Market forces and tech real engines for economies

The world has recently seen quite a few geopolitical and government policy moves making inroads into areas where economic activities are supposed to play the leading role. Such attempts include raising trade tensions and using data protection policies to influence international trade. Policymakers seem to guide economic activities through their political decisions, which appear to go against long-established market rules and norms.

That such attempts will produce the desired results for the "trouble-makers", however, is just wishful thinking.

For example, the Economic Policy Uncertainty Index, developed by Scott R. Baker, Nick Bloom and Steven J. Davis, showed a very volatile movement since 2011, according to the charts published in the November 2016 issue of the Quarterly Journal of Economics. Intuitively, one may assume the global economy would fluctuate in sync with policy changes, or at least reflect some of the policy changes.

But if we superimpose the EPU index on VIX, the Chicago Board Options Exchange Market Volatility Index, which gauges the fear in the financial markets, the divergence was quite significant since 2011, and the two indexes moved further apart from 2015 onward. And even the reworking of the Haver dataset and the drastic oscillation since February did not bring them any closer.

While the EPU index has been fiery, the VIX remains cool, if not dormant. The market incorporates tons of variables from all economic, political and social aspects, and independently reflects the combined effect, because the market forces do not act in tandem with governments' economic policies or international treaties. The market forces plan their own moves and play their own games.

That's why we now have booming stock markets and a generally healthy world economy coexisting with a precarious policy environment.

But why are market forces too powerful to be outmaneuvered by government policies?

They have assumed such power through decades, if not centuries, of economic evolution, which allows the invisible hand to gradually take charge of resource allocation, making governments' macroeconomic adjustments from time to time secondary. Even in emerging economies, the market part of the economy supersedes the government part of the economy. All these point to the mega-trend of market economy.

But despite the market forces getting the upper hand in general, the texture and composition of the market have undergone tremendous changes and shifted to a new paradigm.

So what is the real driving force behind this transformation?

The answer is technology. The digital economy, with its innovations, has reconstructed and reshaped the market. Besides labor and capital, technology is now one of the biggest contributors to total factor productivity.

In the financial markets, technology has become the stem cell, producing new cells to help the organism grow. This calls for "fintech", or financial technologies, to be labeled "techfin", or technological finance, where technology is a necessary condition and finance the specific application.

Anyone who considers the nature of finance unchanged in this new era must have missed seeing this paradigm shift. Technology is leading the way, acting as a force of creative destruction and innovative construction. It is technology that now defines finance, not the other way around. Payment systems no longer need to piggyback solely on central banks' infrastructure, and thus there is a surge in the internet and mobile payment apps such as Alipay and WeChat Pay in China, and M-PESA in Kenya.

Consumer loan, for long commercial bank's fiefdom, has been encroached upon by marketplace lending and "alternative" banking players such as the online-only Atom Bank. Apart from consumer finance, investment and trading have also of late heavily delved into big data, Cloud and artificial intelligence. Quants and algorithms have become the trend-setters, and likely soon be commensurate with the traditional investment genre of value, growth and fundamentals.

Even the bulge bracket banks, one after another, have claimed to be technology companies instead of financial institutions.

More strikingly, the existing market platforms have been challenged or even deconstructed. In fact, markets and market activities have been virtualized or internalized by virtual economy leaders.

On the one hand, the initial coin offerings financing new technologies through cryptocurrencies are growing despite not having a solid legal foundation. They are attracting cash and attention that used to go to initial public offerings on stock exchanges. On the other hand, tech giants such as Google, Facebook and Amazon have built up a funding powerhouse to buy out new companies whose technologies seem promising and future-proof.

This shows the functions of the traditional stock exchanges have actually been internalized by these organizations and their newly established ecosystem.

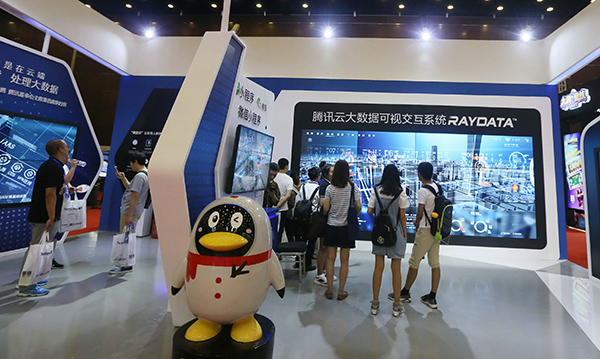

That has been the case in China, too, with Baidu, Alibaba and Tencent acting as not only financing intermediaries but also system integrators in the broader sense of the term. Since classical economic theories highlight economies of scale and economies of scope to reflect the traditional characteristics of market economy, economies of technology might be a new criterion to evaluate a market economy.

Therefore, the solution to any trade disputes or economic cooperation against such a backdrop should be rule-based, market-oriented and technology-driven, no matter who wishes what.

The author is executive vice-president, and a member of China Investment Corp.'s executive committee and China Finance 40 Forum.