Foreign investors set to expand A-share play

New Beijing bourse highlights positive effects of opening-up on financial sector

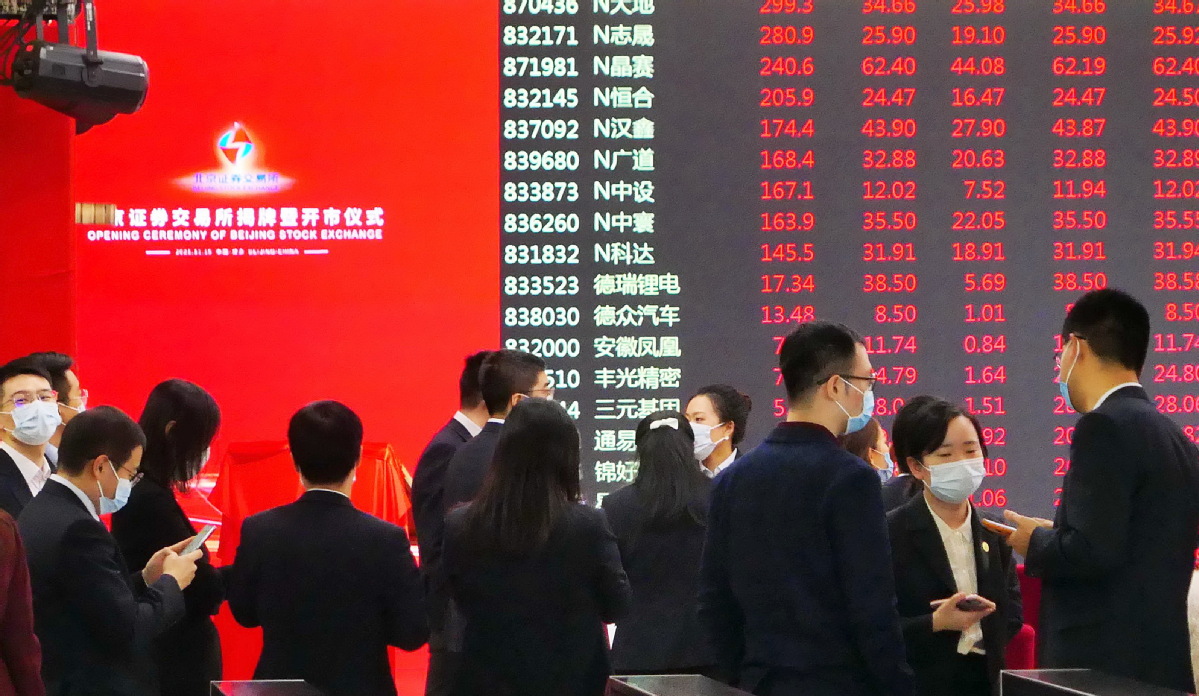

The Beijing Stock Exchange, which opened on Nov 15 for business and is expected to grow into the Chinese version of Nasdaq, has attracted the local capital markets' spotlight that was hitherto shining on bigger bourses such as the Shanghai Stock Exchange.

Now, foreign securities firms, which have played an increasingly bigger role in the A-share market, are unwilling to miss their chance to shine as well on the burgeoning bourse.

For instance, DBS Securities, from the stable of Singapore's DBS, is among the first few foreign securities firms that have received BSE membership. The firm is advancing IPO projects for the BSE, which are expected to enter the application phase next year.

DBS Securities is also working closely with other professional institutions like law firms to conduct internal communication and study BSE policies before their implementation.

The DBS management team said foreign investment banks are more experienced in seeking qualified foreign institutional investors or QFIIs, making more effective underwriting plans for issuers and attracting leading industry investors and strategic investors.

The risks embedded in the operations of small and medium enterprises-SMEs-require the involvement of professional institutions with corresponding risk-taking capabilities. For the BSE-listed SMEs, it will take a longer time for them to get rooted in the market, which means that foreign securities firms can give full play to their comprehensive financial services, DBS said.

Like DBS, UBS Securities Co Ltd, which is linked to its parent Swiss financial giant UBS Group AG, figures among the first few of the 112 member securities firms of the BSE.As UBS has received a license to conduct secondary market brokerage businesses at the BSE, the firm would like to bring more overseas experiences to the Chinese market, said Eugene Qian, its chairman.

The BSE is built on the NEEQ Select, the highest tier of the eight-year-old National Equities Exchange and Quotations system. Some 81 companies have debuted on the exchange already.

To help SMEs float successfully on the BSE, regulators have lowered the threshold. A company with market capitalization estimated at 200 million yuan ($31.3 million) can apply to go public on the bourse. More importantly, no stringent requirement has been set for BSE applicants' profitability. They just need to demonstrate that they have invested a sufficient amount of money in research and development.

In comparison, the threshold is 1 billion yuan for a company planning to go public on the ChiNext of the Shenzhen Stock Exchange, which helps companies from traditional industries come up with new business models and patterns.

A similar benchmark is set for the STAR Market of the Shanghai Stock Exchange, which aims to nurture large technology companies.

Guidelines for QFIIs and RQFIIs to trade on the BSE took effect on its first trading day, which have paved the way for foreign investors.

Apart from bringing the experiences of exchanges from all over the world, JP Morgan will work actively to help companies float on the BSE and obtain refinancing, said Houston Huang, CEO and head of investment banking at JP Morgan Securities (China) Co Ltd.