French Senate rejects 'Zucman Tax' on billionaires' wealth

On Thursday the French Senate, the upper house of the country's parliament, decisively rejected a proposed wealth tax targeting the ultra-rich, known as the Zucman tax.

The bill was defeated by 188 votes to 129, effectively ending its parliamentary progress for now. This rejection follows its earlier approval by the lower house, the National Assembly, mainly supported by supporters of the government and left-wing assembly members.

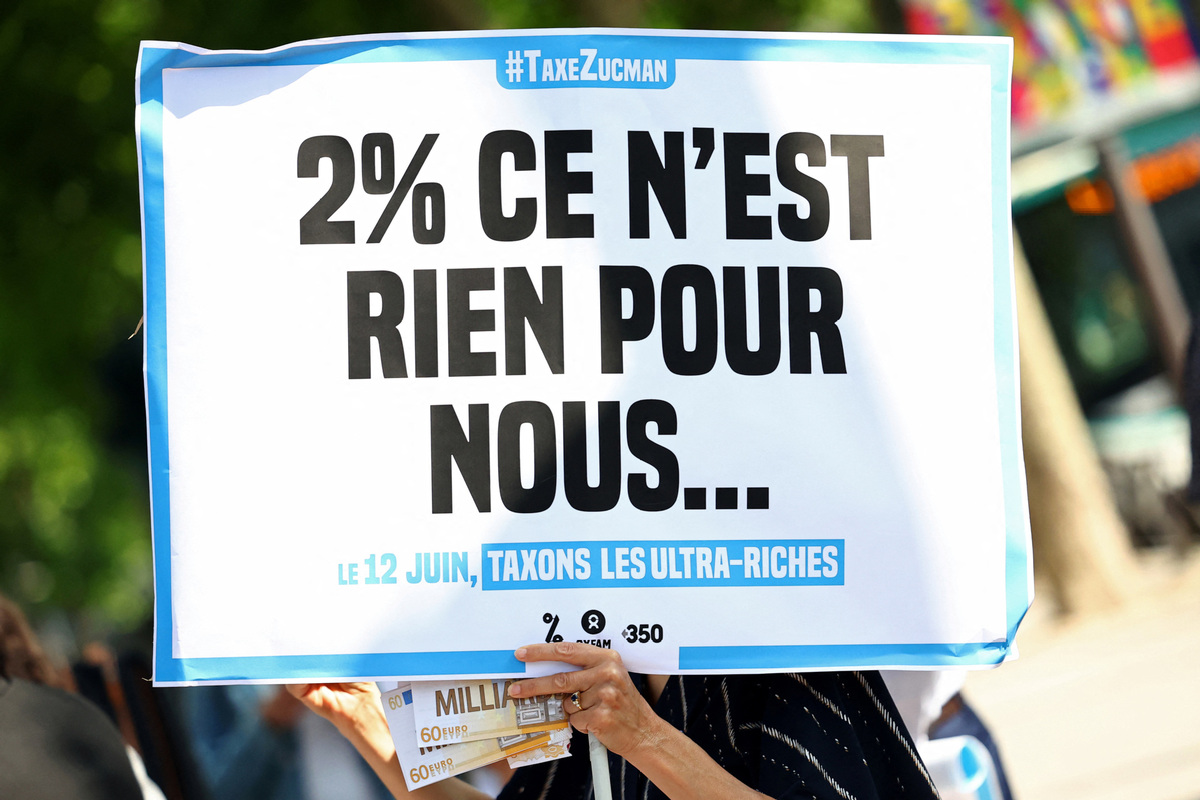

The Zucman tax was inspired by economist Gabriel Zucman, who has extensively researched tax avoidance among billionaires. The plan proposed a 2 percent minimum annual tax on individuals with net wealth exceeding 100 million euros ($115.2 million), aiming to ensure the ultra-rich pay a fairer share of taxes.

In an interview with news channel BFM TV on June 12, Zucman explained the proposal, saying "it's a very targeted plan aimed at the extremely rich, especially those who, despite their huge wealth, currently pay very little in taxes."

He estimated the tax could generate around 20 billion euros annually, affecting about 1,800 households in France.

Why Target Billionaires?

Supporters argue the tax is fundamentally about fairness and correcting a regressive tax system. Anne-Laure Delatte, a researcher in the economics department of Paris Dauphine University and an associate professor at Rouen Business School, told public broadcaster France Inter it was about emphasizing the liquidity of billionaires' wealth.

"These are people who mostly hold their wealth in the form of shares in their own companies," she said. "For example, (chair of luxury goods company LVMH) Bernard Arnault, with 190 billion euros, has 90 percent of his wealth in LVMH shares." Taxing shares was feasible, she added, because "if you own shares, they're liquid in two minutes, unlike real estate or factories".

She also contextualized the 2 percent tax rate, saying "while it might sound high, billionaires typically earn a 7 percent return annually. So if someone has 100 million euros, paying 2 million euros in tax still leaves them with a net gain of 5 million euros."

Delatte also highlighted the systemic imbalance in tax burdens. "Ordinary citizens often pay around 50 percent of their income in taxes to support social systems," she explained. "The ultra-rich pay only 27 percent, largely due to legal tax-planning strategies."

She also explained that holding companies, which exist solely to hold wealth, allow billionaires to defer income tax until assets are sold.

Political Reactions

During a parliamentary session this month, Public Accounts Minister Amelie de Montchalin acknowledged the problem.

"It doesn't make sense for a household with tens of millions of euros to keep their savings in a holding company, use it to fund their lifestyle, and still pay no income tax," she said.

However, the version under debate in Parliament was a diluted version of the original proposal, featuring a 0.5 percent tax rate and excluding business assets—the main component of ultra-rich fortunes.

Senator Emmanuel Capus, from the center-right Horizons party, questioned the premise for the tax, arguing: "It's not clear that the ultra-rich, by structuring their wealth to produce little taxable income, actually pay less tax than the average person."

What's Next

The Zucman tax sparked a larger conversation about wealth inequality and tax fairness in France and globally. It had previously gained international attention after being placed on the G20's agenda in 2024.

At a global tax summit in Paris in June 2024, France's President Emmanuel Macron expressed conditional support, stating he favored taxing billionaires only as part of a coordinated global agreement.

Despite the Senate's rejection, supporters including members of parliament and advocacy groups such as Oxfam and Attac plan to revisit the issue during the 2026 budget debate, in the fall of 2025.

Some experts argue that only a coordinated international approach can make such wealth taxes effective, hinting that the Zucman tax or similar measures could return in future negotiations.