Foreign exchanges woo Chinese companies

By Zhang Ran (China Daily)Updated: 2007-06-11 15:12

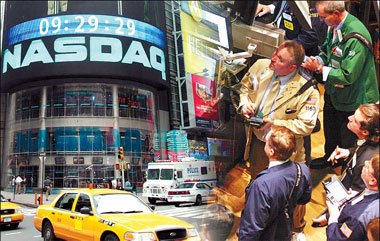

Shanghai, Hong Kong, Singapore, NYSE, NASDAQ, London, Frankfurt... the list of suitors for Chinese companies these days is just endless when it comes to picking the right exchange to list.

As the A-share market swings between an ultra-wide band - and analysts are saying the market will continue to be like this until 2008 - and overseas exchanges ease their rules to cozy up to new listing candidates, Chinese companies suddenly find themselves swamped with choices.

In the last few months, NYSE has weaned away a few Chinese companies that are

believed to have been originally planning to head for NASDAQ. The latest was

Qiao Xing Mobile Communications Co Ltd, which controls CEC Telecom Co Ltd

(CECT), the fourth-biggest Chinese mobile phone maker. It made its debut on the

NYSE on May 3. The company was rumored to have been torn between NASDAQ and Hong

Kong Stock Exchange until it fell for NYSE.

These days it's not uncommon for Chinese companies in search of a home for its shares to be approached by representatives of the two exchanges at the same time. And the results are showing. Last year, six Chinese companies listed in NASDAQ and four in NYSE. In just the first five months of this year, 10 companies have listed in NASDAQ and five in NYSE.

As the Chinese government clearly wants its large State-owned enterprises to list at home, the NYSE, the largest bourse in the world, has been chasing smaller - but perhaps more entrepreneurial - Chinese companies. Among the 99 overseas IPOs last year, 86 came from the private sector.

NASDAQ, meanwhile, hasn't been sitting idle either. Going beyond its traditional focus on the technology industry, it's been actively courting companies from increasingly diverse trades, including services, manufacturing, healthcare and media.

On April 3, Bob Greifeld, president and CEO of NASDAQ, flew to Beijing. Soon after landing, he rang a ceremonial bell in downtown Orient Plaza, announcing the opening of the electronic market for the first time in China, and then went off to release a NASDAQ China Index to track the performance of the 30 largest Chinese companies listed in the United States.

Greifeld was like a man on a mission. And a mission it was, of revenge. Almost on the same day, NASDAQ's rival, the New York Stock Exchange Group, was celebrating its merger with Euronext - thus leading to the creation of the first transatlantic bourse - while NASDAQ failed to acquire the London Stock Exchange (LSE).

"We focus with great intensity on competition with NYSE. We are in the

process of taking a part of the floor of the NYSE 'board by board'," Greifeld

said in Beijing. He was trying to avenge losing Europe to his rival by securing

China.

| 1 | 2 | 3 |  |

(For more biz stories, please visit Industry Updates)