More oil futures products needed

Updated: 2008-01-04 08:52

The continuous surge of crude oil prices in the international market is posing an urgent need for China to establish a comprehensive energy futures market to help domestic downstream enterprises minimize risks arising from frequent price swings.

Analysts said the introduction of more oil futures products is of particular importance at a time when global economic uncertainties have exacerbated the fluctuations in crude prices at unprecedented high levels.

Analysts said the introduction of more oil futures products is of particular importance at a time when global economic uncertainties have exacerbated the fluctuations in crude prices at unprecedented high levels.

"There is clearly an urgent need to expand the scope of the domestic oil futures market by introducing new oil futures products, including futures contracts on crude, gasoline and diesel," said Lin Hui, an analyst at Orient Securities Futures.

"The development of oil futures market is conducive to increasing China's influence in global energy pricing and ensure the country's economic security."

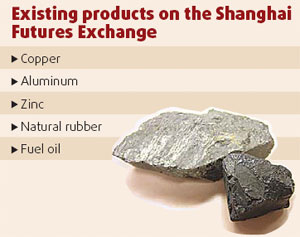

Industry analysts said the trading of fuel oil futures contracts on Shanghai Futures Exchange (SHFE) since 2004 has paved the way for more oil futures products.

Trading in fuel oil futures contracts has become increasingly active over the past three years. The turnover of fuel oil futures contracts on SHFE last year totaled 849.6 billion yuan ($116.86 billion), up 51.1 percent from 2005.

Analysts said what many Chinese downstream enterprises need most is a transparent and effective oil futures market to hedge against risks resulting from sharp swings in international oil prices.

Officials at SHFE have expressed their desire to launch oil futures products to develop the energy-related futures market. The exchange stepped up its research in developing oil futures contracts two years ago.

In September, SHFE signed a memorandum of cooperation with China University of Petroleum in Beijing to jointly set up an institute of research on energy finance and pricing risks.

Yang Maijun, general manager of SHFE, had said at the signing ceremony that the cooperation would enable the exchange to expand the team of experts on energy economy and quicken the pace of introducing oil futures products.

Analysts said an efficient oil futures market can make it possible for prices to reflect the true supply and demand conditions.

"Only when market forces dictate oil prices can the futures market truly reflect the supply and demand conditions in the industry," said Zhou Jie, an analyst at China International Futures (Shanghai) Co. "Small and medium-sized downstream enterprises can benefit from the energy financial market then."

|

||

|

|