Money

China's big banks need $70b capital in 5 years

(Agencies)

Updated: 2010-04-13 16:06

|

Large Medium Small |

China's four largest publicly traded banks need 480 billion yuan ($70 billion) of capital to comply with regulatory requirements for financial strength, according to Industrial & Commercial Bank of China Ltd (ICBC).

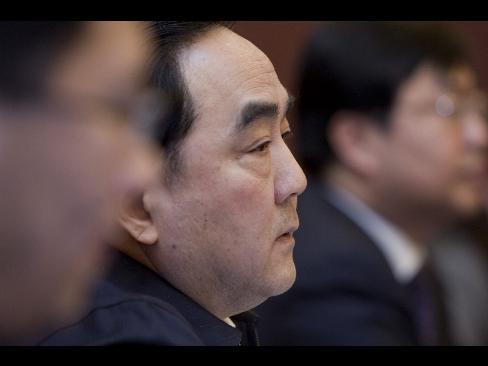

ICBC, China Construction Bank Corp, Bank of China Ltd and Bank of Communications Ltd must maintain a capital adequacy ratio of at least 11.5 percent even as they grow loans by an estimated 15 trillion yuan in the next five years, ICBC President Yang Kaisheng wrote in an article published in the 21st Century Business Herald today.

|

|

Yang's estimate is more than four times the amount ICBC, Bank of China and BoCom have said they plan to raise so far this year. Banks needs to restore capital after extending a record 9.59 trillion yuan in loans last year to fuel a recovery in the world's third-largest economy.

"The growth model of China banks requires them to come to capital markets every few years," said May Yan, a Hong Kong-based analyst at Nomura International (HK) Ltd. "There's no easy way out and this will be a long-term overhang on the market." Yang's estimates are "fairly reasonable."

'Back to Basics'

China's government is stepping up scrutiny of banks to prevent last year's credit boom from triggering a financial meltdown. Chinese banks extended 510.7 billion yuan, less than estimated, of new loans in March after the central bank told lenders to set aside bigger reserves and pace credit growth.

Last year's loan binge prompted tighter capital rules and banking regulator Liu Mingkang said this month that lenders have been told to report on their risk exposure to borrowers including local-government companies by the end of June. Liu said over the weekend that financial regulations will go "back to the basics."

The CBRC told the nation's five biggest lenders to inspect performance at non-bank units set up over the past few years and may force them to exit underperforming areas, Vice Chairman Jiang Dingzhi said at a forum in Beijing today.

Raising Capital

ICBC, Bank of China and BoCom this year have announced plans to raise a combined 107 billion yuan, according to data compiled by Bloomberg.

"Capital constraint of Chinese banks will only be aggravated" by tougher regulatory requirements, ICBC's Yang wrote. "We need to carve a new path for sustainable growth yet limiting the need for capital."

Yang urged the banking regulator to allow lenders to sell loans to third parties and introduce credit-backed securities to help bolster liquidity.

The country's four biggest lenders have limited room to cut dividend payout ratios after lowering them to about 45 percent last year from 50 percent in 2008, Yang wrote in the Chinese newspaper.

China Construction Bank plans to sell shares to raise about 75 billion yuan of capital this year, two people with direct knowledge of the matter said last week.