Industry experts expect real estate restrictions to remain in place

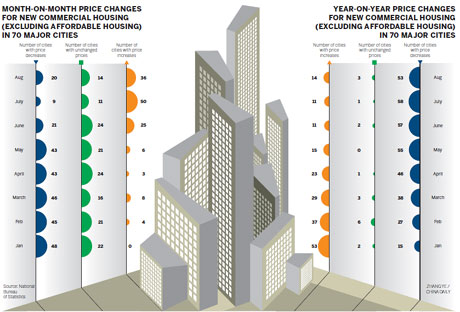

China's house price hike abated in August, as fewer cities saw price increases than in the previous month, the National Bureau of Statistics said on Tuesday.

Among the 70 major cities in China, 36 experienced a month-on-month increase in August, compared to 50 in July. The average price increase was no more than 1.3 percent. And 20 cities saw a price drop, compared with nine in July, according to the bureau.

|

|

"After a strong sales rebound in the past few months, part of the market demand has been met. If the policy remains unchanged and new demand cannot catch up, the market will gradually return to normal," said Zhang Lei, an analyst with Beijing-based real estate consultancy Century 21st.

The pre-owned home market remained stable in August, with prices picking up on a monthly basis in 38 cities, the same figure as in July, the bureau said.

China has tightened its curbs on the property sector since 2010 in an effort to return rocketing house prices back to a reasonable level. The government has restricted purchases in cities while requiring higher down payments and introducing property taxes.

Recent government policies to bolster a slowing economy, including interest rate cuts in June and July, helped boost demand for housing and fuel expectations of price rises.

Government officials have said property price curbs will remain in place.

Gu Yunchang, deputy head of the China Real Estate and Housing Research Association, said there is little chance of prices rebounding substantially as customer demographics have changed.

Compared with 2007 or 2010, self-use buyers now dominate the market due to the policies restricting the number of homes a family can purchase.

"They are more sensitive to price fluctuations and their purchasing power is not as strong as investment-oriented buyers, therefore a major rebound will definitely restrain their demand," said Gu.

Home sales in major cities fell in September after a strong rebound in the previous few months, according to Century 21st.

As of Saturday, around 7,500 new apartments had been sold in Beijing, down 7.4 percent month-on-month. Shenzhen and Chengdu both saw new home sales drop around 30 percent over the previous month. Shanghai, however, experienced an increase of 7.4 percent on a monthly basis.

"I would expect prices and sales to continue to pick up until the end of the year, but at a slower rate," said Carbly Xie, head of research at real estate consultancy Colliers International (Beijing).

The price increases are also related to the location of the projects. As property prices in city centers have increased at a rapid pace in the past few months, those in suburban areas remain stable.

One of Beijing Capital Land's projects, Capital International Peninsula - a project in Wuqing district, Tianjin for instance, saw its prices remain almost unchanged over the past three months, even though sales were brisk.

Yang Hongxu, deputy director of E-house China Research and Development Institute in Shanghai, said the recovery in sales will continue and the performance of large-scale property developers will be better than their smaller counterparts

In the latest report from the China Index Academy, a real estate research institution in Beijing, large-scale developers further strengthened their position after the market correction. And a number of them have raised their sales targets for this year as sales rebounded.

Hong Kong-listed China Overseas Property Ltd, for instance, saw its sales hit HK$83.28 billion ($10.74 billion) in the first eight months, exceeding this year's target of HK$80 billion. Therefore, it lifted its target for 2012 to HK$100 billion. China Resources Land Ltd also raised this year's sales target from 40 billion yuan ($6.33 billion) to 50 billion yuan.

No policy easing

On the policy side, most industry analysts and economists said the nation's real estate policies are very likely to remain unchanged for the remainder of the year.

"China's economic situation is still OK, and there is no need to relax rigorous property policies," said Wang Haifeng, director of international economics at the Institute for International Economic Research, a think tank at the National Development and Reform Commission.

Despite the sluggish economic data in the past few months, more than half of China's leading economists said the GDP growth may still hit 8 percent this year, fueled by the government's recent efforts to boost the economy, according to a recent survey by NetEase, a major portal website in China.

The majority of economists said the government's efforts to stabilize the economy would take effect and GDP growth would reach 8 percent.

Yet concerns are rising that the launch of a third round of quantitative easing, or QE3, by the United States may mean higher prices.

The impact of QE3 on China's property market will be complicated and limited, depending on the Chinese central bank's next move, said Yi Xianrong, a finance researcher at the Chinese Academy of Social Sciences.

QE3 will increase market liquidity, which may push up inflation and house prices, said Yang from E-house China Research and Development Institute. However, he added that a pickup in inflation may then force policymakers to hit the credit brakes and thus check further house price rises.

Xinhua contributed to this story.

huyuanyuan@chinadaily.com.cn