Wang, the Hong Kong-based head of Greater China at JF Asset Management. Chinese insurers are well-equipped to manage their equity investments, though short-term headline profits and investor sentiment will be negatively affected by the market slump, wrote Hong Kong-based Credit Suisse Group analysts Chris Esson and Frances Feng in an April 17 report. Esson and Feng, who have an "outperform" rating on China Life's stock, said they prefer the company to Ping An because the former's equity portfolio provides greater profit-smoothing flexibility. China Life's acquisitions strategy is also not as rife with uncertainty as Ping An's, according to Credit Suisse. China Life's Shanghai-traded stock has plummeted 43 percent this year. (For more biz stories, please visit Industries)

|

主站蜘蛛池模板: 九九热这里只有精品在线| 精品人妻av综合一区二区| 午夜AAAAA级岛国福利在线| 亚洲狠狠婷婷综合久久久| 国产精品成人久久电影| 亚洲av套图一区二区| 成人国产精品一区二区不卡| 毛片网站在线观看| 最新精品国偷自产在线美女足| 日韩中文免费一区二区| 亚洲国产精品一区第二页| 国产成人啪精品视频免费网| 中文字幕乱码免费人妻av| 蜜臀一区二区三区精品免费 | 天天躁夜夜躁狠狠喷水| 国产精品毛片av999999| 国产欧美VA天堂在线观看视频| 人妻无码AⅤ中文字幕视频| 亚洲av永久无码精品漫画| 国产午夜福利精品久久2021| 激情视频乱一区二区三区| 国产乱子伦手机在线| 线观看的国产成人av天堂| 国产永久免费高清在线观看| 亚洲成av人在线播放无码| 中文字幕精品久久久久人妻红杏1| 暖暖免费观看电视在线高清| 久久精品国产亚洲AV麻| 亚洲欧洲日产国码综合在线| 国产高清在线男人的天堂| 国产久免费热视频在线观看| 巨爆乳中文字幕爆乳区| av在线播放无码线| 国产精品一区二区久久岳| 国产日韩欧美在线播放| 日韩三级一区二区在线看| 国产三级+在线播放| 午夜av福利一区二区三区| 在线精品自拍亚洲第一区| 久久精品国产精品亚洲综合| 国产精品人成视频免|