Shift in policy set to bolster recovery

After remaining largely unchanged for over a decade, China's recent monetary policy shift is expected to provide stronger support for economic growth in the coming year.

During the recent Central Economic Work Conference, Chinese policymakers decided to implement a "moderately loose" monetary policy in 2025, a significant departure from the "prudent" policy of the past 14 years. The last time the same policy stance was adopted was back in 2008 to cushion the shock from the global financial crisis.

Analysts said the shift is a response to challenging economic circumstances.

While the economy has retained an upward trend this year, in particular an upswing since October, China still faces deepened adverse challenges from external factors and is also grappling with lingering difficulties at home.

Global geopolitical conflicts are escalating and protectionism is rising. Domestically, there are still problems including insufficient domestic demand, difficulties in the operation of some businesses, and pressures on the employment and income growth of individuals, said Han Wenxiu, executive deputy director of the Office of the Central Committee for Financial and Economic Affairs.

"It's a necessary and feasible adjustment based on the current realities," Huang Hanquan, head of the Chinese Academy of Macroeconomic Research, said in the latest episode of the China Economic Roundtable, an all-media talk show hosted by Xinhua News Agency.

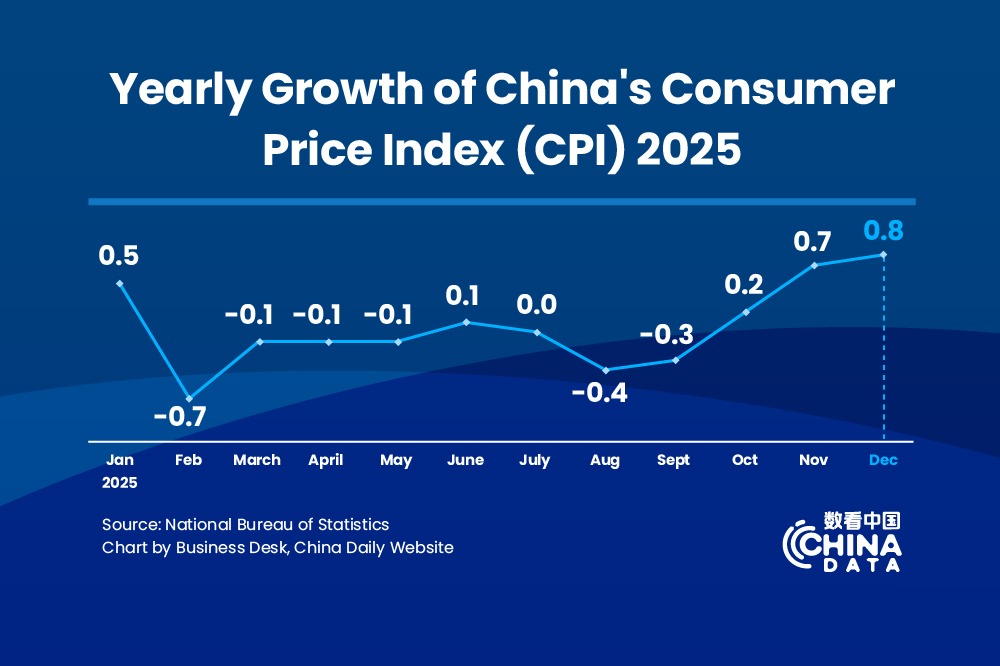

Huang noted that the country needs to expand domestic demand, promote moderate price growth and create favorable conditions for addressing financial risks.

Zou Lan, an official with the People's Bank of China, emphasized that the "moderately loose" stance will enhance the ability to effectively respond to challenges.

The policy adjustment also aligns with the changing global liquidity environment, Huang said.

What will the "moderately loose" monetary policy specifically bring to China? Typically, there will be a more supportive credit environment to direct financial resources to key sectors and weak links in the economy, such as technological innovation, people's livelihoods and consumer sectors, according to analysts.

A strong signal has been sent that China is committed to stabilizing growth, which will boost market confidence, Huang said.

According to the Central Economic Work Conference, China will reduce the reserve requirement ratio (RRR) and interest rates at an appropriate time in an effort to ensure that the growth of social financing and money supply match the expected targets for economic growth and price levels.

The average RRR for financial institutions currently stands at 6.6 percent, suggesting further room for reduction, said Wang Xin, head of the Research Bureau of the PBOC.

Zeng Gang, director of the Shanghai Institution for Finance & Development, predicted that the country's overall financing costs will be further lowered, thereby expanding domestic demand and unlocking potential in consumption and investment.

China also needs to channel more funds into sectors related to economic transformation, such as new quality productive forces, industrial upgrading and green development, Huang said.

The latest data indicate the effectiveness of the policy. At the end of November, China's outstanding yuan loans were 254.68 trillion yuan ($34.84 trillion), an increase of 7.7 percent from a year ago.

"The overall financial growth remained stable and liquidity was adequate at a reasonable level, suggesting continued strong support for the real economy," said Wen Bin, chief economist at China Minsheng Bank.