|

BIZCHINA> Top Biz News

|

|

Pick-up seen in Q2 domestic M&A deals activity

By Zhou Yan (China Daily)

Updated: 2009-07-28 08:12

China's mergers and acquisitions (M&A) market saw a modest pick-up in domestic deal activity in the second quarter after a steep decline in the first three months of 2009, professional services firm PricewaterhouseCoopers (PwC) said. A PwC report released yesterday showed that domestic transaction volumes in the second quarter increased by 32 percent, to 811 deals worth $28.3 billion, from 616 deals worth $17.6 billion done during the first quarter. Domestic transactions, whose volumes saw an over 35-percent increase from the first quarter to the second, contributed to an all-time high of 87 percent, or 708 deals, of the total volumes during the second quarter. "The turnaround in domestic deal activity levels was mainly due to the improving confidence arising from the central government's stimulus measures and ongoing policies to support consolidation in industries like cement, steel and financial services," the report said. However, overall M&A activity in the first half still sank by 21 percent to 1,427 deals from 1,812 in the same period last year, with activity levels down for both domestic and foreign deals, according to information provider Thomson Reuters, which provided data for PwC's report.

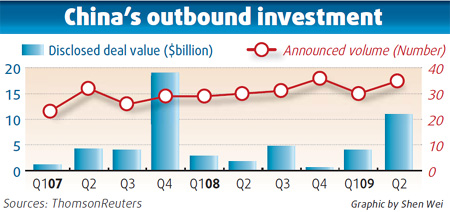

"It indicates that China's economic recovery has been quicker than most other countries," said Benjamin Ye, PwC's transactions partner based in Shanghai, attributing the drop in foreign-backed deals largely to the overseas companies' low visibility over global earnings prospects at the beginning of the year. Although less impacted, on a year-on-year basis, the total domestic-to-domestic deal volume fell 16.8 percent to 1,227 in the first half of 2009 from 1,475 made in the same period of last year. Over the first six months of this year, the largest announced domestic transaction was Ping An's acquisition of 30 percent of Shenzhen Development Bank's shares for $3.2 billion, while the largest outbound investment was the $8.9-billion takeover of Swiss oil and gas explorer Addax Petroleum by domestic oil refiner Sinopec. "Outbound investment activity remains a bright spot for China's M&A, and we've seen a trend that investors' focus started to shift from the traditional energy industry to some non-traditional sectors like manufacturing," said Wang Xiaogang, PwC's transactions partner. The outbound deal activity increased by 10 percent in the first-half over the same period last year. In addition, financial services, which were largely independent from its subdued global peers, remained the most active sector by deal volume and value terms from January to June, when 202 transactions worth $10.6 billion were inked. The real estate sector also saw a strong pick-up with 148 deals. "Domestic deal activity is likely to recover to 2008 levels during the remainder of 2009 because of China's better-than-expected GDP figures amid the stock market gains, and the resumption of IPOs," said Ye, adding that foreign corporate and financial investors would remain more cautious. "We don't see a return to 2008 levels of activity until 2011 for foreign buyers," he said. (For more biz stories, please visit Industries)

|

|||||

主站蜘蛛池模板: 亚洲国产精品久久久天堂麻豆宅男 | 亚洲美女高潮不断亚洲| 久久精品中文字幕99| 亚洲十八禁一区二区三区| 亚洲暴爽av天天爽日日碰| 国产精品线在线精品国语| 无码精品人妻一区二区三区中| 一区二区丝袜美腿视频| 亚洲VA欧美VA国产综合| 91国产超碰在线观看| 国产在线精品中文字幕| 亚洲福利一区二区三区| 成人一区二区三区激情视频 | 免费人成在线观看网站| 国产丝袜在线精品丝袜| 午夜福利国产一区二区三区| 92精品国产自产在线观看481页| 边做边爱完整版免费视频播放| 在线日韩日本国产亚洲| 人人妻人人揉人人模人人模| 日本中文字幕有码在线视频| 亚洲av套图一区二区| 国产精品中文字幕第一页| 我的漂亮老师2中文字幕版| 久久国内精品一区二区三区| 欧美性猛交xxxx乱大交极品| 久热这里只有精品视频六| 91中文字幕一区在线| 98精品全国免费观看视频| 猫咪网网站免费观看| 亚洲国产美女精品久久久| 亚洲色大成网站www久久九九 | 国产福利精品一区二区| 九色精品国产亚洲av麻豆一| 久久人人97超碰国产精品| 亚洲国产精品18久久久久久| 午夜在线不卡| 亚洲国产高清精品线久久| 超薄肉色丝袜一区二区| 国产农村妇女高潮大叫| 日韩无套无码精品|