Companies

Chinese firms up the stakes in Europe

By Andrew Moody (China Daily)

Updated: 2010-10-04 10:23

|

Large Medium Small |

|

|

|

(From left) Li Shufu, chairman of Zhejiang Geely Holding Group, Swedish Minister for Enterprise and Energy Maud Olofsson and Volvo CEO Stephen Odell at the Volvo headquarters in Torslanda, Sweden, on March 28, when Geely bought Volvo from Ford. [Photo / Reuters] |

BEIJING - Chinese companies are increasingly looking toward Europe to extend their business operations.

In recent months there have been a number of high-profile deals. In August, Zhejiang Geely Holding Group Co completed its takeover of Swedish carmaker Volvo Car Corporation.

And late last month Shanghai-based Bright Food (Group) Co Ltd emerged as the frontrunner to acquire United Biscuits, the UK biscuit maker currently owned by private equity firms.

Other recent deals include Shanghai industrial conglomerate Fosun International Ltd acquiring a 7.1 percent stake in French holiday resort operator Club Mediterrane, commonly known as Club Med, in June.

Eric Thun, lecturer in Chinese business studies at the Said Business School at Oxford University, said Europe was now often more attractive than the United States for Chinese companies looking for investments.

"They are interested in capital-intensive manufacturing processes and countries like Germany are world leaders in this area," he said.

"It is not always about acquisition. You see a number of Chinese companies setting up research and development facilities in Germany because they want to be in industrial clusters where they have access to highly skilled labor, research institutes and training facilities."

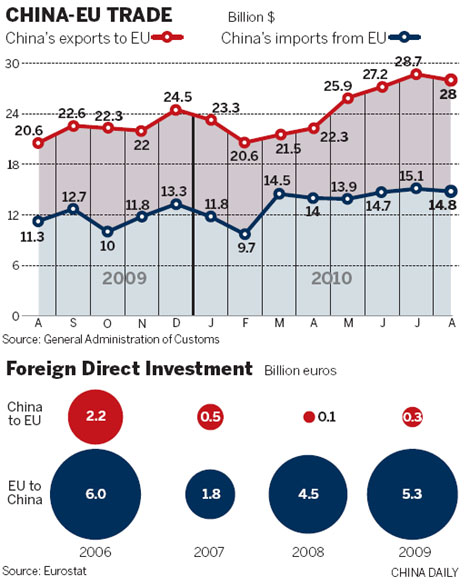

According to China's Ministry of Commerce, 5.8 percent of Chinese overseas direct investment in 2007 was directed at Europe, behind Asia on 62.6 percent, Latin America 18.5 percent and Africa 5.9 percent, but ahead of North America on 4.3 percent.

There were 252 investments by Chinese companies in Europe in the 10 years up to 2007, according to research by international business adviser Ernst & Young.

Of these, the largest number, 101, went to the United Kingdom with 40 going to Germany, 24 to France and 15 to Sweden.

Andre Loesekrug-Pietri, chief executive officer of private equity firm A Capital Asia, which has offices in Beijing and Shanghai, believes there are going to be more investments by Chinese companies in Europe.

He said recent moves by the Chinese government to simplify foreign exchange approval procedures could prove a catalyst for more mergers and acquisitions.

"This should make it easier for Chinese companies to invest abroad and Europe is a key interest for many Chinese companies," he said.

Loesekrug-Pietri, whose company advised Fosun on the recent Club Med deal and was also a co-investor, said a lot of European companies were looking for Chinese partners to access a market with more than 1 billion people.

"Having a Chinese investor could give them some sort of assurance they have a strong ally in what is a highly competitive market, but one that is also perceived as more and more difficult."

Zhang Tianbing, a partner in global management consulting firm A.T. Kearney, who is based in Shanghai, said bridging China's technology gap is one of the main aims for Chinese companies investing in Europe.

"If you look at the car industry and the acquisitions of companies such as Rover and Volvo by Chinese companies, these allowed Chinese businesses to acquire technological ability that had been built up over almost a century," he said.

"Keeping the manufacturing in Europe, and even most of the research and development, is part of the value of these acquisitions. Maybe some of that manufacturing will migrate to China over time," he added.

Eric Schmidt, chairman of Beijing-based China Entrepreneurs, which organizes forums and conferences in China linking Chinese and European companies, said Chinese companies represent the perfect exit strategy for many European family-owned businesses.

"There are many second and third generation businesses, in such sectors as fashion, for example, where the current generation don't want to be in the business their parents or grandparents started. Chinese companies have the cash and are hungry for their brands," he said.

"They might have even been suppliers to them in the past and it is a way for them to move up the value chain."

Mike Bastin, a brand expert and visiting professor at the China Agricultural University, warns there are dangers for Chinese companies that overestimate the value of European brands.

"Brand values can be intangible and might not always compensate for the difficulties in integrating corporate cultures. Chinese companies need to pay more attention to modern methods of quantifying intangible brand values," he said.

The appetite for major acquisitions in Europe by Chinese companies is unlikely to be sated any time soon, however.

There is continued speculation that vulnerable European banks could be the next acquisition targets for Chinese companies.

"I would not be surprised if there was an announcement of a Chinese takeover of a major European bank," added Zhang at A.T. Kearney.