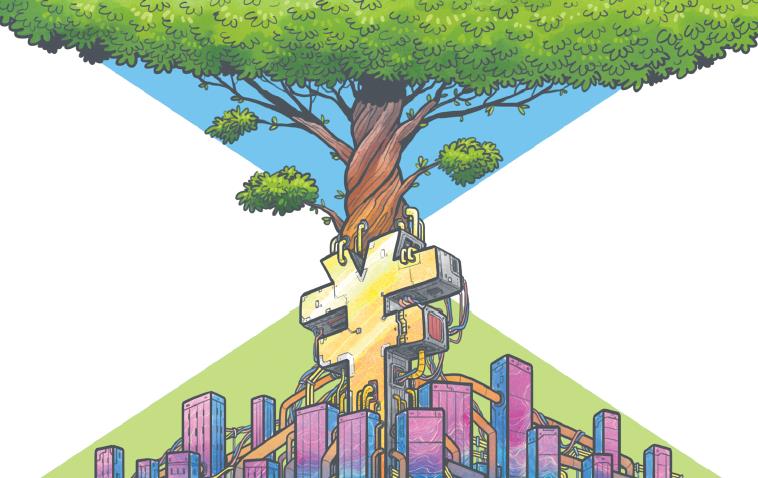

China, EU lead 'green revolution' with finance standards

China and the European Union are jointly leading reform of global green finance by promoting a common scheme of classification, which has focused attention on the importance of investment in addressing challenges of climate change, analysts said.

On April 21, China finished the revision of the Green Bond Endorsed Project Catalogue which is a set of fundamental standards for selecting appropriate investment targets for green bonds.

It removed fossil fuel projects from the list, an action that made the catalog consistent with international rules.

A comment from the Climate Bonds Initiative, an international organization working to mobilize a $100 trillion bond market for climate change solutions, said that the new version of the catalog represents "another significant progress made by China in unifying domestic green finance standards", and it is regarded as the country's latest and clearest definition of the "green "label in terms of objectives and projects.

On the same day, the EU Taxonomy Climate Delegated Act debuted in Brussels, Belgium, establishing a list of economic activities deemed to be environmentally sustainable, in line with the EU's targets for dealing with climate change challenges.

China promised to peak carbon dioxide emissions by 2030 and achieve carbon neutrality by 2060.The EU's long-term goal is to be carbon neutral by 2050, and to reduce carbon emissions by 55 percent by 2030. Both goals are in line with the two economies' commitments under the Paris Agreement on climate action.

The synchronous moves of China and the EU will promote a common set of green finance standards worldwide, and accelerate the debut of China-EU Shared Classification Catalogue for Green Finance, according to analysts.

The two sides have shown strong willingness to explore a common taxonomy. The classification criteria of China and the EU also overlap in the principles, environmental objectives and methodology of screening qualified economic activities, they said.

It is possible that the Chinese central bank and its EU counterpart will jointly announce the common taxonomy later this year, Yi Gang, governor of the People's Bank of China, said at a roundtable discussion during the Boao Forum for Asia last week.

"The China-EU classification of green finance has inspired similar efforts around the world, from Colombia and South Africa to Singapore and Mongolia, which has triggered a global discussion on what should be considered a priority of investment to address climate change challenges," the CBI said in a commentary.

Since there is still a gap in defining green assets and projects in major economies, it is an important work to unify the classification standards among different markets, it said.

To implement China's carbon neutrality goals, the government and regulators are planning more policies that could make carbon emissions costlier for the entities concerned, while companies with green strategies could receive more support from various sources, analysts said.

Many market participants are beginning to adopt specific carbon emission reduction measures to meet the commitments of climate change and sustainable development, which will become a business license of sorts for enterprises, said Zhou Yueqiu, chief economist of Industrial and Commercial Bank of China.

Most of the world's leading financial institutions have established the environment, social and governance, or ESG, development framework, and the global green credit, green bond and carbon markets are developing rapidly.

"The green revolution is undoubtedly taking place, and the newly released standards made by China and the EU have shown the global market's great progress in sustainable investment," said Sean Kidney, the CBI's CEO and co-founder.

Frank Rijsberman, director-general of the Seoul-based Global Green Growth Institute, said that developing and emerging market countries could improve fund mobilization through issuance of more green bonds, which requires unified international taxonomy.

According to Ignazio Visco, governor of the Bank of Italy, one of the areas that the Sustainable Finance Study Group of the G20 is focusing on is making the metrics for classifying and verifying investment sustainability, and the group's work has made rapid progress in the last weeks.

Visco disclosed that in the first half of May the study group will organize a G20 Finance Roundtable with the private sector, to offer an in-depth perspective from a range of private sector stakeholders and to provide specific suggestions to feed into the G20 Roadmap to advance the sustainable finance agenda.

"This will also lead the way toward the Venice Climate Summit, which will also be held next July," he said.