The growth of China's yuan-denominated lending lost steam in December, as banks started to worry about credit risk amid an economic slowdown.

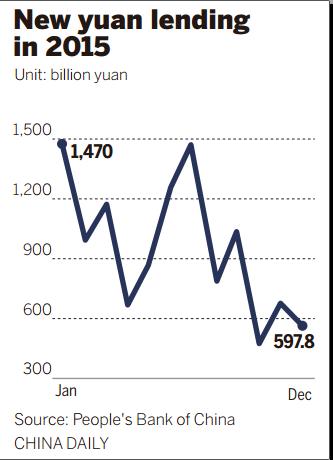

New yuan loans slipped to nearly 598 billion yuan ($90.8 billion) in December, down from 709 billion yuan in November and less than the market's expectation of 700 billion yuan, the People's Bank of China said on Friday.

For the whole year, however, the country's financial sector has issued 11.7 trillion yuan in new loans, even higher than the 9.59 trillion yuan in 2009 after the global financial crisis.

The record-high credit growth last year has prompted concerns among economists about the government's and enterprises' debt burden, which is seen as a side effect of the monetary easing to prevent a sharp economic slowdown.

Liu Ligang, chief economist in China at ANZ Bank, said that credit risk is increasing this year as GDP growth may continue to decelerate to around 6.5 percent — down from about 7 percent last year. This will further erode enterprises' profits and increase the possibility of debt defaults.

The industrial rebalancing reform, which may lead to bankruptcy of unprofitable companies, will also increase banks' nonperforming loans, he said.

Local governments swapped 3.2 trillion yuan in debt for long-term, low-return bonds purchased by banks last year, which will further reduce the banks' profitability this year, said experts.

The Chinese Academy of Social Sciences said that the total corporate debt was more than 140 percent of GDP last year, the world's highest ratio.

Total social financing, a broader measure of financial activities that also includes equity, increased by 15.41 trillion yuan last year, or 467.5 billion yuan less than in 2014, the PBOC said.

Research from Fitch Rating showed that total social financing had reached about 2.5 times the total GDP by the end of last year, and it may increase to 2.6 times this year, suggesting high leverage in the economic structure.

China's total outstanding credit growth increased by 15 percent last year, compared with 14.9 percent in 2014, a research note from UBS AG said. "The dual strength of both bank and shadow credit expansion likely reflects the government's recent calls for stronger financial support for the economy, and a faster pace of implementation of infrastructure projects," said Wang Tao, the Swiss financial group's chief economist in China.