Hong Kong stock investors told to take cover

Dickie Wong, executive director of research department at Kingston Securities, said investors should avoid purchasing individual mainland technology stocks.

"The valuations of the HSI and the Hang Seng TECH Index have dropped to attractive levels, so investors can consider investing in ETFs, such as Tracker Fund of Hong Kong, and ETFs tracking the Hang Seng TECH Index," Wong said.

In his view, traditional old-economy stocks still offer good investment potential for the rest of the year. Such companies include real-estate investment trusts, Hong Kong-based developers, telecom shares, and utility companies, as their shares offer stable investment yields.

Sincere Securities Chief Executive Officer Louie Shum agreed. "Those undervalued old-economy stocks should fare better and attract capital that can boost the HSI."

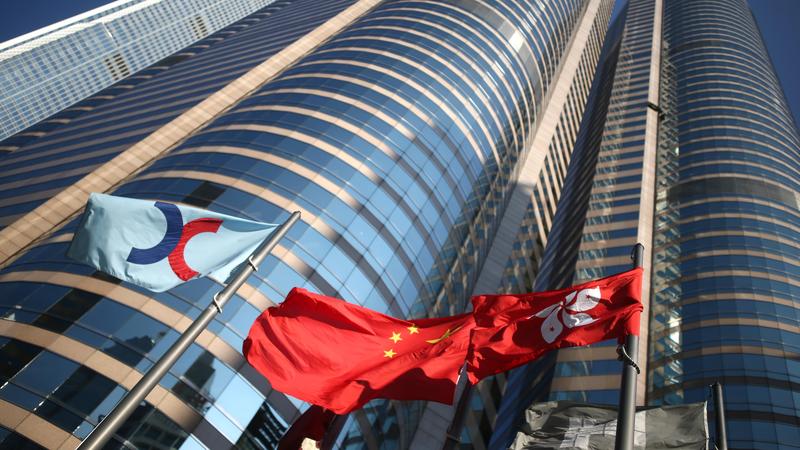

Hong Kong Exchanges and Clearing should be one of the beneficiaries, Shum said. "Mainland technology companies intending to list their shares in the Hong Kong offshore equity market may boost the revenue and profit of the stock exchange operator," he said.

Other market strategists are upbeat about the overall momentum of the city's stock market, saying the central government's monetary and fiscal stimulus policies as well as strong corporate earnings, should support the HSI's medium- and long-term performance.

"We are confident about mainland and Hong Kong equities. We think they will be supported by the economic recovery trend, a loose monetary environment, and the continued improvement in corporate profitability," the Deutsche Bank Chief Investment Office said.

US-based investment management firm T. Rowe Price is on the same page, saying that Chinese equity consolidation seems overdone in the wake of supportive flow dynamics and clarification of technology regulations.

Besides policy stimulus and corporate profitability, market liquidity should also lend support to the equity market by the end of this year.

Timothy Fung, Asia head of equity advisory at BNP Paribas Wealth Management, said the impact of the forthcoming US Federal Reserve's tapering is expected to be less disruptive than that in 2013.

"The influence of mainland capital in the Hong Kong stock market has increased significantly in the past 10 years. Generally speaking, mainland liquidity is less correlated to the US rates cycle, and against the COVID-19 backdrop, any adverse growth outcomes could trigger an immediate shift in central bank rhetoric back to a more dovish mode," Fung said.

"Thus, we see the Fed continuing to support risk assets this year by discussing its bond buying again at its next meetings in September and November, but only announcing in December that it will start tapering from January onwards," said Mansoor Mohi-uddin, chief economist at the Bank of Singapore.

The US Federal Reserve maintained its cautious stance at its meeting last month, keeping its federal funds rate at zero to 0.25 percent and continuing to print money and buy US$120 billion in bonds each month. The US central bank reiterated that the domestic labor market still needs to improve further before it can start tapering its quantitative easing.

- China willing to advance just and equitable global anti-corruption system

- Chongqing hosts Silver Age fashion model competition

- Hengshan Mountain glistens with iconic winter rime scenery

- Ningbo hospital staff disciplined following pediatric surgery death

- Mainland warns Taiwan leader against provoking conflict

- Former senior official of Shenzhen under investigation