Looking to quell financial risks

Government Work Report shows China's intent to tackle challenges arising from new-age monetary products

As cryptocurrency bitcoin's value roller-coasted globally in recent months, so did the sleep pattern of Beijing-based cargoloader Zeng Wen, 27, who doubles up as a part-time risk-happy investor.

Zeng used to earn 2,800 yuan ($442.2) in monthly salary before he, armed with no more than rudimentary market knowledge and a smartphone with 4G mobile internet, started investing in virtual or digital currencies in 2017.

Called cryptocurrencies, bitcoin and the like have emerged as a relatively new, if unregulated, investment class, compared to shares, bonds, conventional currencies, precious metals, commodities and property.

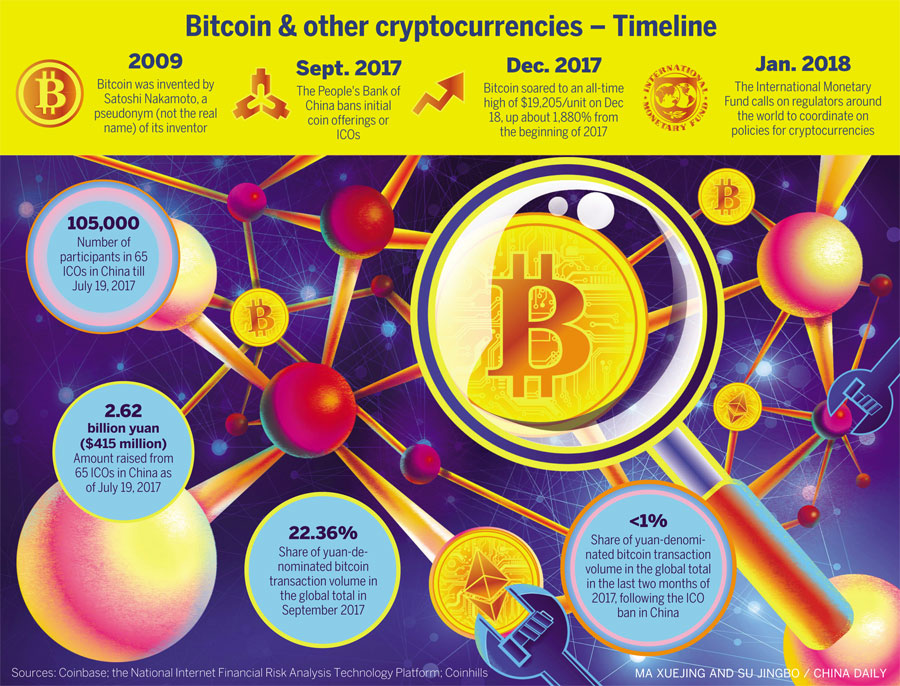

Riding his luck and adventurous spirit, Zeng made a whopping 1.2 million yuan within two months. The notional profit boosted his risk appetite. But then, bitcoin's price swung wildly. First, it soared to its all-time high of $19,205 per unit on Dec 18, up about 1,880 percent from the beginning of 2017, according to data compiled by Coinbase, an online platform for trading in digital currencies. Then, it plummeted by 45 percent within a week.

Before he could cash out, bitcoin plunged further, and the value of his investment, and presumably of those of his ilk in China as well as elsewhere, depreciated sharply.

This raised concerns about possible market speculation, financial fraud and potential social unrest. Alarm bells rang in the corridors of regulators and governments alike.

In China, Premier Li Keqiang lost no time in taking stock of the situation. On March 5, delivering his annual Government Work Report to the national legislature, he said China will strengthen coordination in financial regulation over emerging sectors.

The authorities concerned, Li said in his speech, will crack down on illegal fundraising, financial fraud and other illegal activities, adding that regulation of internet finance will be further improved.

As if taking cue from Premier Li, the governor of the country's central bank, Zhou Xiaochuan, said at a news conference on Friday that the People's Bank of China opposed direct transactions between the bitcoin and the renminbi, its fiat money or the Chinese currency. Nor would it endorse use of virtual currencies for retail payments.

Zhou echoed sentiments of some deputies attending the two sessions that financial products like bitcoin entered the market without prudential oversight, hence a thorough scrutiny is required to ascertain if they could be promoted further without jeopardizing the financial system.

Prevention of financial risks is one of the key topics of deliberations at the ongoing annual sittings of the National People's Congress and the National Committee of Chinese People's Political Consultative Conference.

Just as well, perhaps, because legislatures, government bodies, financial regulators, expert committees and analysts the world over are all busy pondering ways and means of sustaining order in the global financial system, so as to avert another full-blown crisis of the kind witnessed in 2008.

"Loopholes in the financial regulatory system should be fixed, meaning tighter financial regulation compared with the past (might be necessary)," said Yang Weimin, deputy head of the Office of the Central Leading Group on Financial and Economic Affairs, and a member of the National Committee of the CPPCC.

Yang's comments follow reported plans by the PBOC and other financial regulators, to rein in cross-border fund outflows through financial transactions related to cryptocurrencies like bitcoin (which was invented in 2009, the first type of digital coin and the most popular one) and initial coin offerings or ICOs (which are used by tech startups mainly to raise funds in the manner of initial public offerings).

Fresh measures are expected to be launched when conditions are ripe. Bloomberg reported quoting unidentified officials that regulators are also planning to scrutinize Chinese banks and online payment accounts of businesses and individuals suspected of facilitating trades on offshore cryptocurrency venues. The account-owners could have their assets frozen or be blocked from the domestic financial system.

Any such measures would seek to cut off one of the few remaining avenues for Chinese citizens to buy digital assets.

In September last year, the PBOC banned ICOs after it was revealed in a report of the National Internet Financial Risk Analysis Technology Platform that as of July 19, 65 ICOs had already raised 2.62 billion yuan in China from 105,000 investors.

Sensing trouble ahead, the PBOC took a pre-emptive measure by asking domestic trading platforms for cryptocurrencies to halt operations. A PBOC statement said ICO, in essence, is a way of "unauthorized and illegal public fundraising" which is suspected of being associated with illegal activities like financial fraud and pyramid schemes.

ICO platforms should not engage in exchange services between fiat currencies, virtual coins and tokens, the PBOC said in its statement.

The move is considered a watershed in the development of virtual currencies in China. But a few recalcitrant individual Chinese investors turned to overseas trading platforms all the same.

Such platforms "pose risks including illegal offerings, false information, fraud and pyramid schemes", the PBOC sources were quoted as saying by Xinhua News Agency.

China had messaging apps related to cryptocurrencies removed from online stores, while administrative departments related to industry and commerce were asked to revoke the business licenses of companies engaged in virtual currency transactions.

Such measures are in line with a global trend. Governments and regulators the world over are looking to regulate or rein in trading in cryptocurrencies.

For instance, in January, the International Monetary Fund warned of risk from the soaring prices of digital coins, and called on regulators around the world to coordinate on policies.

The US Securities and Exchange Commission warned investors about potential risk related to stocks of companies that claim a relationship to, or engagement with, ICOs.

Similarly, the Bank of England denounced the "anarchy" of cryptocurrencies being used for criminal activities. The Daily Telegraph reported that BoE Governor Mark Carney said bitcoin was "a global speculative mania" rather than a useful new invention, and assured that regulation of bitcoin would be a topic for the G20 meeting this month.

But government response to cryptocurrencies has been varied. For instance, Japan amended its law last year to legalize virtual currencies like bitcoin as a payment method.

Amid all this, like regulators, experts have called for international cooperation on the regulation of digital currencies.

"Some countries have incorporated virtual currency transactions and ICOs into the legal supervision system. China can reach cross-border cooperation with these countries to protect the legitimate interests of financial consumers," said Yang Dong, director of the Financial Technology and Internet Security Center, which is part of the Renmin University of China in Beijing.

Yang's view may be linked to the fact that the China market used to be dominant in the world of cryptocurrencies, in terms of transaction volumes, computing capability and the devices used to "mine" digital coins.

In September last year, the highest transaction volume of yuan-denominated bitcoin accounted for 22.36 percent of the global total, according to Coinhills, a provider of information on cryptocurrencies. But, following the PBOC ban, the figure plummeted to less than 1 percent in the final two months of 2017, it said.

The tightening of regulation led to a sharp decline in virtual currencies' value, which may be conducive to the industry's long-term development though, some investors said.

"The top priority in renewing regulatory measures is to ensure the security of the national financial system," said Zhong Xinlong, a consultant at Chinese research company CCID Consulting." It takes some time to research and develop an effective mechanism to ensure the safety of cryptocurrency trading, as well as to offer trading framework and relevant financial services."

Agreed Jason Jia, who has been dabbling in cryptocurrencies for more than eight years now. "The effects of tighter regulation can be felt now. Quite a few Chinese traders have quit trading."

But not everyone is nervous or chastened. "Without a doubt, earnings (from trading in cryptocurrencies) would grow substantially in the future," said Liang Tiancheng, a latecomer among digital investors. In less than three months, he invested 20,000 yuan, and return on his investment averaged 5 percent.

Bitcoin's rise, rather its roller-coaster ride, is expected to continue this year, according to a recent report released by Canaccord Genuity, a financial services firm.

On Mar 5, bitcoin's price surged to $11,377 per unit, up about 58 percent from a month earlier, according to Coinbase data. But cargoloader Zeng Wen, who oscillated from one extreme of 2,800 yuan in monthly salary to the other extreme of 1.2 million yuan in notional wealth within two months, may not lose much sleep over it this time round.