Golden targets

Rising geopolitical tensions call for Hong Kong to develop world-class gold storage facilities and set up cooperation zones with the Chinese mainland to facilitate physical deliveries of the precious metal. Liu Yifan reports from Hong Kong.

Growing need for diversification

The move comes as global central banks aim to diversify their reserves amid heightened geopolitical tensions and concerns over asset weaponization. The trend accelerated after Russian banks were banned from the global financial messaging network SWIFT following the conflict with Ukraine, which started in 2022. According to the World Gold Council, central banks acquired 1,037 tons of gold last year - the second-largest annual purchase on record - after reaching a peak of 1,082 tons in 2022.

Central banks' appetites for gold have not declined despite these record figures. The 2024 Central Bank Gold Reserves survey, conducted from Feb 19 to April 30 with 70 participants, found that 29 percent of central banks plan to increase their gold reserves in the next 12 months - the highest level since 2018.

The survey revealed that the planned purchases are primarily driven by the need to rebalance gold holdings to a more strategic level, domestic gold production, and financial market concerns, such as increased crisis risks and rising inflation.

Gold prices have reached all-time highs this year. Goldman Sachs Research analyst Lina Thomas has predicted the price of the precious metal could climb to $3,000 per troy ounce by the end of next year.

Goldman Sachs said policymakers are increasingly worried about the debt sustainability of the US, which has around $35 trillion in borrowings, equating to 124 percent of the country's GDP. With many central banks holding a significant portion of their reserves in US Treasury bonds, concerns about exposure to US fiscal risks are rising.

Secretary for Financial Services and the Treasury Christopher Hui Ching-yu says Hong Kong's strength in professional services can attract those who want to diversify geographically. In terms of trading and pricing, he says Hong Kong is an international market with secure and unrestricted capital flows, and many trade aspects are tax-free, providing great convenience for physical transactions.

Vivian Cheung Kar-fay, acting CEO and chief operating officer of the Airport Authority, says there has been a significant increase in interest from investors for gold storage, trading, and settlement in Hong Kong in recent years.

She points to HKIA's status as one of the world's busiest aviation hubs, noting its secure location for the precious metals vault. This makes it an ideal storage facility for investors globally, and she says it will continue to fulfill this important role in the future.

According to the World Gold Council, about 212,582 tons of gold had been mined by the end of last year, with about two-thirds extracted since 1950. Of the amount, about 96,487 tons, or 45 percent, were in jewelry. Bars and coins, including gold-backed ETFs, accounted for about 22 percent, while central banks held around 17 percent. Additionally, the underground stock of gold reserves was estimated at 59,000 tons.

Maximizing strategic position

Hong Kong now ranks among the world's largest gold import and export markets by volume due to its proximity to major gold consumption markets like the mainland and India, according to Financial Secretary Paul Chan Mo-po.

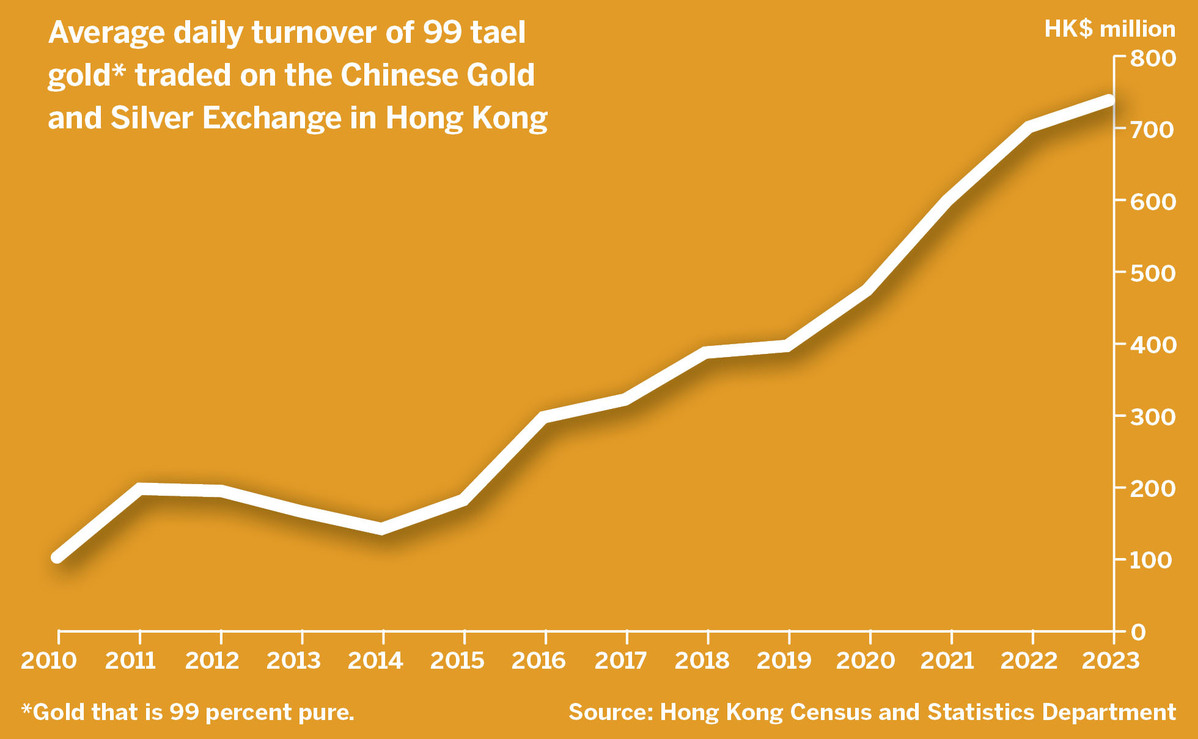

He said turnover in the 99 percent pure gold, or 99 tael gold traded on the Chinese Gold and Silver Exchange, achieved a compound annual growth rate of more than 18 percent in the past decade. In the first quarter of this year, turnover grew by about 20 percent year-on-year.

Tan suggests that Hong Kong set up warehouses recognized by international commodity exchanges, like the London Metal Exchange. Support should be given to banks, particularly large Chinese lenders, to establish world-class vaults to provide storage and delivery services for gold trading and the international board of the Shanghai Gold Exchange.

Meanwhile, tax incentives and other measures should support the Airport Authority's plans to expand precious metals storage facilities, and large Chinese enterprises like China Merchants Group and Sinopec should be encouraged to expand commodity storage and logistics facilities in Hong Kong, says Tan.

In developing Hong Kong's gold futures trading and expanding into other nonferrous metals and commodity futures, Fang Zhou, research director of the One Country Two Systems Research Institute, cites Hong Kong's proximity to the mainland - one of the world's largest consumers and importers of commodities, yet still relatively isolated from international markets given low pricing power.

Fang writes in an article that a key characteristic of futures markets is their proximity to commodity supply and demand. This is clearly shown in the US, where New York is the nation's dominant financial center while the biggest commodity futures market is in Chicago due to its location near major agricultural production and trading areas. Singapore has developed a crude oil futures market by leveraging its large refining center and strategic port location near the Strait of Malacca.

However, Fang points out that a significant challenge for Hong Kong is that trading commodity futures ultimately requires physical delivery, with the main users located on the mainland.

Thus, Hong Kong could consider proactively collaborating with the mainland, such as establishing a special cooperation zone in a designated area near the Hong Kong-Shenzhen border, where designated delivery warehouses could be set up to address the final delivery issue.

"When developing its futures market, Hong Kong must also coordinate with existing mainland futures exchanges to ensure complementary development and strategies, avoiding harmful competition," says Fang.