Getting the most out of forex reserves

Updated: 2007-09-26 13:41

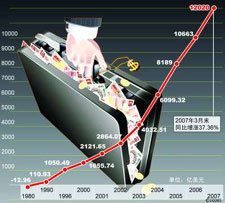

It has been reported that China Investment Co, the long-awaited State forex investment company that is expected to make better use of the country's huge foreign exchange reserves, will be inaugurated on September 28.

After three decades of robust and continuous economic growth, the country has accumulated $1.3 trillion of foreign exchange reserves. This is about half of China's annual gross domestic product (GDP), which means every two percentage points of revenue from the foreign exchange reserves equals one percentage point of growth in GDP.

Information about the reserve's investment portfolio is not available to the public, though research indicates a big proportion of its funds are in the global bond market, especially in US bonds. Before 2004, the reserve's assets were primarily invested in US treasury and mortgage bonds. Corporate bonds gained more attention after 2004.

Compared with other financial assets, especially shares, bonds are less risky - and less rewarding. Putting the country's forex reserves into the bond market was fine when the reserves were small. The wisdom of this stance becomes questionable once the forex reserves exceed the amount needed for trade settlements.

Past experience proves that a stock-centered investment portfolio is much more rewarding than a bond-centered one. In the last century, the annual difference in returns between the two portfolios was between 5 and 8 percent in the US and around 3 percent in Europe and Japan.

Given the gigantic size of China's forex reserves, the country could expect to see its returns increase by the equivalent of about 1.5 percent of GDP if the investment portfolio became more stock-centered.

Switching the portfolio's focus would be worth a try despite the higher risks involved with stock investments. The newly established forex investment firm is obviously a pilot step in this direction.

During the transitional period, the key issue will be what kind of financial assets are worth investing in.

All non-bond financial assets fall into categories of shares of listed companies and equities of private firms. The stock of listed companies is more liquid and transparent, so it is relatively more expensive. The equities of private firms are less costly, less liquid and less transparent, but more rewarding in the long run.

An institutional investor will generally include both of them in its portfolio, with different proportions of each. So which one should the investors of China's forex funds favor - shares on the stock exchange or the equities of private firms? In other words, the investors will have to choose between acting like a mutual fund manager and a venture capital runner hunting for private equity.

|

|