China dismisses Moody's downgrade as 'inappropriate'

BEIJING - China's Finance Ministry Wednesday dismissed a decision by international rating agency Moody's to downgrade China's credit ratings.

The downgrade was based on the "pro-cyclical" rating approach which is "inappropriate," the Ministry of Finance (MOF) said.

Moody's said Wednesday that it had downgraded China's long-term local currency and foreign currency issuer ratings to A1 from Aa3 and changed the outlook to stable from negative.

The rating agency attributed the decision to expectations that China's economy-wide leverage would increase over the coming years, planned reform program would likely slow, but not prevent the rise in leverage, and sustained policy stimulus would cause rising debt.

"These viewpoints, to some extent, overestimate the difficulties facing the Chinese economy and underestimate the capabilities of China to deepen supply-side structural reform and expand overall demand," the MOF said.

China's economy started strongly in 2017. Gross domestic product grew 6.9 percent in the first quarter, above the full-year target of 6.5 percent and the 6.8-percent growth in the fourth quarter of 2016.

For the first four months, fiscal revenue jumped 11.8 percent, compared to 8.6 percent for the same period last year.

The MOF pointed to the strong performance as an effect of ongoing supply-side structural reform.

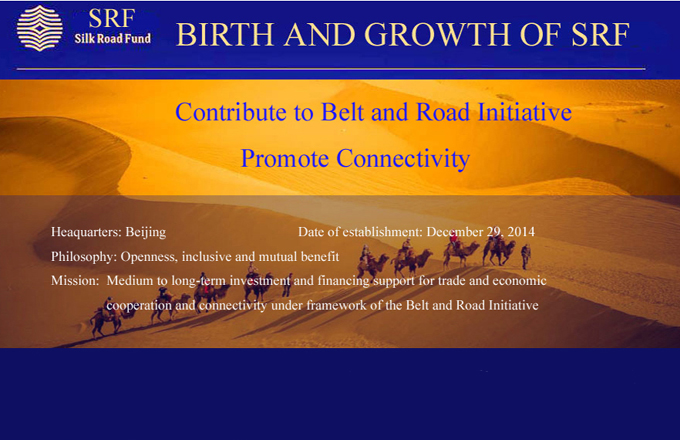

"China's economy is expected to maintain steady and relatively fast growth thanks to the deepening reforms in State-owned enterprises, finance, taxation and pricing, in addition to the implementation of the Belt and Road Initiative," the MOF said.

The ministry also refuted Moody's expectation that China's government debt-to-GDP ratio would rise to 40 percent in 2018.

"China's government debt risks are controllable overall, with a debt ratio of 36.7 percent in 2016, well below the 60-percent warning line of the European Union and lower than those of other major developed or emerging economies," the MOF said. "Government borrowing will be under strict control under the backdrop of supply-side structural reform. And expected medium-to-high GDP growth in the coming years will also provide fundamental support for reining in local government debt risks."

The ministry said it was unlikely for China's government debt risks to see major changes in 2018-2020, compared to 2016.

Moody's also claimed that increases in China's local government financing platforms and debt owed by SOEs would lead to rising government contingent liabilities.

The ministry said this was "baseless."

According to China's laws on guarantee and budget, local government contingent liabilities include no more than the guaranteed debt they issue using loans from foreign governments or international organizations.

The debt owed by local or central SOEs must only be borne by the enterprises themselves instead of governments, according to China's corporate laws.

Echoing the ministry, the National Development and Reform Commission (NDRC), China's top economic planner, said Wednesday that deleveraging, as a major task of the country's supply-side structural reform, was making progress and China's debt risks were controllable.

China's overall leverage ratio is at a medium level internationally and it is stabilizing, said the NDRC, citing data from the Bank for International Settlements.?