Tianjin Updates

2026-02-04

Thai students to train in China as universities expand high-speed rail cooperation

More than 40 students from Thailand will take part in high-speed rail training programs in China this year, following a new cooperation agreement between Tianjin Railway Technical and Vocational College and Mahasarakham University.

read more- Tianjin’s Ninghe district unlocks vitality

- Tianjin sets goals for 15th Five-Year Plan period

- Tianjin private firm drives high-quality growth

Copyright ©? Tianjin Municipal Government.

All rights reserved. Presented by China Daily.

京ICP備13028878號-35

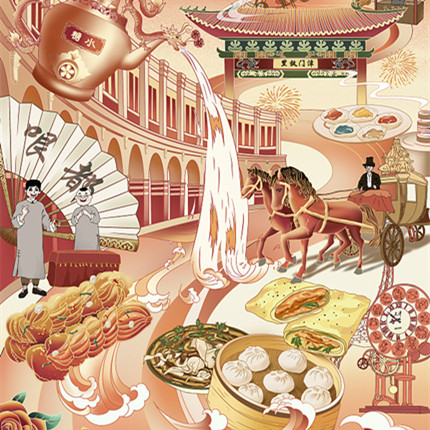

Why Tianjin

Why Tianjin Investment Guide

Investment Guide Industry

Industry Industrial Parks

Industrial Parks

Health

Health Visas

Visas Education

Education Sports and recreation

Sports and recreation Adoption

Adoption Marriage

Marriage