Positive news fails to lift markets

Updated: 2011-08-06 09:09

By Hu Yuanyuan (China Daily)

|

|||||||||||

|

|

|

A trader looks on as he works on the floor of the New York Stock Exchange on Friday. World stocks dipped again on Friday despite US data showing higher than expected job gains. [Photo / Reuters] |

BEIJING - With stock markets around the world stumbling, China's foreign minister said closer international cooperation is needed for the world's economy to stabilize.

"The global economy is slowly recovering, but the situation is still complex," Foreign Minister Yang Jiechi said in a written interview with Polish media on Friday.

He added that countries should cooperate to boost the global economy's recovery and to reform the international financial system.

Yang said China is confident in the Eurozone and the euro, while urging the United States to adopt a responsible attitude in its monetary policy.

Stocks initially rebounded on Friday on positive news that the United States had added more jobs than expected in July, then continued to decline.

The Dow Jones industrial average and the S&P 500 index both tumbled more than 4 percent on Thursday, the biggest one-day point decline on Wall Street since the global financial crisis.

London's blue chip index FTSE 100 closed down 146.15 points on Friday, or 2.7 percent at 5246.99, as investors continued to pile funds into safer havens such as bonds, gold and the Swiss franc.

"Many of the buy trades we saw from investors were placed on very short term contracts, emphasizing that the concerns over global growth will not disappear with today's jobs figures," Joshua Raymond, chief market strategist at City Index, told Reuters.

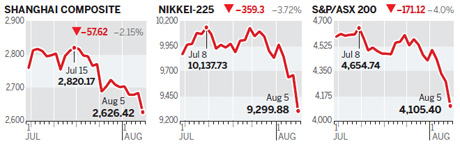

Caught in the wake of Thursday's loses, the Shanghai Composite Index slumped 2.2 percent to 2626, and Hong Kong's Hang Seng Index dropped 4.3 percent to 20946.14, its biggest decline since November 2009. Japan's Nikkei 225 stock average slid 3.7 percent.

Despite the $2.4 trillion in spending cuts mandated over the next 10 years, the US remains on a highly unsustainable path of deficits and debt, and needs to undertake a massive reduction in spending to get its financial house in order, said Sandeep Malhotra, chief investment officer at Swiss private bank Clariden Leu.

The alternative, as predicted by the International Monetary Fund, is a debt-to-GDP ratio exceeding 100 percent by 2020.

Jim O'Neill, chairman of Goldman Sachs Asset Management, said if the US tightens too much, the economy could go back into a recession.

"I think the yields available on some European debt, especially Italy, are very attractive for medium to long term investors like China," O'Neill said.

Dong Xian'an, chief economist with Peking First Advisory, said that China's central bank should be very careful in making any move to further tighten monetary policy.

"As the world's second largest economy, China should boost global confidence with stronger growth, especially when the US and EU economies are facing more challenges," said Dong.

Zhou Hao, China economist at Australia and New Zealand Banking Group, said the European debt crisis and the lower-than-expected growth of the US economy will have limited impact on China's economy.

"China's net exports accounted for about 3 to 4 percent of the GDP, and most exported products have a lower elasticity due to low cost. Therefore, even though the external demand is shrinking, the impact on the country's economy will be limited," said Zhou.

The biggest influence, according to Zhou, is that the central bank's real purchasing power will fall. Inflation, Zhou said, remains the top concern for China's economy, though many economists and analysts believe that inflation, a priority for the country's economy, may have peaked in July.

Wang Tao, head of China economic research at UBS Securities, expects July's consumer price index, a measure of inflation, to stand at 6.4 percent, the same as June's. She said the possibility of another interest hike cannot be ruled out.