Risk prevention, restructuring key to H2

China managed to withstand pressure and achieve hard-won growth in the first six months as the National Bureau of Statistics recently announced the nation's economy in the first half grew 2.5 percent year-on-year, while second-quarter growth stood at 0.4 percent year-on-year.

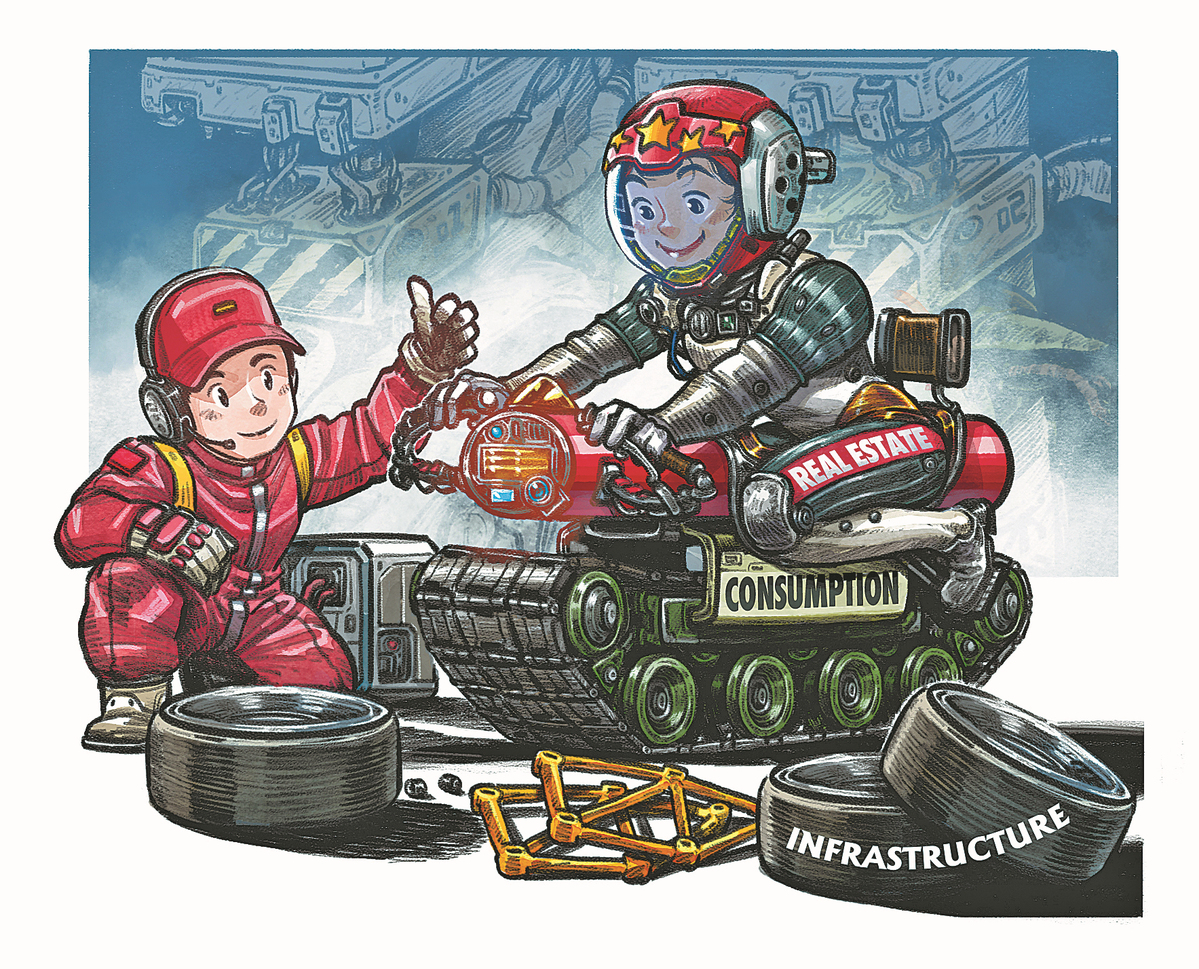

Looking back at the first half, amid complex interlinked internal and external factors, the main reasons China's economy withstood pressure and maintained stable growth were the unexpected resilience of exports and rapid policy responses. Amid the high probability of recession in the United States and the general downward adjustment in global economic growth, China will see its drivers of growth shifted from exports to infrastructure, consumption and real estate.

Among all economic drivers, the stimulative effect of concentrated deployments of infrastructure so far this year, and the continuous rebound of consumption, will be a strong guarantee for a medium-to-high rate of economic growth in the third quarter. For the final quarter, whether further assistance can be achieved is still an unknown quantity in terms of real estate variables. As stronger macroeconomic policies have been rolled out and more frequently than normal to better shore up momentum, we expect the government will also pay closer attention to the balance among risk prevention, structural adjustment and stable growth.

'Unexpected' resilience

China's economy faced a series of unexpected disruptions caused by internal and external causes in the first half, especially in the second quarter. Seen from an external point of view, under the impact of the Russia-Ukraine conflict and the accelerated rate hikes by the US Federal Reserve, the global economic growth rate led to adjustments in expectations. That is, the expected growth rate was further cut from being halved from last year's figure to only one-third of that. Demand has been shrinking sharply since this year. In addition, due to geopolitical issues, COVID-19 resurgences and protectionism in parts of the world, tensions in global supply chains have intensified, and so have supply shocks.

Domestically, COVID-19 weighed more on economic recovery in the second quarter. The macroeconomic situation faced by various market entities is complex and challenging, and the impact of weaker expectations is still getting on investors' nerves. However, under the combined effect of active reactions by a complete industrial chain and the timely implementation of policies, the decline of various economic indicators began to narrow in May, and then turned from declines to increases in June, which deeply reflects the strong resilience of the Chinese economy.

From the perspective of the demand side, in the first half, exports rose 13.2 percent year-on-year, fixed asset investment increased 6.1 percent year-on-year while total retail sales of consumer goods edged down 0.7 percent. To many market experts' surprise, exports once again were the main driver in boosting the economy.

We believe that the stronger-than-expected resilience of exports was the core endogenous driving force of China's economy in the first half, while infrastructure investment was the exogenous force brought about by active fiscal deployment. The combination of the two helped China's economy to stabilize under severe circumstances and achieve positive economic growth, beating more pessimistic expectations.

Digging a bit deeper, the advantages of the whole industrial chain accumulated in the nation for a long time and have played an important role. First, industrial and supply chains have shown strong resistance to pressure during the COVID-19 era. The year-on-year growth rate of exports rebounded sharply in May and June, recording surges of 16.9 percent and 17.9 percent, respectively, a performance even better than pre-pandemic levels. Strong external demand will not only directly drive GDP growth, but will also support manufacturing investment. In the first half, manufacturing investment rose 10.4 percent year-on-year.

Second, the government put forward macro policies in a timely manner as a response to the COVID-19 impact on the economy in the April-June period. The State Council-the nation's Cabinet-alongside departments with various functions, accelerated the implementation of stabilization measures and ramped up infrastructure to secure growth so as to ensure that China's economy won't stall.

Resilience expected

The nation's economy in the second half is expected to see further resilience, with that of the third and fourth quarters supported by their respective driving forces.

Looking to the second half, although orderly recovery of industrial and supply chains will continue to activate economic entities and consolidate trade advantages, under the combined effect of falling overseas demand and a high base, exports will likely decelerate.

We believe that the main driving force of China's economy in the second half of the year will be shifting from exports to infrastructure, consumption and real estate, and there will be an obvious sequence for driving forces from various sectors. June was the first month to see a significant recovery from the recent COVID-19 resurgences, and it is also a crucial month, as the month's performance is key to evaluating that of the whole year. Whether it is consumption, exports or industrial added value, the trend of stabilizing and rebounding witnessed a firm uptrend in June. Real estate investment, however, did not see a quick recovery due to new contagion outbreaks, with the decline expanding from 7.8 percent to 9.4 percent.

Based on these conditions, we expect the economy may enjoy strong short-term momentum, with infrastructure development and consumption rebounds acting as a strong push for the rebound of economic growth in the third quarter, while further recovery in the fourth quarter still depends on changes in real estate variables.

First of all, from the perspective of infrastructure activity, the year-on-year growth of single-month infrastructure investment in June reached 12 percent, a level not seen since 2018. In addition, a total of 1.37 trillion yuan ($203.1 billion) of new special bonds were issued in June (about 40 percent of the total issuance in the first half). With the concentrated issuance of funds in the next two months bearing fruit, the growth rate of infrastructure investment in July and August will continue to increase. A further upward trend is expected to drive at least 2-2.5 percentage points of GDP growth in the third quarter.

Second, the consumption sector has not yet recovered to an ideal level. In June, sales performance of consumer goods was encouraging, with a year-on-year increase of 3.1 percent. The sector quickly turned positive only one month after the COVID-19 resurgence, while in contrast, it took the sector almost six months after the hit of the virus in 2020 to turn positive.

Actually, the rapid rebound in consumption was mainly driven by policies. Under the promotion of the policy halving the purchase tax on automobiles, retail sales of automobiles rebounded sharply from-31.5 percent in April and-16 percent in May to 13.9 percent in June, while catering revenue (-4 percent) and the real estate-related industry chain (home decor-4.9 percent, furniture-6.6 percent), which are restricted by offline scenarios, are still relatively weak. After the introduction of the latest edition of COVID-19 protocols, consumption recovery is expected to gradually shift from physical goods to services, and from online to offline, and there is still room for further improvement.

It should be noted that when it comes to the fourth quarter, the driving force of infrastructure and consumption is expected to decline gradually. On one hand, deployment of fiscal support will have been mostly arranged or implemented in the first three quarters. Even if the special debt of 2023 is issued ahead of schedule, the overall scale will be relatively limited. On the other hand, consumption recovery is mainly driven by policy rather than per capita income growth. After the backlog of demand was released in the fourth quarter, it is difficult for consumption growth to greatly exceed the long-term average level (3.8 percent) since the beginning of the COVID-19 era. Therefore, whether or not the economic growth rate in the fourth quarter can reach a higher level will still depend on the situation of real estate recovery.

With the internal and external macro-environment generally controllable, the nation will continue to see support backed by policy moves. If China can achieve medium to high-speed economic growth throughout the year, macro policy is bound to be further strengthened. But at the same time, fiscal constraints imposed by unconventional additional support from policy, possible financial risks, and the possible long-term backlash should be closely monitored. Therefore, the positive tone of macro moves should be more prudent, focusing on the balance among risk prevention, structural adjustments and stable growth.

The writer is chief economist at ICBC International. This article is a translation of an op-ed by the writer for the China Chief Economist Forum, a think tank.

The views don't necessarily reflect those of China Daily.

- US failure on COVID sees 'tragic milestone'

- COVID-19 cases rise in parts of US amid sustained vaccination push

- Development of China's Public Health as an Essential Element of Human Rights

- Listed banks urgently need common equity tier 1 capital: PwC report

- Experts call for improved grassroots facilities