Economy

Income tax threshold in surprise increase

By Wang Xing (China Daily)

Updated: 2011-07-01 09:56

|

Large Medium Small |

NPC sets the mark at 3,500 yuan after gauging public opinion

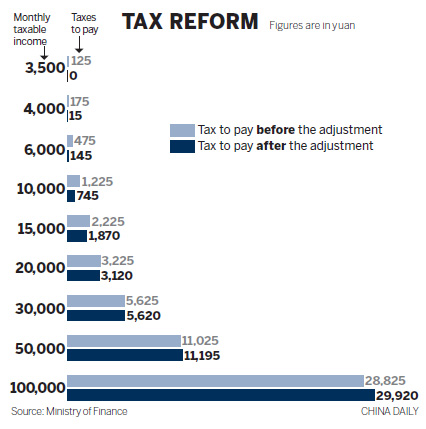

BEIJING - The monthly personal income tax threshold will be raised to 3,500 yuan ($540) from 2,000 yuan, providing a bonus to wage earners with a larger than expected tax cut.

The National People's Congress (NPC) said it would lift the threshold from the previously proposed 3,000 yuan, after public opinion, solicited by the NPC, overwhelmingly favored further tax cuts. The adjustment will take effect on Sept 1, according to the NPC.

"Under the new amendment, about 7.7 percent of wage earners will have to pay tax, down from the current 28 percent," Wang Jianfan, deputy director of the tax policy department at the Ministry of Finance, said at a news conference on Thursday.

After the introduction of the new tax rate, the government will get 160 billion yuan less in income tax revenue each year, he said.

| ||||

The proposal, which was published online up to the beginning of June to solicit public opinion, drew a record 240,000 responses. About 83 percent of the respondents wanted the threshold to be raised, according to the NPC's official website.

The new tax threshold reflects that the government responds to public opinion, Jia Kang, head of the Research Institute for Fiscal Science affiliated to the Ministry of Finance, told China Daily.

"It's a small adjustment, but shows the government's ready to respond to public demand," he said.

The new tax rate for lowest income earners will be reduced from the proposed five percent to three percent. The amendment was easily approved with 134 voting in favor, six against and 11 abstentions, the NPC said on Thursday.

China introduced an income tax law in 1980 and raised the threshold to 1,600 yuan a month from 800 yuan in 2006, and then increased it again to 2,000 yuan in 2008.

But the threshold increase lags behind the rise in consumer prices since the last adjustment.

According to the National Bureau of Statistics, food prices surged 7.2 percent last year. And income earners' share of national income has reduced in recent years from 67.2 percent in 1995 to 57.1 percent in 2008.

China's top financial college, the Central University of Finance and Economics, published a report in May saying that China's current tax burden is heavier than many middle- and upper-income countries. The research suggests that the government should reduce tax rates while increasing spending in crucial areas such as healthcare and education.

Gu Shengzu, an NPC member who participated in the amendment discussion on Monday, said the new threshold is a good start but tax reform still has a long way to go. The rate for the highest income bracket should be reduced further, Gu said.

Li Daokui, an adviser at the People's Bank of China and professor at Tsinghua University, said at a forum in Beijing earlier this month that what China needs is "fundamental reform" of the tax system.

He suggested that a single rate be adopted (as opposed to the current progressive rate).

When income tax was first launched in 1980, it mostly targeted foreign workers.

Revenue from personal income tax totaled 483.7 billion yuan in 2010, up from 41.4 billion yuan in 1999, accounting for 6.3 percent of the country's tax haul, according to figures from the Ministry of Finance.

Zhao Yinan contributed to this story.

| 分享按鈕 |