Companies

New M&A strategies for Chinese firms

By Karen Yip (China Daily)

Updated: 2010-09-13 11:02

|

Large Medium Small |

|

|

|

Two Club Med employees walk by catamaran sail boats at the company's resort in Grecolimano, Greece. The 7.1 percent equity investment by the Chinese company Fosun Group into Club Mediterranee SA has become a new form of overseas investment by Chinese companies. Yannis Kontos/ Bloomberg |

BEIJING - It took Guo Guangchang and Henri Giscard d'Estaing 80 days to get to know each other before they decided to seal a $31 million deal in June.

The transaction - a 7.1 percent stake in Club Mediterranee SA - would give Guo, chairman of Fosun Group and one of China's richest men, a seat on the board of the famed French luxury leisure group.

It was a charm offensive of sorts, especially at a time when mergers and acquisitions (M&As) by Chinese firms are attracting negative sentiments from businesses and local communities, particularly in the West, where such activity has increased dramatically.

As such, the Fosun-Club Med deal is significant in many ways and sets a precedent for other outbound Chinese M&As.

"Instead of raising eyebrows, we said let's go for a minority stake - and it was well accepted by the public. This is the first Chinese M&A deal that didn't create an outcry in France or in the West," said Andre Loesekrug-Pietri, a partner in A Capital Asia, who was the exclusive financial advisor for Fosun in the Club Med deal.

Fosun's stake in Club Med is expected to increase to 10 percent soon, Loesekrug-Pietri said, and it would automatically give the diversified conglomerate two chairs on Club Med's Board.

"It's a smart way for Guo and his men to acquire international experience, learn how to grow and manage a credible, trusted brand and how to manage different nationalities," he said.

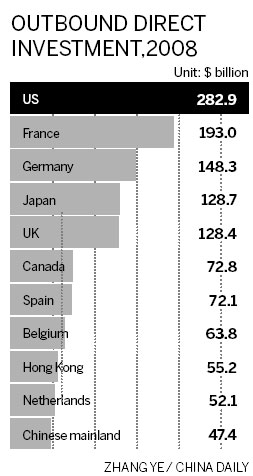

So far, Chinese M&As in value terms have been dominated largely by resources deals and State-owned enterprises. It is now diversifying in terms of the sectors involved and the types of players.

Garry Wang, who provides consultancy and research on M&As for the Greater China region at Mercer Consulting, quoted a Chinese minister on overseas acquisitions as saying, "Just because you can doesn't mean you should." Wang then added: "Many Chinese companies have strong balance sheets and are looking to make acquisitions overseas. Think of how many Western multinationals are truly successful in China. There are not many. And they've been here for 30 years."

For Chinese companies to be successful overseas, he said, they need to understand local markets, be patient, and have strong business plans.

"Financing deals are easy but integrating operations, managing very different cultures and people are issues that are extremely difficult to solve," he added.

Already there is a trend among Chinese firms moving towards the direction of acquiring minority stakes or establishing joint ventures or alliances, said Laurel West, Asia Director, Industry and Management Research at The Economist Intelligence Unit (EIU).

"Companies just stepping out on the international stage need to learn to walk before they can run. This means taking smaller stakes or forming alliances or joint ventures where they can learn from the foreign entity before they dive in and try to run a foreign company by themselves," she said.

"So Fosun's approach makes sense," West said.

Wang highlighted similar approaches adopted by US and European companies when they first came to China in the 1980s and 90s, when minority stakes and joint ventures were very popular.

The Fosun-Club Med deal also signaled a shift in growth strategies to asset-light companies where branding and image are important to secure market share.

"We see many more Chinese companies looking to do deals for reasons other than the securing of natural resources. This is mainly a growth strategy. Organic growth in North American and Western European markets, for example, has been impossible for many Chinese companies," said Phil Shirley, M&A Leader-Hong Kong, at Mercer Consulting.

"We notice private equity firms actively assisting Chinese portfolio companies in pursuing such strategies for example to capture cost synergies by shifting the manufacturing operations of Western targets to China," he added.