China to lower burden on micro and small enterprises: Premier

China will this year lower financing costs for micro and small enterprises by one percentage point, Premier Li Keqiang said at a news conference Friday.

China will take multiple measures to continue tackling financing difficulties faced by the private economy and micro and small companies – a critical problem that has weighed on economic growth and market vitality, Li said.

Authorities will encourage financial institutions to improve management mechanisms to provide cheaper services for small, private companies, said Li.

"We also need to treat all businesses under various types of ownership as equals. As far as lending is concerned, some problems and obstacles exist," he said.

Li also said that strengthening financial services for the real economy and forestalling financial risks are "mutually reinforcing".

"We have the confidence of forestalling the emergence of systemic financial risks," he said.

The country contained the rise in financing costs of small, private companies last year through a number of measures, including cutting the reserve-requirement ratio by four times, Li said.

- NEV surge contributes to record air quality improvement in Beijing

- China's Global Governance Initiative receives positive feedback at forum

- China's Xizang sees steady tourism growth in 2025

- First-of-its-kind pearl auction held utilizing Hainan FTP

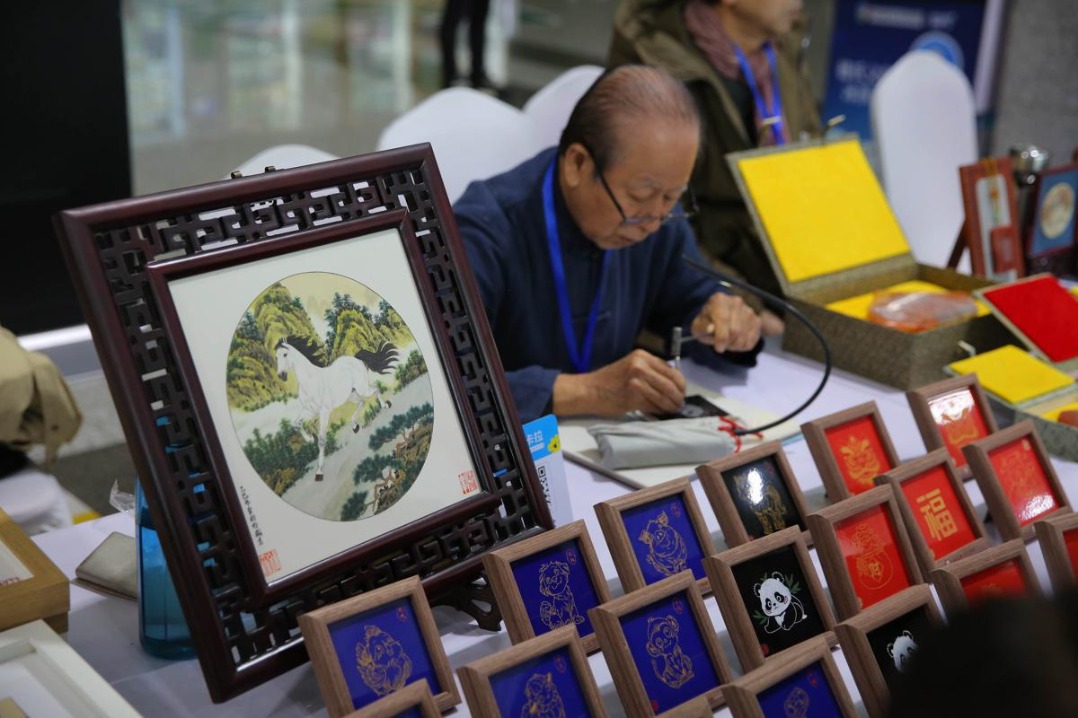

- Agarwood exhibition steeps Shanghai museum in fragrance

- The Fujian Coast Guard conducts regular law enforcement patrol in the waters near Jinmen