Micro companies are the lifeblood of financial industry, according to CGB

As large companies rely less and less on bank loans, and with smaller players borrowing more and more, a shift among banks toward financial services for small businesses has become apparent.

In a recent interview with China Daily, Dong Jianyue, chairman of China Guangfa Bank, said: "The days when banks could rely on a few big clients for rich profits are gone. Today, large companies are choosing to raise funds on capital and bond markets."

But, Dong said, "Small and micro businesses are showing greater momentum. They rely more on banks, present scattered risks and make a better choice for the sustained development of the banking industry."

Established in 1988, CGB was one of China's earliest incorporated joint-stock commercial banks. The Guangzhou-based company has allocated increasing resources to serving small and micro companies in recent years, with outstanding loans to such businesses reaching 136.8 billion yuan ($22 billion) at the end of 2013. That figure reflected a rise of 25 percent over the beginning of the year and accounted for 20 percent of all loans.

By the end of March, outstanding loans to small and micro businesses had risen to 150.9 billion yuan.

Lending to individuals for business purposes surged 97 percent last year and 270 percent year-on-year in the first half of this year, with first-half-year growth putting the bank in first place in China's banking industry.

An economically strong province, Guangdong, from where CGB has expanded across the country, is home to the largest number of developed small businesses in the country, Dong said.

Outstanding loans to small and micro businesses in the province were up by 12.2 percent to 1.35 trillion yuan in the first half of this year, 2 percentage points more than the rate for all business loans, according to the province's financial affairs office.

CGB has taken an innovative approach to assisting small businesses, expanding to all of its branches a model for tailoring products to different groups of small businesses, Dong said.

The model helps address the risks of lending to small businesses, the size of the loans they seek and the relatively high cost of such loans.

One example was a loan product made to businesses in an auto industry park in Guangzhou's Huadu district. One of the businesses, Lam Automotive Equipment (Guangzhou) Co received funds without having to come up with collateral, based on its sound financial records.

The company has expanded by 30 percent annually in the overheated car industry but receives payment for its invoices in an average three to six months, said its general manager, Huang Yuanshen.

Getting a loan from CGB provided greatly needed working capital, Huang said.

By the end of June, CGB had approved 231 lending programs like the one for the auto industry base with a total credit line of 36.4 billion yuan and covering sectors such as industrial parks, wholesale markets, warehousing and logistics businesses.

In another product of CGB, a client can get up to 500,000 yuan in a single, collateral-free loan and a credit line of up to 3 million yuan that is good for five years. The client can borrow and pay back the money anytime, pay interest on a daily basis and receive the money at a bank counter or through mobile or Internet devices.

More than 90 billion yuan in such loans was delivered since the service was launched a year ago. Last August, CGB became the first shareholding bank to issue a business debit card, which gives small business managers access to 24-hour services.

And to boost efficiency, CGB initiated a service allowing loan applicants to go through pre-approval on a tablet or smartphone, shortening the process from as long as three days to less than a minute.

To better serve small companies, by the end of June, the bank had set up 168 small business financial service centers at its sub-branches.

In 2012, the bank redesigned its systems to become more responsive to and control the risks of serving small businesses. Outstanding loans to small and micro businesses nationwide accounted for 29.3 percent of all business loans at the end of June, 0.2 percentage point higher than at the end of March, according to the central bank.

New loans to small businesses totaled 1.03 trillion yuan in the first half, up by 2.6 billion yuan over the same period last year and accounting for 32.5 percent of all new business loans.

Bian Xiaoyu, a researcher with market research firm CI Consulting, said the increase of small businesses and the country's economic restructuring mean banks are going to have to change their business models. Many are taking steps to cut the cost of lending to small businesses and improve their products, Bian said.

The State Council, the nation's cabinet, issued guidelines in July to make it easier for businesses to get loans. It listed detailed measures to ensure that more loans would go to small and micro businesses, the service industry, the agricultural sector and projects that improve the environment and people's lives.

|

|

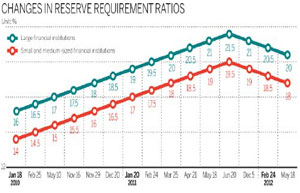

| Nation's big five banks plan bond sales in order to boost their capital | More lenders make RRR cuts |