Rewind shocks

Reversal of globalization is leading to long-term stagflation

The global economy saw high growth rates and low inflation in the 1990s, a time known as the Great Moderation Era. After the global financial crisis in 2008, the world economy entered a period of low economic growth, low inflation, low interest rates and high government debt, a period characterized by the US economist Lawrence Summers as a period of secular stagnation.

The academic community believes that the main factors contributing to long-term stagnation include the aging of the global population structure, a slowdown in technological innovation, and rising imbalance in income and property distribution in major countries. These factors are structural issues rather than cyclical issues, and thus secular stagnation could continue for a considerable period of time.

It was in this context that the Modern Money Theory was proposed. The theory holds that as long as a government can pay its debts with its own currency, the country's central bank can pursue unlimited money printing to boost economic growth and solve domestic problems, on condition that such actions will not trigger high inflation.

However, the arrival of high inflation this year has exceeded expectations. In June, the consumer price index, a key gauge of inflation, surged by over 9 percent year-on-year in the United States, and major European countries are also facing similar levels of inflation. The high inflation faced by major developed countries has forced their central banks to start the process of raising interest rates and shrinking their balance sheets.

The question is, why did inflation, which has been under control for over 20 years, start to surge after the COVID-19 pandemic?

There are at least three immediate contributing factors. First, after the outbreak of the COVID-19 pandemic, some major countries adopted ultra-loose fiscal and monetary policies to bail out the economy. Developed economies have largely focused on shoring up spending by issuing direct subsidies to low- and middle-income families. This has resulted in a pattern in which consumer spending has recovered at a rate faster than production. This uneven recovery has pushed up inflation. Second, the pandemic has led to direct shocks to the global production network and supply chains. The disruption to key supply chains due to crises and the sharp rise in global transportation costs, especially ocean shipping costs, has resulted in a significant shortage of goods in the final product market and induced imported inflation. Third, the conflict between Russia and Ukraine that broke out in February is still ongoing. With Russia being an exporter of almost all key bulk commodities and Ukraine being one of the world's leading exporters of agricultural products, the conflict has pushed up the prices of bulk commodities, especially food and energy.

However, from the medium- and the long-term perspectives, one of the fundamental reasons for the sudden rise in the global inflation is that globalization, which has gathered steam since the 1980s, has suffered setbacks since the mid-2010s.

Economic and financial globalization kept gathering steam after the mid-1980s, especially with the active participation of emerging market countries. The acceleration of economic globalization meant that various production factors could be better allocated on a global scale, which undoubtedly led to higher levels of economic growth.

However, the distribution of benefits from globalization has been uneven despite the benefits being enhancing overall globally. The "elephant curve", produced by the former World Bank economist Branko Milanovic, argues that the main beneficiaries of globalization have been the middle class in emerging market countries and high-income groups in developed countries, while the main losers from globalization are the middle class in developed countries. In other words, the acceleration of globalization has led to a heightened imbalance in income distribution in developed countries and a greater divide among different income groups. In this context, political conflicts within developed countries have intensified, and some populist leaders have blamed globalization for their country's domestic woes, leading to the rise of populism, protectionism and isolationism.

After the global financial crisis in 2008, major developed countries adopted ultra-loose monetary policies to support their bailouts, which led to new highs in stock market indexes and further enlarged the income gap between asset owners and those without assets and that between large asset owners and small asset owners. For example, about 40 percent of the wealth in the US is owned by families that only take up about 1 percent of the population.

Under this context, the domestic political landscape of developed countries has undergone drastic changes. Politicians who cater to the tastes of groups that have suffered from losses and blame the domestic predicament on economic globalization have taken office and introduced policies leading to setbacks or even the reversal of economic globalization. 2016 was the most significant year in this regard, as there were two epoch-making events. First, in June 2016, the United Kingdom held a referendum that led to its withdrawal from the European Union, marking a major setback for European integration. Second, Donald Trump won the US presidential election later that year. His coming to power spoke volumes about the divisions in the US.

Another two key events after 2016 further exacerbated the reversal of globalization. First, in March 2018, the US provoked a trade war with China and began to impose high tariffs on a large number of Chinese imports, forcing a response from the Chinese government. The second is the outbreak of the COVID-19 pandemic in early 2020. The pandemic has forced many countries relying on imports to take into account the security of their industry chains. It led to the shortening and regionalizing of global industry chains, possibly fragmenting the global industry chains into regional industry chains, which heralds a drop in the strength of the global production network.

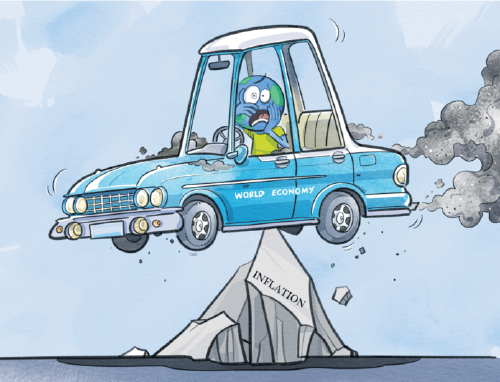

The setbacks for economic globalization mean more obstacles for the better allocation of various factors of production on a global scale and rising costs for the global flow of production elements and commodities. The roles of countries within the global production network will be restructured. In other words, if the rapid progress of globalization has significantly lowered the production costs of various products, thus ushering in an era of high growth rates and low inflation, then the reversal of globalization will significantly increase the production costs of various products, leading to an era of stagflation characterized by a low growth rate and high inflation.

The direction and pace of globalization is closely related to the wellbeing of every country and every person on this planet. Faced with immediate short-term challenges such as unemployment, inflation, lack of confidence, declining income and shrinking assets, we have to look to the future and pay attention to changes in long-term variables such as globalization.

The author is deputy director of the Institute of Finance and Banking at the Chinese Academy of Social Sciences and deputy director of the National Institution for Finance and Development. The author contributed this article to China Watch, a think tank powered by China Daily.