Survey reveals rapid growth in settlement, finance transactions

Chinese and overseas banks polled in a survey say they will continue to increase their use of the yuan in cross-border settlement, finance and investment, and have higher expectations for its international status as a major world currency in future.

Research carried out by Bank of China Ltd showed that of the 807 foreign companies questioned, more than 40 percent thought the yuan is likely to become as important a world currency as the US dollar and the euro. The survey questioned 3,162 Chinese and foreign companies.

Local respondents had even higher expectations of the currency's wider use with 17 percent expecting it to account for at least 40 percent of outbound transaction settlements in the next five years.

The study found that 26 percent of the overseas companies said they conducted more than 15 percent of all import/exports settlements in the yuan, a 10 percentage point rise on their activities in 2013.

Nearly 41 percent of the overseas companies reported having cross-border receipts and payments made in the yuan by third-parties outside of the Chinese mainland, increasing from 10 percent in 2013.

The survey also found that willingness to use the yuan had further increased.

|

| Yuan among most-used currencies |

|

| Yuan use rises to 8th position |

About 87 percent of the domestic companies and 69 percent of the overseas companies - rising of 10 and 8 percentage points, respectively, from the previous year - said they expected to use the yuan in cross-border transactions or increase the use of the Chinese currency in future payment settlements.

Yue Yi, executive vice-president at Bank of China, said: "The trend of more internationalization of the yuan is inevitable as overseas players increase their expectations for the Chinese currency, which is now accepted by a wider range of companies in the international market."

Earlier this year, the People's Bank of China, the central bank, designated certain Chinese banks as clearing banks in several European countries including the United Kingdom, Germany and France.

In October, the British government issued a sovereign yuan-denominated bond, becoming the first Western country to do so.

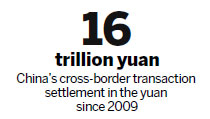

China's cross-border transaction settlement in the yuan has totaled 16 trillion yuan ($2.6 trillion) since 2009. In the first three quarters of 2014, cross-border yuan settlement exceeded 4.8 trillion yuan, compared with just over 3 billion yuan in 2009.

Although growth in the use of the yuan will slow, Yue said, it is still expected to maintain a stable and relatively quick expansion.

"The growth rate depends on which national facilitating policies are introduced for financial services, which in turn are closely related to how soon and how widely China will open its capital market," he said.

The central government is now planning to extend the preferential policies for the China (Shanghai) Pilot Free Trade Zone to some other cities, which will further increase the cross-border use of the yuan.

Cross-border yuan settlement and financing are still the most popular renminbi financial products. Over the past 12 months, 63 percent of the domestic companies surveyed and 38 percent of the overseas companies said they used cross-border renminbi settlement products. A quarter of the domestic and 14 percent of the overseas firms used cross-border renminbi financing products.

The use of renminbi cash management products and yuan-denominated bonds still remain at a relatively low level and thus have huge potential for growth, said Teng Linhui, deputy general manager of the global trade services department at Bank of China. Over the next few years, Chinese banks will continue to expand their offerings of overseas financial products in yuan, Teng said.

Yue said the internationalization of the yuan is one of Bank of China's crucial drivers for growth. He said it will continue to pay close attention to the expansion of the cross-border renminbi market, supporting innovations in offshore renminbi products, providing cross-market, cross-product transaction platforms, and building its globalized risk management procedures.