|

Construction workers in the Kashgar Economic Development Zone in the Xinjiang Uygur autonomous region. Investment in infrastructure in the zone has reached 35 billion yuan ($5.7 billion). [Photo / Xinhua] |

Party moves to change method by downplaying growth of GDP

The ruling party's move to make local government debt a major criterion in the evaluation of government officials demonstrates the central government's deep worry over ballooning local debt and represents its latest efforts to put a lid on excessive borrowing.

In a recent announcement by the Organization Department of the Communist Party of China, the ruling party said it will abandon the "GDP ranking" system among provinces, counties and prefectures, which put considerable pressure on local officials, prompting them to relentlessly pursue large investments at the cost of environmental degradation and debt buildup.

"Playing down the importance of GDP is not new. It is a redeclaration of this issue. What is important is the criteria that replace the indicator," said Shi Hongxiu, a public finance professor with the Chinese Academy of Governance.

By warning that "local officials will be scrutinized on the debt raised during their terms", he said Beijing is targeting the phenomenon of "local officials leaving their debts to their successors".

China's local officials have an "impulse" to raise mounting debt to fuel GDP growth in a short time under the current performance evaluation system, he said, while leaving the repayment issue to their successors.

The incentive environment has pushed the size of local governments' debt to an alarming level, with market institutions estimating the total size being as much as 25 trillion yuan ($4.1trillion). If true, it means that every Chinese person has a liability of nearly 20,000 yuan.

Official auditing results have not yet been released.

However, many economists also argue that there is justification for local governments to raise debt. China's urbanization drive will have huge financing demands for construction of infrastructure, farmland and water conservancies, affordable housing, tourism development and so on.

Hindering governments' ability to make up the shortfall of revenue by raising debt could risk delaying economic development.

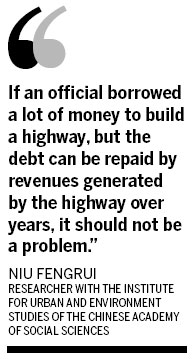

Niu Fengrui, a researcher with the Institute for Urban and Environment Studies of the Chinese Academy of Social Sciences, said that evaluating officials simply on the amount of debt they incur oversimplifies a complicated issue.

"If an official borrowed a lot of money to build a highway, but the debt can be repaid by revenues generated by the highway over years, it should not be a problem," Nui said.

"In addition, the completion of the highway within the official's term means that his successors do not have to build a highway but can enjoy the benefits of the highway. So it is not fair to put all the responsibility onto the official's shoulder," he said.

It is reasonable to emphasize people's livelihoods, but development should not be neglected because it will eventually benefit people's livelihoods, he said.

Yet he also acknowledged that many local projects have been started only with the aim of boosting local officials' "face" without fully considering whether they can generate returns. These "image projects" are what should be penalized, rather than the sheer size of the debt.

But the problem is it is a complicated process to determine the economic viability of so many projects, experts said. Shi argued that to uproot excessive borrowing, the government should be barred from participating in infrastructure projects.

"Government's direct involvement in economic activities has caused market distortion. For example, the price of industrial land was held at an artificially low level. Governments should issue municipal bonds to finance the private sector's involvement in infrastructure," he said.