Monday index down 3.68%, with lowest trading volume for June

By Li Zengxin (chinadaily.com.cn)Updated: 2007-06-25 15:47 After a 3.29 percent drop last Friday, Chinese stocks closed down by another 3.68 percent today, to lose the 4,000-point battleground amid long-spread swings. Total turnover of the stocks enclosed by the two major indices was 214.2 billion yuan, the lowest in a month.

The benchmark index climbed to 4,131.13 as the daily highest soon after a higher opening from 4,102.79, then it dived more than 100 points in minutes. After hitting through the 4,000-point mark, it turned up and reached the second highest point, before reversing the trend again by the noon break. In the afternoon, it slid all the way to the lowest 3,912.42 near the end. Finally, a weak turning-back stopped it from losing the 3,900-point ground.

Shanghai Composite

Index

Source: www.sina.com.cn

Of the A shares listed in Shanghai, merely 67 went up today but 720 dropped and 52 finished unchanged. Zhejiang HSD Industrial surged 10.03 percent to 11.08 yuan on top of the gainer's list. Garment-maker Jiangsu Hongdou Industry plunged 10.06 percent to lead the fall.

Large traders were mostly down, dragging the index to a new deep. China Unicom, with the largest trading volume, was down 0.31 yuan while China Merchants Bank, with the largest transaction value, gained 3.27 percent.

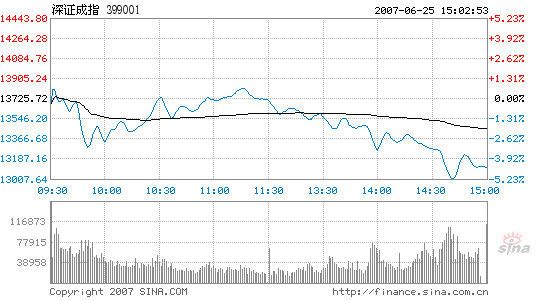

The Shenzhen Component Index, tracking the smaller Shenzhen Stock Exchange, opened lower from 13,678.53, and mapped a similar path with the Shanghai Index. It finished at 13,109.26, down 616.46 points or 4.49 percent.

Shenzhen Component

Index

Source: www.sina.com.cn

Of its A shares, 45 went up, 492 closed down and 76 unchanged. Hunan Ginde Development was sealed at the maximum daily increase cap of 10 percent as the biggest gainer. Fujian Minnan Zhangzhou Economy Development, however, fell most. The largest traders, China Vanke and Shenzhen Development Bank were both down.

Shares in the agriculture, paper making and real estate industries were comparatively stronger than the others. Jiangxi Gannan Fruit rose 6.05 percent to 33.3 yuan as the leading agricultural stock.

B shares fell. Of the 109 B-shares listed on the exchanges, only five were up and nine flat. Anhui Gujing Distillery again surged 10.07 percent as the top gainer. Closed-end funds also dropped, with both the fund indices plunging more than 3 percent.

Unlike most analysts expected, the stocks didn't reverse a downward trend started last Friday, in absence of further tightening measures over the weekend.

If the consumer price index (CPI), a key gauge of inflation, continues to rise, "we don't exclude the possibility of raising interest rates again," Zhou Xiaochuan, governor of the People's Bank of China said in Basel, Switzerland, on Saturday.

The central bank has raised rates twice this year, with the latest on May 19 when the benchmark one-year deposit rate was raised 27 basis points to 3.06 percent.

Also in May, the CPI rose the highest in more than two years - 3.4 percent year on year - as pork and food prices soared. It was the third month this year that the CPI exceeded or nudged the 3 percent mark set by the central bank for this year.

High volatility in the stock market also scared new investors away from

investing directly on individual stocks. Daily new A-share account openings have

been growing slowly while new fund accounts were maintained above the

100,000-level last week.

New Account Opening Date A

share B

share Mutual fund Total 2007-06-18 216,688 1,739 188,064 406,491 2007-06-19 184,620 1,725 138,155 324,500 2007-06-20 171,984 1,566 113,932 287,482 2007-06-21 160,104 1,359 133,766 295,229

Source: China Securities

Depository and Clearing Co Ltd

This year, mutual funds have paid out 89.275 billion yuan in profits to investors, much larger than the 65.147 billion yuan for the same period last year, according to the China Securities News. Open-end funds paid 85.825 billion yuan while closed-end gave 3.45 billion yuan to subscribers. Of the 307 open-end mutual funds, 26 paid out more than 1 billion yuan each, said Wind Info, a leading financial data provider.

Following the lead of banks, securities and fund management companies will soon launch their investment plans as the Qualified Domestic Institutional Investors (QDII). But according to securities insiders, due to the limited QDII scale in the early stages, the domestic A-share market will not be greatly affected by the outflow of funds.

The China Securities Regulatory Commission recently announced rules allowing eligible securities and fund management companies to get QDII licenses. Currently, there are nine securities companies and nearly 20 fund management companies meeting the above requirements.

A report from China International Capital Co Ltd predicts that the QDII program will have a limited impact on the A-share market. Many securities and fund management companies are not very knowledgeable about overseas markets; their investment may focus on the H-share market in Hong Kong. Due to the recent red-hot A-share market, their enthusiasm for overseas investment is not so high, says the report.

Opposite opinions are voiced by Tang Xiaosheng from Guoxin Securities Co.

Tang thinks the QDII rules may be one of the regulators's measures to control

the overheated market. Over-priced stock and expectations of capital outflow

will bring pressure to the A-share market, particularly, after regulators

tripled the stamp tax for stock trading in A-share market. As a result, H-shares

have become more attractive not only in terms of price but also in transaction

cost.

(For more biz stories, please visit Industry Updates)