|

|

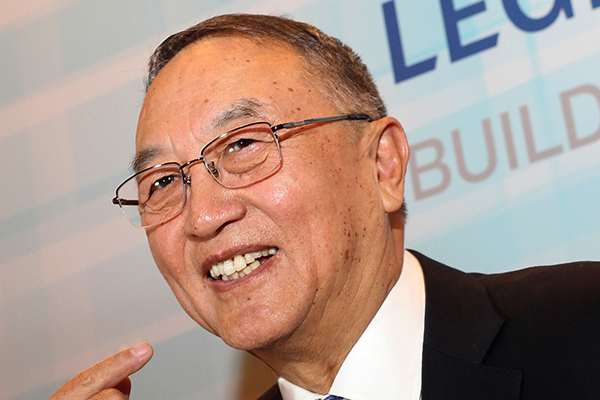

Liu Chuanzhi, chairman of Legend Holdings Corp, speaks at a news conference on the company's IPO in Hong Kong on Monday. Legend now runs diversified businesses from financial services, consumption, agriculture, real estate, chemical to energy. [Photo/China Daily] |

Conglomerate Legend Holdings Corp, which is the parent company of Hong Kong-listed Lenovo Group Ltd, the world's largest computer maker by sales, aims to raise more than $1.8 billion in an initial public offering.

Legend is offering 352.9 million shares at HK$39.80 ($5.13) to HK$43 apiece, the company said in a statement in Hong Kong on Monday. The net proceeds are estimated at HK$14.08 billion, assuming the final offer price is HK$41.40, the mid-point of the initiative price range.

A 15 percent over-allotment option, also known as a green shoe, may be exercised if the offer is heavily oversubscribed, the company said.

Legend was established in 1984 with 200,000 yuan ($32,200 at current exchange rates) in initial capital from the nation's top research institute, the Chinese Academy of Sciences. It has since grown into a company with $47 billion of assets and interests in financial services, consumption, agriculture, real estate, chemicals and energy. It controls or has invested in hundreds of companies.

After becoming the world's biggest computer manufacturer, Legend has a new vision, said 71-year-old Liu Chuanzhi, founder and chairman of the company, as he attended a meeting held in Hong Kong. Legend aims to meld industrial development and financial services, he said.

"Legend is committed to become a globally respected and trusted company, by owning leading companies in diversified sectors. We also have a global vision, and have started agriculture programs in Australia and Latin America," he said.

Legend has agreed to sell as much as $950 million of stock, or about half the IPO, to 24 cornerstone investors including Hong Kong billionaire Cheng Yu-tung, controller of local jewelry brand Chow Tai Fook, and Walter Kwok, former chairman of Sun Hung Kai Properties Ltd.

Other investors include State-backed conglomerate CITIC Ltd and China Reinsurance (Group) Corp. Each has agreed to invest $50 million in the offering, according to the terms. Consumer electronics maker TCL Corp and an arm of billionaire Guo Guangchang's Fosun International Ltd each have agreed to buy $30 million of stock.

Legend has a 30.6 percent stake in Lenovo. In addition, it has a 23.87 percent share of CAR Inc, the nation's largest car rental company, which went public in Hong Kong in September, and stakes in online payment provider Lakala Payment Co Ltd and dental clinic chain iByer Dental Group.

Analysts at Goldman Sachs Group Inc earlier said that they expected Lenovo's holding company to achieve a compound annual growth rate of 13 percent in earnings from 2014 to 2017.

Goldman Sachs said growth will be mainly driven by the acquisition of IBM Corp's x86 server business, integration with Motorola Mobility, and a turnaround in Legend's vehicle leasing, elderly care, foods and petrochemical businesses.

Legend said 55 to 60 percent of the proceeds will be used to fund strategic investments for new acquisitions or in industries with high growth potential, such as consumer companies and elderly care. Another 10 to 20 percent of the proceeds will be used in financial investment, while 15 to 20 percent will go to repay the 2 billion yuan worth of corporate bonds that fall due this year.

"Legend chose to go public in Hong Kong because we are fond of the regulated and transparent market. It is also an internationalized market. We have confidence that our share price will be supported by our performance," said Liu.