|

BIZCHINA> Top Biz News

|

|

Anniversary rallies elusive

By Shen Jingting and Bi Xiaoning (China Daily)

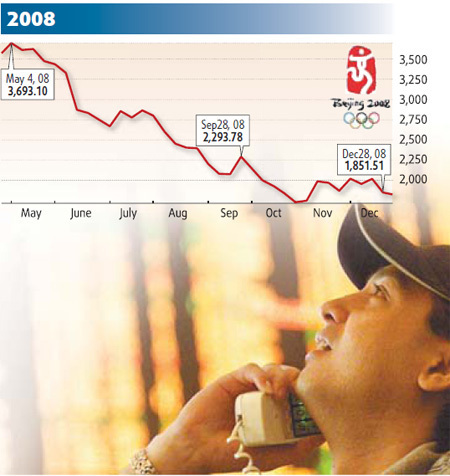

Updated: 2009-09-04 07:58 As China's 60th anniversary approaches, speculation is reaching fever pitch about the performance of the Shanghai main bourse. Most Chinese investors associate key dates with a boom in the market but history rarely supports such optimism. Some veterans of the business are actually predicting a downturn. Stocks jumped 5 percent yesterday after a month-long slump on the A-share market. That is being put down in part to a statement from Liu Xinhua, vice chairman of the China Securities Regulatory Commission, that regulators would promote a stable market. It was also helped when an official with the National Development and Reform Commission (NDRC) yesterday revealed that Premier Wen Jiabao might announce more favorable policies to boost domestic consumption at next week's "Summer Davos" in Dalian. "Premier Wen Jiabao will attend the opening plenary and deliver a special speech," said Li Bin, deputy director-general with the department of foreign affairs, NDRC. "At this event, China will present the achievements of the Chinese government in coping with the global financial crisis and safeguarding steady economic growth, as well as plans for the next steps. The new measures could be some favorable policies to boost domestic consumption, as we aim to restore confidence and maintain stabilization." Not everyone is convinced the turnaround can be sustained. "When most people reckon something will happen, it usually doesn't," said Jia Wei, a private investor with more than 10 years of experience in China's A-share market. This view is born out by an analysis of several big events and the corresponding behavior of the markets in recent years. When Beijing successfully won the bid in 2001 to host the Olympic Games, investors expected a bullish market ahead. The same sentiment was evident in the first half of 2008, but when the Olympics actually opened on Aug 8, 2008, the Shanghai Composite index was down by more than 50 percent from the start of the year, reaching 2605.72.

The market dropped sharply by 17 percent from May's peak of 1510.17, closing at 1250.27 on the last trading day before China assumed control on July 1. In the 18 years since the national bourses were established, the market has fallen during 11 of the Septembers ahead of the National Day on Oct 1. It has only gained a significant rise above 5 percent in four of the Septembers, suggesting the important date does not translate to a rise in share values. Zhao Xijun, deputy dean of the Financial and Securities Institute at Renmin University of China, said he did not believe the government would issue stimulus policies at Dalian. "When the government intervenes in the market, it does so only when it absolutely needs to, rather than because of some special event or special date," he said. "It's become a tradition to forecast an Oct 1 market boom but this kind of thinking should be changed. The government tends to take market-oriented measures to oversee the stock market now." The Chinese A-share market is famous for its volatility, largely because investors speculate on government policy changes. Any slight changes in the government attitude, whether from an official announcement or mere rumor, can result in turbulent market movements. The most impressive example dates back to May 2007, when the Ministry of Finance said it would raise stamp duty on stock transactions. The market shed 21.4 percent over the following five days as investors panicked. Shortly afterward, the market climbed to a record high of 6124.04 on Oct 16. "The stock market has its own internal operation mechanism. The excessive worship of policy may change market trends for a while but, in the long run, it still sticks to its own processes," said Tan Xiaoyu, an analyst with Guotai Junan Securities. "If we look ahead, the stock market still connects with the overall economic situation and business performance of listed companies." Jerry Lou, a Hong Kong-based China strategist for Morgan Stanley, said, "The intrinsic economic momentum has started to emerge, so (the Chinese stock market) does not need to merely look to policies." "In the following 12 months, with the economy improving and more business reports of enterprises being released, there can be no doubt that the stock market will rise by 30 percent, reaching 4000."

(For more biz stories, please visit Industries)

|

|||||||