How to smoothen path for further opening-up

Over the last four decades, China has integrated into global networks in trade, finance, data and culture. But, as the United States has embraced protectionism, continued progress on global integration will require China to adjust its approach.

In the 20 years since China's State-owned enterprises began listing shares and raising funds in the Hong Kong Special Administrative Region, the city-known for its low tax rates and rule of law-has become a global financial center. The SAR has served as a catalyst and intermediary for broader financial-market liberalization in China, offering a kind of buffer zone for experimenting with the interactions between the Chinese mainland and offshore renminbi financial markets.

Thanks to this approach, China's share of global debt and equity markets has increased sharply. In 2004, China accounted for 1.2 percent of the world bond market, compared with 42.2 percent for the US, 26.5 percent for the European Union, and 18.7 percent for Japan. By the end of 2018, China's bond market had expanded to account for 12.6 percent of world total, while the US' had shrunk to 40.2 percent, the EU's to 20.9 percent, and Japan's to 12.2 percent.

Similarly, the mainland's share of global equity market capitalization rose from 1.2 percent in 2004 to 8.5 percent in 2018; add to that Hong Kong's share, and China's total rises to 13.6 percent. Over the same period, the US' share of global equity market capitalization fell from 45.4 percent to 40.8 percent, the EU's from 16.3 percent to 10.8 percent, and Japan's from 16.3 percent to 7.1 percent.

Yet China still has a lot of work to do on integration. As a recent McKinsey report showed, more than 80 percent of the revenues of China's 110 global Fortune 500 companies are domestic, and foreign ownership in China's banking, securities and bond markets remains below 6 percent.

Also, the barriers to continued progress are significant. To continue China's integration into global networks, the authorities need to overcome at least four major strategic challenges.

First, they have to rein in debt which has increased more than fivefold economy-wide over the last decade. While China can afford to consume and invest more, given its domestic savings rate, it will also need to deepen its equity markets, in order to lower long-term debt risks.

Second, China must find ways to advance the internationalization of the renminbi. Since 2009, the Chinese government has been taking measures to expand the renminbi's international use. But, according to the Bank for International Settlements, the renminbi accounted for just 2.1 percent of total daily foreign-exchange trading in April 2019-far behind the US dollar (44 percent), the euro (16 percent) and the Japanese yen (8.5 percent).

Third, China will also need to adjust to having a broadly balanced current account, after decades as a major surplus country. To maintain a healthy balance of payments and avoid taking on too much risk, China must now ensure that its capital outflows are roughly balanced with inflows of foreign funds.

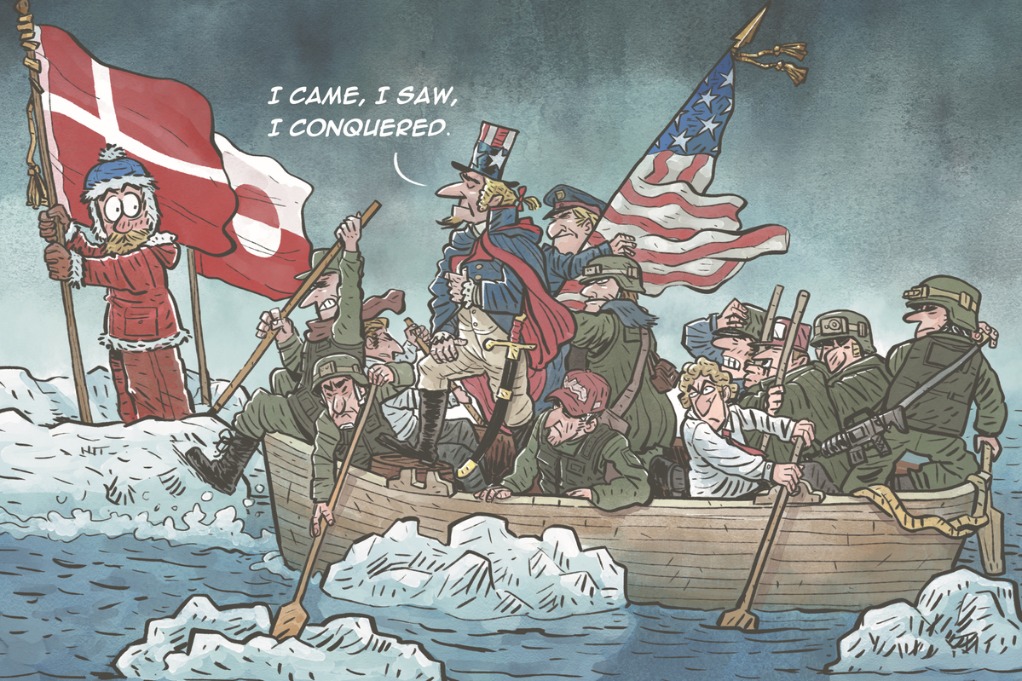

The fourth challenge China faces lies in the unfriendly external environment, shaped by anxieties over excessive or uneven flows of goods, capital, data, people and culture. Nowhere is this more apparent than in the US administration and its assault on the global trading system, including a trade war with China.

China has broadened its two-tier approach to integration in recent years, incorporating a growing number of mainland provinces into pilot projects such as the China (Shanghai) Pilot Free Trade Zone. China hopes that, much like the Hong Kong SAR, these pilot cities can sustain its integration momentum, helping it gradually align its legal and regulatory regime with global frameworks for trade, finance and taxation.

But China will need to expand and augment these efforts if it is to protect its linkages to global finance, data, and knowledge networks. Only with bold, smart and innovative action can policymakers ensure that China's pilot cities continue to lead the way toward a more open, integrated, peaceful and prosperous future.

Andrew Sheng is a distinguished fellow of the Asia Global Institute at the University of Hong Kong and a member of the UNEP Advisory Council on Sustainable Finance. And Xiao Geng, president of the Hong Kong Institution for International Finance, is a professor at and director of the Research Institute of Maritime Silk Road at Peking University HSBC Business School.

Project Syndicate