60 People, 60 Stories

Joy ride

By Zhou Yan (China Daily)

Updated: 2009-09-30 07:42

As one of the earliest stockbrokers in Shanghai, Ren Chengde has seen it all.

|

Ren Chengde started as a stock broker in 1993 and now serves as a senior stock analyst at China Galaxy Securities in Shanghai. [China Daily/Gao Erqiang]

|

Since the first share was traded in 1988 in Shenzhen, the Chinese mainland's other stock exchange, there has never been a day of calm, says Ren, 46.

| ||||

"I'm amazed at how far the stock market has developed despite the various scandals in the past that rocked its very foundation," Ren says.

By sucking in trillions of yuan of investment funds from hundreds of millions of corporate and personal investors nationwide, the flood of liquidity has fueled the stock market to fulfill its primary function of helping to fund the growth of many cash-starved, State-owned and private sector enterprises across industries.

A total of 1,628 enterprises have reportedly raised an aggregate 23.6 trillion yuan on the two stock exchanges in the past two decades. Some of these companies, including the Industrial and Commercial Bank of China, PetroChina and Haitong Securities, have grown exponentially in size and scope since they were listed.

Because margin trading is outlawed, wide price swings, sometimes manipulated by sharp traders, have remained as the high-risk, high-profit game that appeals to the gambling instinct of many investors.

Indeed, many investors seem to have become addicted to the sharp price swings that have provided ample opportunities for quick gains.

"During the first 15 years, the mainland stock market had been operating in a vacuum cut off from the macro-economic environment," Ren says.

"It was driven solely by speculation and irregular trading in those days."

From 1990 to 2001, during which the benchmark Shanghai Composite Index surged 23 times and peaked at 2,245.42 points, from 95 points, the market was also tainted by a series of scandals. These included the Yinguangxia case, in which its shares rose more than fourfold in 2000 before a profit overstatement of $93 million from 1998 to 2001 was exposed and four of the firms' senior officials were jailed for forging documents.

The situation pushed the State Council, the country's Cabinet, to establish the China Securities Regulatory Commission (CSRC) to regulate the market on Oct 12, 1992. The move ended local government autonomy of the two exchanges.

The CSRC's role as a securities watchdog was consolidated in July 1999, when China's Securities Law helped it put in place a centralized and unified regulation of the domestic securities market.

The stock market took another major step when the securities watchdog in April 2005 resumed nontradable share reform, which was called off in 2002 to resolve conflicts between nontradable and tradable shareholders, by allowing more than $200 billion of mostly State-owned equity to be converted to tradable shares.

The move lifted the cloud of uncertainty over the market at that time. Ren and many other stock analysts believed that the shareholding reform was the turning point that quickened the pace toward the maturity of the market.

After a short correction to bottom at a new six-year-low of 998 points in June 2005, the leading indicator picked up steam and reached its all-time high of 6,124.04 points on Oct 16, 2007. The outbreak of the global financial crisis in late 2007 precipitated the crash of 2008 that took the index to its nadir of 1,664 points on Oct 28, 2008.

The leading indicator has since more than doubled to 3,471 points on Aug 4 this year.

"Fluctuation is the nature of the stock market and there are always bumps along the way," Ren says.

"The market trend so far remains in accordance with government policies, but we will finally let the market speak for itself."

Time Line

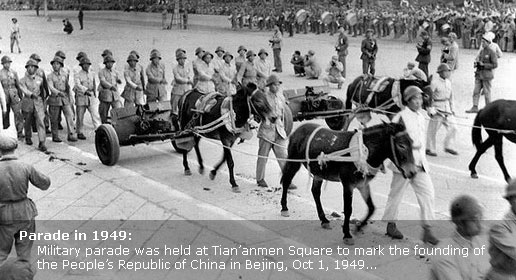

1949-1950

Most stock exchanges shut down following the civil war.

1952

Both the Tianjin and Beijing stock exchanges are closed over the decline in business and bad debt.

1966

The government stops paying private stock interests over buyouts of corporate capital to form public-private partnerships in 1956. The stock market is halted.

1981

China starts issuing treasury bonds.

1990

Shanghai Stock Exchange, the first and largest domestic bourse, restarts operations for the first time since 1949.

1992

The China Securities Regulatory Commission (CSRC) under the State Council is established.

1999

The Securities Law takes effect.

2002

Temporary regulations for Qualified Foreign Institutional Investors are publicized.

2007

The Shanghai Composite Index hits an all-time high of 6,124.04 points.

March 2009

The CSRC releases rules for initial public offerings on the growth enterprise board, marking the launch of the NASDAQ-style board in Shenzhen.