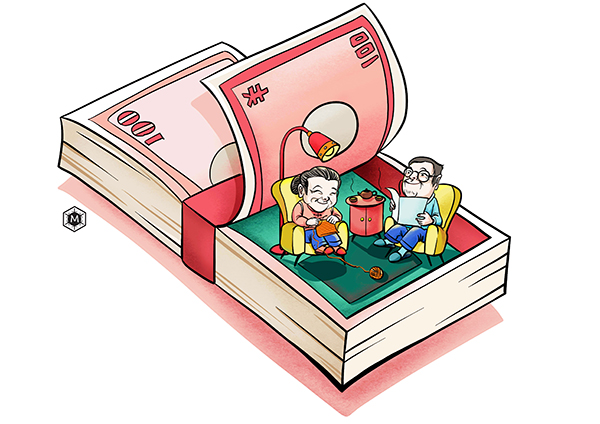

Insurance reform to boost public welfare

|

| Ma Xuejing/China Daily |

The State Council, China's Cabinet, recently decided to transfer 10 percent equity shares of State-owned enterprises and financial institutions to the National Council for Social Security Fund. A pilot program for such transfers will be launched in some central SOEs by the end of this year, and gradually extended to other SOEs.

Under certain circumstances, the NCSSF could establish a pension fund management company to independently use the transferred assets. The council can receive only equities and earn dividends on them but cannot take part in the management of the SOEs or financial institutions concerned.

This is the third round of reform aimed at transferring SOEs' assets to the NCSSF since 2001, when the central government first decided to reduce its holdings in SOEs to raise funds for the NCSSF. The second round of reform was launched in 2009.

But the reform this time is bigger, because the first two rounds of share transfers related only to partial IPO shares or additional shares.

The central government has transferred the shares of SOEs and financial institutions to the NCSSF several times to narrow the widening gap between the social security fund and increasing financial pressure in recent years due to the aging population. For instance, in 2014, the nationwide premium for urban employees' basic pension insurance was 2.04 trillion yuan ($308.3 billion), whereas the old-age pension was 2.18 trillion yuan. In 2015, the annual overall premium increased to 2.3 trillion yuan, but the pension amount increased to 2.58 trillion yuan. And last year, the annual overall premium rose to 2.68 trillion yuan, but the pension amount soared to 3.19 trillion yuan.

In the past three years, the growth rates of national pension insurance premium were much lower than those of old-age pension, indicating an ever-increasing fiscal subsidy for pension.

Established in 1997, China's basic pension insurance system for urban employees is different from that of Western countries, which was implemented after World War II, because in China it is used to pay old-age pension to retired employees, most of whom didn't pay any pension insurance premium before. In some countries, such as the United States and Canada, the basic old-age pension insurance fund didn't have to bear the historical burden like China does.

The recent document issued by the State Council says the purpose of transferring State-owned assets in this round of reform is to bridge the gap in pension funds, in order to ensure equality between different generations of employees.

The transfer of State-owned assets to the NCSSF will help reduce the financial and premium burden on those paying pension insurance premium today. The current amount of State-owned capital is 147 trillion yuan. If we deduct the assets of some special SOEs, State-owned institutions such as public welfare-oriented enterprises and noncommercial financial institutions from the overall State-owned assets, the estimated State-owned assets transferred to the NCSSF is likely to reach 10 trillion yuan. And the dividend large-scale State-owned shares earn can basically offset the gap between annual pension insurance premium and old-age pension expenditure.

The reform, however, faces many challenges. For instance, SOEs should take the asset transfer into consideration before making any significant changes such as those related to shareholding, restructuring and listing in the market.

Moreover, it is important to establish a reasonable dividend mechanism, and the shares transferred to the NCSSF should be managed independently, which requires specific regulation on State-owned asset management and collection. When the nationwide pension insurance system is unified, the relationship between the central and local governments in terms of financial and administrative powers should be further coordinated and regulated.

Transferring State-owned shares to the NCSSF is a significant part of supply-side structural reform, which reflects the new idea, new thought and new strategy of the Communist Party of China Central Committee, with Xi Jinping as the core, for national governance. It will benefit the people and enhance their sense of gain, laying a solid social foundation for promoting socialism with Chinese characteristics in the new era.

The author is director of the Center for International Social Security Studies, Chinese Academy of Social Sciences.