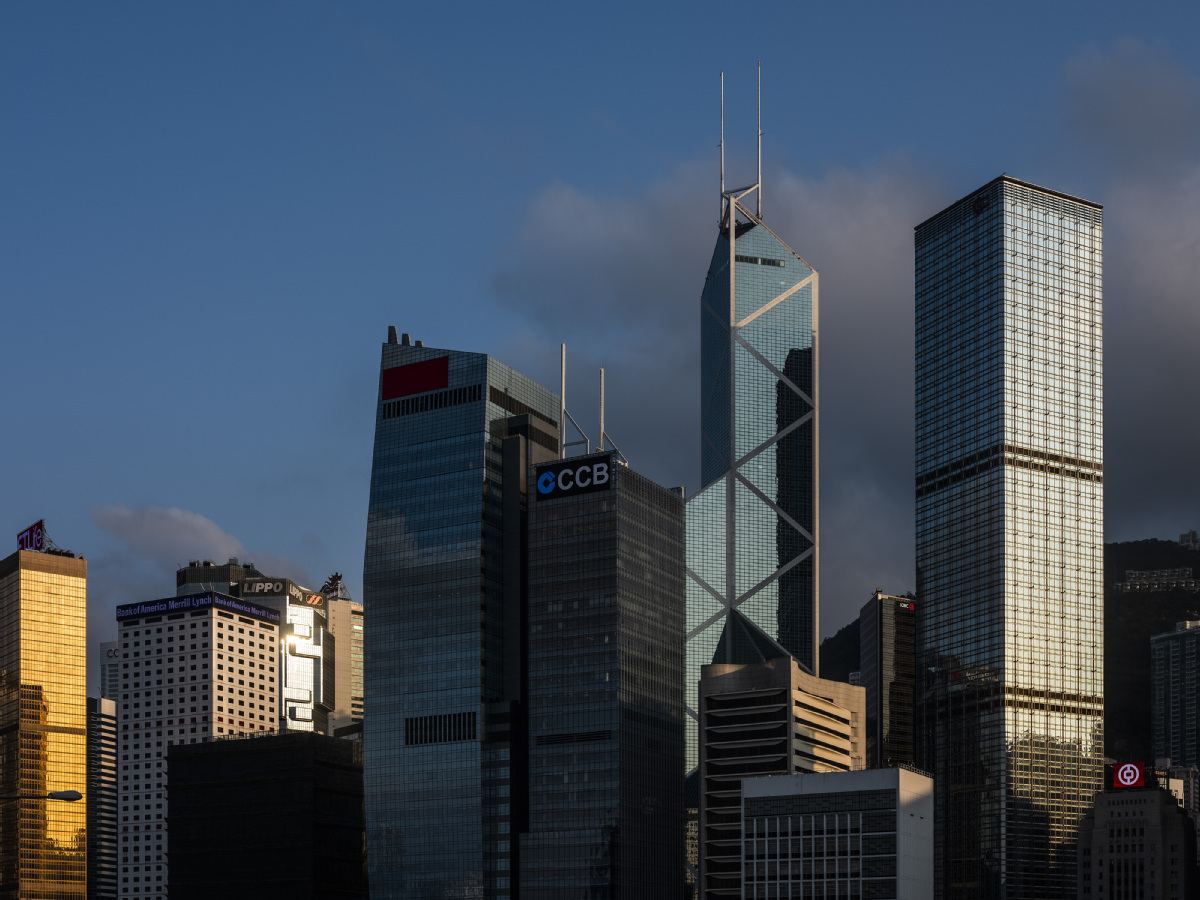

Lopsided industrial structure the root cause of wealth gap in HKSAR

The wealth gap between the rich and the poor has always been a deep-rooted problem of Hong Kong's. With the added impact of the COVID-19 pandemic, grassroots families are invariably bearing the brunt of the worsening unemployment. The median household income recorded a significant drop in 2020. For instance, the median income of economically active households has decreased from HK$36,500 ($4,710) in the first quarter of 2019 to HK$36,200 in the same period of 2020, a decline of HK$300. The drop continued thereafter, and by the third quarter of 2020, it was down to HK$33,700, a decline of HK$2,100 and 5.9 percent year-on-year. What Hong Kong must urgently tackle is for sure the pandemic, but the community should be ready for constructive discussions aimed at resolving its deep-rooted wealth gap.

The traditional economic liberalism of Hong Kong has resulted in two fundamental factors that contribute to a serious wealth gap between the rich and the poor in recent years. The first one is the consumer service-dominated industrial structure, which has created a lopsided employment market. Financial services had an added value of HK$580.1 billion to the economy in 2019, accounting for 21.2 percent of Hong Kong’s GDP, but the sector only employed 272,600 people, which accounts for only 7.1 percent of total employment. In contrast, the number of employees in the retail, hospitality and food services sectors, which hire as many as 556,772 people, accounts for 14.5 percent of total employment or twice the amount of the financial services industry, yet these industries only have an added value of HK$150.5 billion, amounting to 5.5 percent of the GDP or approximately a quarter of that of the financial services industry. Under such a lopsided industrial structure, wealth is highly concentrated in financial sectors, with the majority of the population unable to reasonably share the fruits of economic development.

This "polarized" employment market has created structural inequality in income distribution. On the one hand, while producer services industries, which consist mainly of financial and professional services, have benefited from the economic development on the mainland and see a surge in income, they have generated limited employment opportunities. On the other hand, although the local consumer service industry, which has a large cluster of low- and middle-income workers, has benefited from the Individual Visit Scheme, which brought in millions of mainland tourists in recent years, and the creation of numerous job openings, its income growth has been sluggish. This group of workers is also worst affected by the pandemic. Therefore, the fragility of this long-existing polarized job market is fully revealed amid the economic downturn.

The second fundamental factor is that the rise in asset prices results in the widening wealth gap between the rich and the poor. Besides wages, family income also includes asset appreciation from predominantly stock and property markets. Between 1997 and 2019, the housing price index increased by 134.8 percent, while the average salary increased only by 50 percent, far less than the growth in asset prices. In other words, people with financial assets and property have earned much more in real terms than those without such assets.

The global quantitative easing policies since the "financial tsunami" of 2008 facilitated an increase in asset prices, allowing the wealthy class with more assets to earn more asset-based income. According to the Hong Kong Monetary Authority, the ratio of property prices to average income hit a record high of 18.8 in the second quarter of 2020. The Census and Statistics Department revealed that half of the households in Hong Kong, or about 1.3 million households, did not possess any real estate assets or a flat of their own in 2019, which means they’ll need to have a total of HK$9.15 trillion if each of them buy a flat, or need to take out HK$6.4 trillion mortgage, assuming an average of 70 percent of the flat price is paid in mortgage. This reflects that while the wealth of the homeowners continues to grow, people without a real estate property will find it increasingly difficult to purchase one. As the wealth gap further widens, it has fomented a deep-seated social conflict.

Wealth inequality has always been a real concern; however, with policies designed to resolve the issue failing to target its root causes, the results are ineffective. The SAR government will have to engage every sector of the community in making concerted efforts to balance Hong Kong’s industrial structure and resolve its entrenched land and housing problems. These two formidable missions can only be accomplished with a high degree of public support and daring leadership of the SAR government.

The author is senior research officer of the One Country Two Systems Research Institute.

The views do not necessarily reflect those of China Daily.