Markets

Tightening, EU hit markets

By Zhang Shidong (China Daily)

Updated: 2011-05-24 13:01

|

Large Medium Small |

|

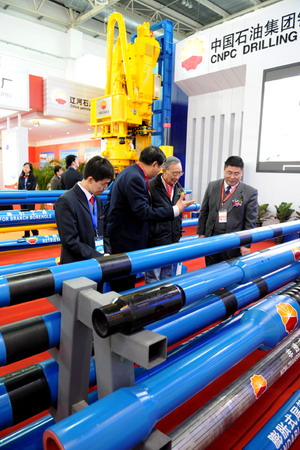

PetroChina Co displays equipment at an expo in Beijing. The company sank to a six-month low on Monday as crude dropped. [Photo / China Daily] |

Benchmark declines the most since January 17 on earnings outlook

SHANGHAI - China's benchmark stock index fell the most in four months on Monday, erasing this year's gain.

The retreat came on concern that government measures to tighten liquidity, allied to the European debt crisis, will slow growth in the world's second-largest economy.

Jiangxi Copper Co tumbled 3.5 percent after a preliminary reading of a purchasing managers' index showed China's manufacturing may expand at a slower pace this month. PetroChina Co, the nation's largest oil producer, sank to a six-month low as crude dropped after Fitch Ratings cut Greece by three grades. Poly Real Estate Group Co paced declines by real estate companies as the country's money-market rate rose.

The Shanghai Composite Index, which tracks the bigger of China's stock exchanges, slid 83.89 to 2774.57 at the 3 pm close, erasing this year's advance of as much as 8.9 percent. Monday's decline was the largest since Jan 17.

"Europe's debt crisis and signs of slowing economic growth in China have hurt investor sentiment," said Luo Bin, general manager at Shanghai Mingyu Xiaoyang Investment Management Co, which manages the equivalent of $60 million. "We need to be cautious now and it may be still some way before the market finds its bottom."

|

||||

Jiangxi Copper lost 3.5 percent to 32.66 yuan ($5.02). Copper dropped as much as 2.4 percent and zinc fell as much as 1.3 percent in London.

China's preliminary manufacturing index, known as the Flash PMI, was at 51.1 compared with a final reading of 51.8 in April, HSBC Holdings PLC and Markit Economics said on Monday. The reading was the lowest in 10 months, HSBC said. A number above 50 indicates expansion.

Premier Wen Jiabao is aiming to tame inflation in the world's fastest-growing major economy while sustaining expansion to create jobs and maintain social stability. The risk of a "hard landing" in China is rising as property sales weaken and construction slows because of weaker demand, JPMorgan Chase & Co said on May 17.

In Europe, the Spanish Prime Minister Jose Luis Rodriguez Zapatero's Socialist party suffered its worst defeat in more than 30 years in local elections amid a backlash over austerity measures. Fitch downgraded Greece's credit rating to B+ from BB+, four notches below investment grade and Standard & Poor's said that Italy's rating was at risk of a downgrade. The European Union is China's biggest export market, making up about 20 percent of its overseas shipments.

Barclays PLC forecasts the global economy will expand 4.1 percent this year, down from 4.9 percent in 2010, the company said in a report last week. Morgan Stanley said in a May 18 report that growth will slow to 4.2 percent.

PetroChina dropped 1.9 percent to 10.87 yuan, its lowest close since Nov 23. China Shenhua Energy Co, the nation's largest coal producer, retreated 3.1 percent to 27.63 yuan. Crude for July delivery lost as much as $1.85 to $97.64 a barrel in after-hours trading in New York.

Hedge funds cut bullish bets on oil to a three-month low as the dollar strengthened amid an exodus from commodities. The funds and other large speculators reduced so-called net long positions, or wagers on rising prices, by 13 percent in the seven days ended May 17, according to the Commitments of Traders report from the Commodity Futures Trading Commission.

The seven-day repurchase rate increased 62 basis points, the most in a week, to 4.70 percent in Shanghai, according to a weighted average compiled by the National Interbank Funding Center. It touched 4.74 percent earlier, the highest level since May 16.

China's stocks haven't reached a bottom as the market's price-to-book value trades higher than average and valuation gaps between different industries are still high, according to China International Capital Corp.

The price-to-book ratio, a more reliable valuation indicator than the price-to-earnings ratio, is still about 10 percent higher than its average over the past seven years, Hao Hong, a strategist at CICC, wrote in a report on Monday.

Bloomberg News

| 分享按鈕 |