-

Shandong charts path for high-quality urban development

2026-01-22

Shandong has a plan to develop modern, people-centered cities with a focus on innovation, livability, beauty, resilience, culture, and smart technology, as stated in an initiative released on Jan 21.

-

County weaves enough supply for demand

2026-01-22

As people look forward to dressing up for Spring Festival, one area is ramping up the production of hanfu, a traditional costume now being infused with contemporary elements.

-

Yantai's global narrative: From city voice to shared story

2026-01-22

Yantai has redesigned how it speaks to the world.

-

Linyi forges specialized industrial clusters to boost economy

2026-01-21

Linyi is implementing a focused strategy to build a competitive industrial landscape through specialization and clustering, according to the city's latest government work report, which outlines the key tasks for this year.

Transformed Development Drivers

Transformed Development Drivers

Rural Vitalization

Rural Vitalization

Marine Economy

Marine Economy

What's on

What's on

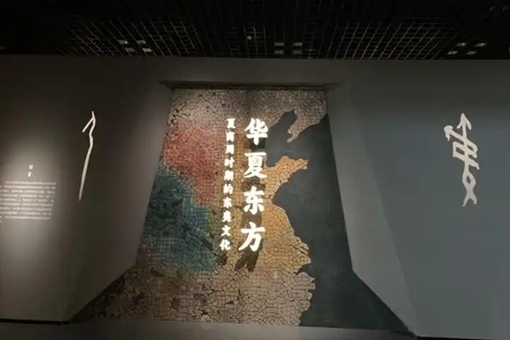

Heritage

Heritage

Traditional Culture

Traditional Culture

Celebrities

Celebrities

Why Shandong

Why Shandong

Industrial Parks

Industrial Parks

Belt & Road

Belt & Road

Sister Cities

Sister Cities