Financial de-risking creates unexpected risks

The world today faces multiple crises on several fronts, from prevailing global political unrest and the rise of terrorism and cyberattacks, to the increasingly sophisticated methods used by criminal gangs to launder their ill-gotten gains. Governments around the world have responded, with mixed results, by imposing ever-stricter policies on financial institutions to minimize the possibility that they may inadvertently - or indeed purposefully - assist such activities. The understandable logic behind all this, of course, is that better monitoring of cash flows helps build a more secure financial sector that is harder to manipulate for nefarious purposes.

As a result, resources deployed by financial institutions to conquer these scourges have increased exponentially over the past five years. Anti-money-laundering compliance costs in Asia alone amounted to $1.5 billion last year, risk-management and research service provider LexisNexis estimated. The impact this has had on financial institutions in Hong Kong has been stark - the city's Joint Financial Intelligence Unit received about 77,000 suspicious transaction reports last year, an increase of around 55,000 from four years previously. The Hong Kong Monetary Authority, meanwhile, can now impose fines of as much as HK$10 million per breach, and in the first few quarters of last year seized assets worth up to HK$105 million following investigations.

So it appears the stringent monitoring requirements recently imposed by local authorities have been somewhat successful. And yet these actions have had significant unexpected consequences, perhaps the most prominent of which is the rise of a phenomenon known as "de-risking". Entire portfolios and client types deemed high-risk - a result of cumbersome "know your client" requirements - are being denied basic banking services. A recent HKMA survey showed both individuals and businesses are finding it much tougher to open a bank account locally, as requirements to document a customer's source of funds, provision of business services, expected transaction patterns, and many others, are becoming increasingly burdensome. Customers are also complaining that documentation is being demanded in an often-haphazard manner and with little clear guidance, ensuring the process can be drawn out dramatically. Small- and medium-sized businesses engaged in certain sectors - such as jewelry, precious gemstones, or trade-based finance - are being particularly hard hit.

This issue is not just prevalent in Hong Kong. A World Bank global review in 2015 revealed that 46 percent of money transfer operators surveyed had received notification from their bank over the previous few years regarding the forthcoming closure of their accounts. A further Dow Jones study the following year revealed that 40 percent of more than 800 financial-service providers surveyed had within the previous 12 months terminated a full business line or segment due to new regulatory obligations imposed on them by their local authorities. The subsequent costs involved in monitoring that risk had resulted in the service line becoming inherently unprofitable.

With all this, it is easy to forget those who are most likely to be directly affected by these regulations. As money transfer operators find it increasingly difficult to operate, there are whole segments of society, including many hundreds of thousands of immigrants in Hong Kong, who may soon experience the full effect of de-risking. Remittances contribute significantly to sustaining the welfare of approximately 700 million people around the world, often representing the most vital source of income for food, housing, education and healthcare locally. Non-government organizations and charities are also affected, with evidence mounting that those reliant on humanitarian assistance are being denied basic necessities as these accounts are closed. Indeed, up to 14 percent of respondents to the Dow Jones survey admitted they were considering exiting their business relationship with such organizations.

The HKMA has at last begun to respond to some of the concerns that have been raised. A recent circular emphasized that financial institutions providing retail and other services accessible to a wide number of customers should not adopt practices that would result in financial exclusion. Instead, such organizations should provide a "risk-based approach" based on proportionality and "risk differentiation" for each customer. Nevertheless, the circular was light on specific actions financial institutions can take to actually achieve this. To confuse the matter further, the Securities and Futures Commission continues to take a hard line on activities it oversees, such as access to investment services.

It is clear Hong Kong will soon start to lose its competitive edge to economies such as the Chinese mainland, which has already seen an uptick in hiring as they pick up portfolios that other banks around the world have felt are too risky to maintain, such as in shipping finance. To counter this, authorities in the city must get on the same page and become fully committed to a unified approach. Anybody who owns a small jewelry business or runs a local charity may well feel that both the government, as well as those financial institutions that maintain their accounts, have some way to go.

The author is a risk-management consultant and writer who has worked in Asia for the past 16 years.

(HK Edition 10/17/2017 page9)

Today's Top News

- Civilizational links for a fairer world

- Manufacturing in China spurs global growth

- Taiwan lawmakers vote to pass motion to impeach Lai

- Xi: Steadfastly implement conduct rules

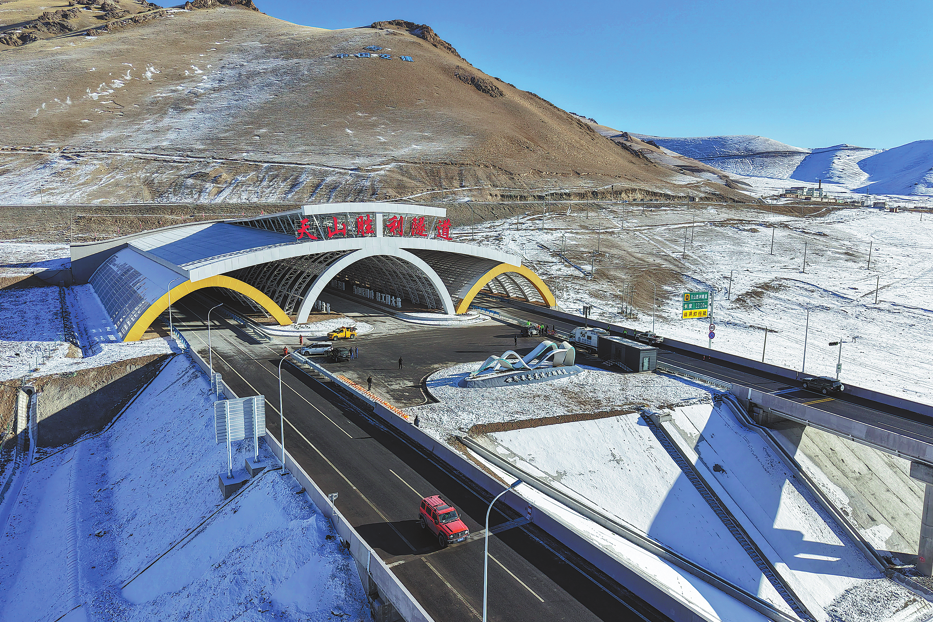

- High-speed rail reaches 50,000 km milestone

- China puts sanctions on US defense firms, execs