|

|

|

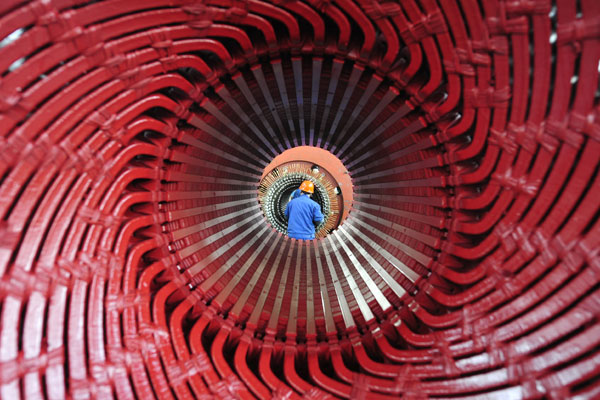

A worker installs rotor coil at a CITIC Heavy Industries Co Ltd plant in Luoyang, Henan province. The HSBC Purchasing Managers'Index slipped to 48 in March from 48.5 in February. Huang Zhengwei / For China Daily |

There is no worry of a hard landing in China. Economist Paul Krugman in a recent post ("How Much Should We Worry About a China Shock?" The New York Times, July 20, 2013) says he is very worried about the indirect and unanticipated effects of a Chinese hard landing. Michael Pettis, an important China observer who lives in Beijing, has in his new

|

|

|

|

book, "Avoiding the Fall: China's Economic Restructuring", predicts that China's GDP growth will slow down to 4 to 5 percent in the next 10 years.

All these concerns have gained currency only recently. China's first quarter GDP growth rate fell from 7.7 percent in the fourth quarter of last year to 7.4 percent, which is the lowest level since September 2012. There are also other clues that may make expert economists worried, such as a quick devaluation of yuan, rare drop in exports, volume contraction of real estate transaction, historically first defaults in trusts and bonds, etc., all of which presents a picture that we are headed toward economic hard landing.

But we may not need to worry about it either in the short run or in the long term.

In 2014, China can achieve the economic growth rate of 7.5 percent. Though the GDP growth for the first quarter is lower than the expected economic growth target of 7.5 percent, thanks to fiscal and monetary policies, the next quarters may see higher growth rate. Although Premier Li Keqiang has said that the government will not use massive fiscal stimulus program, the government has plans of "micro-stimulus", such as tax incentives for small and micro enterprises, shantytowns transformation and railway construction. We can also expect relatively loose monetary policy, too, since the M2 growth rate of slowdown from February's 13.3 percent to 12.1 percent and a comparatively low CPI of 2.4 percent in March have given enough space for the adjustment of interest rate or deposit reserve rate. In fact, 50.30 of PMI in March indicates that the economy as a whole is expanding.

We also should not worry about import and export. Though there has been a decrease of 3.4 percent in imports and a decline of 1.6 percent in exports in the first quarter and, more importantly, a fall of 9 percent in imports and a drop of 11.3 in exports in March, this is mainly because of one-off factors, such as last year's inflated data due to special circumstances and slowdown of cross-border arbitrage of RMB between Hong Kong and Chinese mainland. The truth is that except for a significant drop of 33 percent in exports to Hong Kong, there has been an increase in exports of 6.3 percent to EU, an increase of 0.9 percent to US, an increase of 2 percent to ASEAN and an increase of 2.6 percent to Japan. With the US economy getting stronger and EU's economy becoming more stable, exports will pick up further.

Even in the long term, China will not experience a hard landing.

Take real estate for instance. People worry that China, like Japan, might fall into decades of economic stagnation if the real estate bubble bursts. But the real reason behind Japan's stagnation is its aging population and zero growth. Moreover, inconvenience of renting, lack of investment channels and fear of inflation make people more willing to buy houses, which creates strong demand of houses not only for residences but also for investment. A down payment of at least 30 percent to buy a house makes an important buffer even if there is a significant decline in housing prices.

As far as local government debts are concerned, since the government owns a lot of companies, all of land, most of minerals and the rights to issue currency, these debts will not create the crises we are witnessing in the EU.

|

|

|