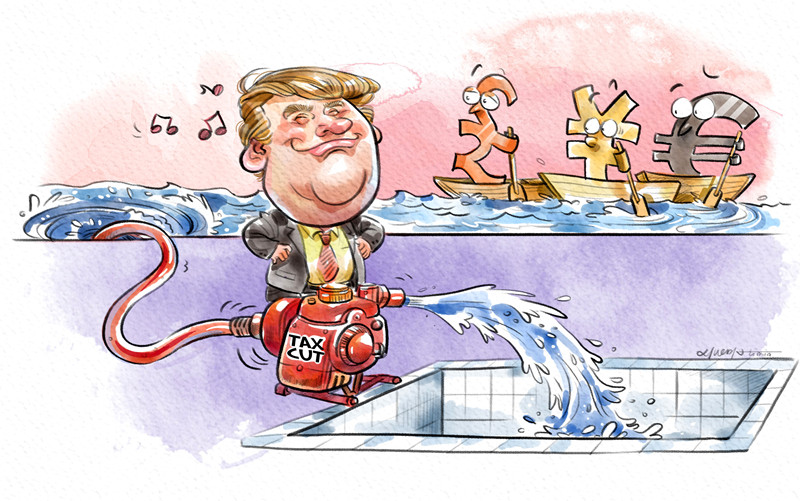

US tax cut can be turned into an opportunity

The United States Senate has approved a bill to reduce taxes for businesses and the rich as part of the promises US President Donald Trump made during his presidential campaign, which will have a big impact on many economies, especially China's.

But given the global trend of cooperation and competition, China could transform the challenges created by the US tax cut into a driving force for the economy. Through interactions with its major trade partners, including the US, Japan and the European Union, China could promote win-win development to build a community of shared future for humankind.

Many economies, including China and the US, use tax cuts as a tool to boost the economy. But the US' tax cut policy is guided by "Reaganomics", or the economic policy president Ronald Reagan followed in the 1980s. China, too, used tax cuts to propel reform and opening-up in the 1980s, and they have yielded positive results.

Trump wants to make "America great again" by using, among other economic tools, tax cuts, whereas China has cut taxes to deepen supply-side structural reform in line with its economic "new normal". The world's two largest economies have a common orientation-they believe that "tax cut leads to inspiration and further optimizing of economic operation", as proved by the Laffer curve, which shows the theoretical relationship between rates of taxation and the resulting levels of government revenue.

But the two countries' tax reforms are different. Trump's tax cut is aimed at greatly reducing the tax burden of enterprises and individuals, while in China, the standard rate of income tax for enterprises was reduced to 25 percent many years ago, and high-tech companies can enjoy a preferential tax rate of 15 percent. And for the past few years, small and medium-sized enterprises have been paying 12.5 percent income tax, and some local governments have offered even more preferential tax rates to attract enterprises.

Besides, China raised the threshold of individual income tax in the last round of individual income tax reform; in fact, individual income tax accounts for only about 6 percent of China's overall tax revenue, whereas in the US it accounts for about 47 percent of the federal government's total tax income.

Therefore, China has less room to reduce enterprises' income tax, and the individual income tax reform will focus more on building comprehensive and classified tax systems.

Moreover, unlike in the US where mainly direct taxes are imposed, China's tax revenue comes mainly from indirect taxes. As China is reforming the indirect taxation system, by replacing business tax with value-added tax, the ratio of direct tax will gradually increase to optimize the taxation system.

This means China's tax system optimization will be different from the US', because in China it is important to reduce the various non-tax burdens of enterprises, which are still high in China compared with the international level in general. In this regard, Trump's tax cut is likely to help China reduce the non-tax burdens of enterprises. For instance, the premiums enterprises pay for their employees' social insurance and public housing reserve fund could be reduced, and so could other nontax burdens through administrative approval.

So China should not follow the US' example; instead it should promote reforms in two areas based on its actual condition. The first is to reduce administrative costs and improve administrative efficiency. And the other is to promote public-private partnerships, which are better equipped and more efficient in attracting private capital for the construction and operation of public projects and infrastructure. This turn may effectively ease the government's financial burden and help improve people's livelihoods.

In other words, China is in a position to transform the challenges brought about by the US tax cut into an opportunity to facilitate economic development, in order to expedite the supply-side structural reform and better serve the people.

The author is the director of the China Academy of New Supply-side Economics, and former director of the Institute for Fiscal Science Research under the Ministry of Finance.